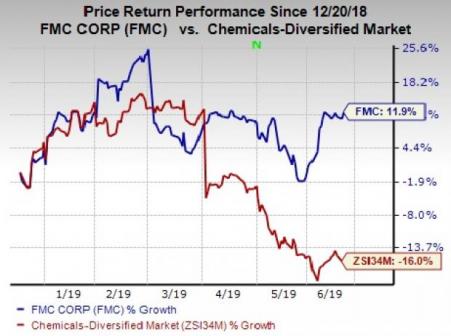

Shares of FMC Corporation (NYSE:FMC) have gained around 12% over the past six months. The company has also significantly outperformed its industry’s decline of roughly 16% over the same time frame.

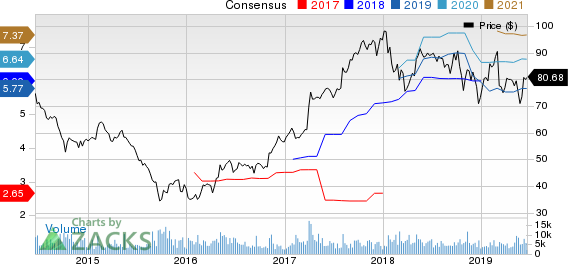

FMC, a Zacks Rank #3 (Hold) stock, has a market cap of roughly $10.6 billion. Average volume of shares traded in the last three months was around 1,151.2K. The company has an expected long-term earnings per share growth rate of 10.8%.

Let’s take a look into the factors that are driving this chemical company.

Driving Factors

Forecast-topping earnings performance in the first quarter and upbeat outlook have contributed to the gains in the company’s shares. FMC’s adjusted earnings went up roughly 9% year over year to $1.72 per share in the first quarter. It also topped the Zacks Consensus Estimate of $1.62.

Factoring in strong first-quarter performance, FMC bumped up its guidance for 2019. For 2019, the company expects revenues to be between $4.5 billion and $4.6 billion, indicating a rise of 6% at the midpoint versus recast 2018 and $50 million higher than the prior guidance.

Adjusted earnings are forecast in the range $5.62-$5.82 per share, an increase of 9% at the midpoint compared with recast 2018 and 7 cents higher than the prior guidance.

For second-quarter 2019, revenues are projected in the band $1.185-$1.215 billion, indicating 4% growth at the midpoint compared with recast second-quarter 2018. Adjusted earnings are expected to be in the range $1.60-$1.70 per share, indicating 10% growth at the midpoint compared with recast second-quarter 2018 figure.

FMC is seeing strong demand for its industry leading products, which is driving its revenues. In Latin America, the company is witnessing strong demand from cotton growers in Brazil as well as solid demand for insecticides in soybean applications.

Strong demand for pre-emergent herbicides and insecticides is also driving the company’s agriculture business in North America. The company expects an increase in corn and wheat acreage to drive growth in North America in 2019.

FMC also remains committed to expand its market position and strengthen its portfolio. The company remains focused on investing in technologies and products and launching new products with a goal to enhance value to the farmers. New product introductions are expected to support its results this year. The company expects new products to account for around $60-$70 million in incremental sales growth in 2019.

Stocks to Consider

A few better-ranked stocks worth considering in the basic materials space include Materion Corporation (NYSE:MTRN) , Flexible Solutions International Inc (NYSE:FSI) and AngloGold Ashanti Limited (NYSE:AU) .

Materion has an expected earnings growth rate of 27.3% for the current year and carries a Zacks Rank #1 (Strong Buy). The company’s shares have gained around 23% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flexible Solutions has an expected earnings growth rate of 342.9% for the current year and carries a Zacks Rank #1. Its shares have surged around 157% in the past year.

AngloGold Ashanti has an expected earnings growth rate of 90.6% for the current year and carries a Zacks Rank #1. Its shares have shot up roughly 90% in the past year.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

FMC Corporation (FMC): Free Stock Analysis Report

Flexible Solutions International Inc. (FSI): Free Stock Analysis Report

AngloGold Ashanti Limited (AU): Free Stock Analysis Report

Materion Corporation (MTRN): Free Stock Analysis Report

Original post