On Tuesday EUR/USD pair hit the highs at 1.0774, but in the afternoon it began to decline quite rapidly. Despite the fact that both in the Eurozone and the U.S. ambiguous statistics were published, investors expressed a preference for the U.S. currency. In the Eurozone, weak data on the index of business activity in the services sector by Markit was released, showing a decline to 53.6 points in January from 53.7 points a month earlier. On the other hand, the index of business activity in the manufacturing sector rose to 55.1 points in January, from 54.9 points a month earlier. The U.S. PMI Markit index in the manufacturing sector rose to 55.1 points in January from 54.3 points a month earlier, while sales in the secondary housing market fell by 2.8%.

On Wednesday, the macroeconomic calendar will provide us with data on the index of business optimism in Germany by IFO (11:00 GMT+2). It is predicted that the index will rise to 111.3 points in January, from 111.0 points a month earlier. Confirmation of the forecasts can support the exchange rate of EUR/USD and lead to an increase to the area of 1.0759.

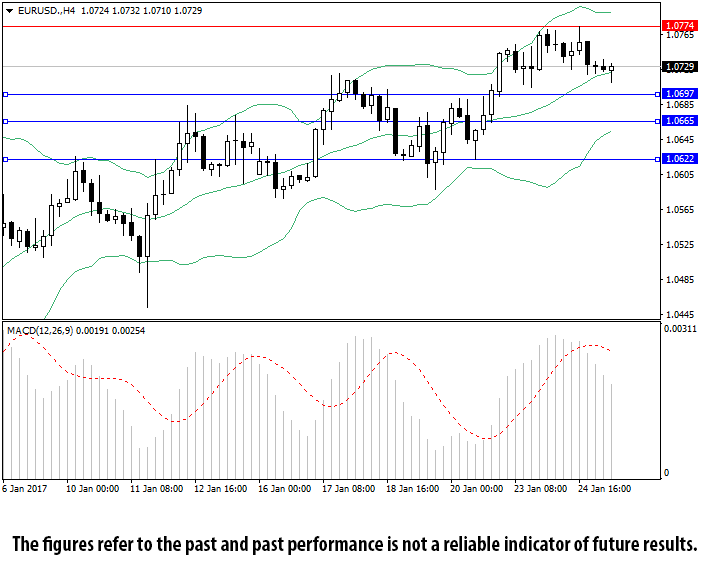

On the 4-hour chart Bollinger bands are directed sideways, indicating the relative calm in the market. The MACD histogram is in the positive zone, its volumes are decreasing.

Support levels: 1.0697, 1.0665, 1.0622.

Resistance levels: 1.0774, 1.0817, 1.0872.