The Bank of Japan concludes a two day policy meeting today, with the scheduled rate decision, statement and press conference as always, scheduled into the economic calendar as tentative. Traders will be on alert for any sort of delays which could be a price action precursor to the Fed decision which comes later on tonight.

The markets are eagerly awaiting the BoJ’s direction on further increasing negative interest rates, as well as how they will expand their asset purchasing program to further stimulate an economy stuck in the doldrums. Any weakness in the BoJ’s approach will likely force USD/JPY sharply lower again.

Kuroda and his men have continued to talk the talk, now we wait… again, to see whether they will actually walk the walk!

For those of you more fundamentally inclined, the WSJ has an excellent article on Japanese monetary policy and what a steepening of the yield curve actually means.

But over here in trader-world, we’ll stick to the charts and market psych of the decision, trying to combine where the chance of the biggest fundamental disappointment might lie alongside higher time frame technical levels. Doing this, we were last week thinking about USD/JPY as follows:

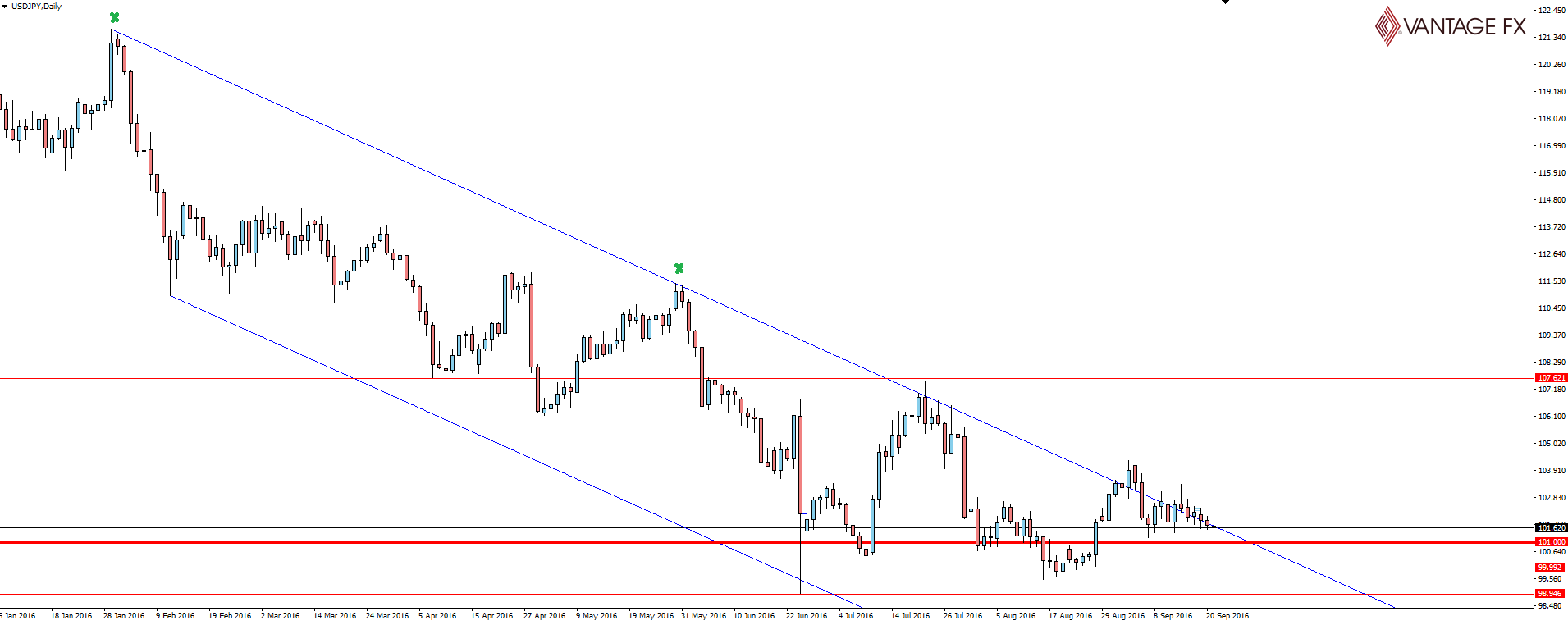

“Likewise on USD/JPY, we have a higher time frame bearish channel with price at resistance. If price rolls over here, new lows are certainly opened up if the Fed doesn’t move.”

Taking a look at the daily chart and we can see that the level is still being respected.

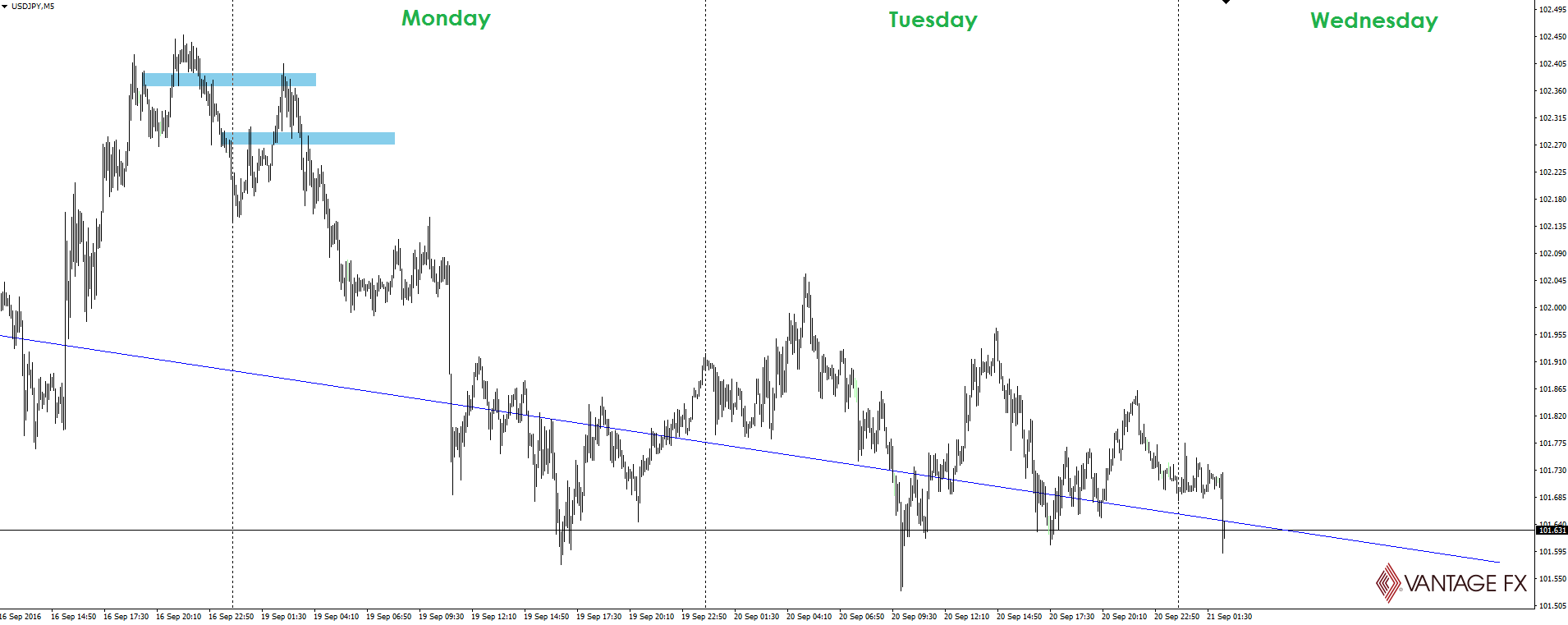

You’re right that the daily charts that I’m posting don’t change too much, but the intra-day levels that you can manage your own trades around do.

While the USD chart has actually rallied since Monday due to the weight applied to EUR/USD, you can see that USD/JPY has trended steadily south. If you were looking to set up for USD shorts, I hope that you decided on USD/JPY and used either of these two intra-day levels on Monday morning to set up your position.

This would have given you ample breathing room heading into today’s BoJ decision, allowing you to take a ‘free’ punt on the outcome, or closing in the session leading up to the decision to lock in some nice profits.

Heading forward and that higher time frame bearish trend line is still in play and while it’s certainly still holding as a zone, a clean re-activation will be important for the bears looking for new lows.

Let’s do this!

On the Calendar Wednesday:

JPY BOJ Policy Rate

JPY Monetary Policy Statement

JPY BOJ Press Conference

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.