Medium-term technical outlook on Boeing (NYSE:BA)

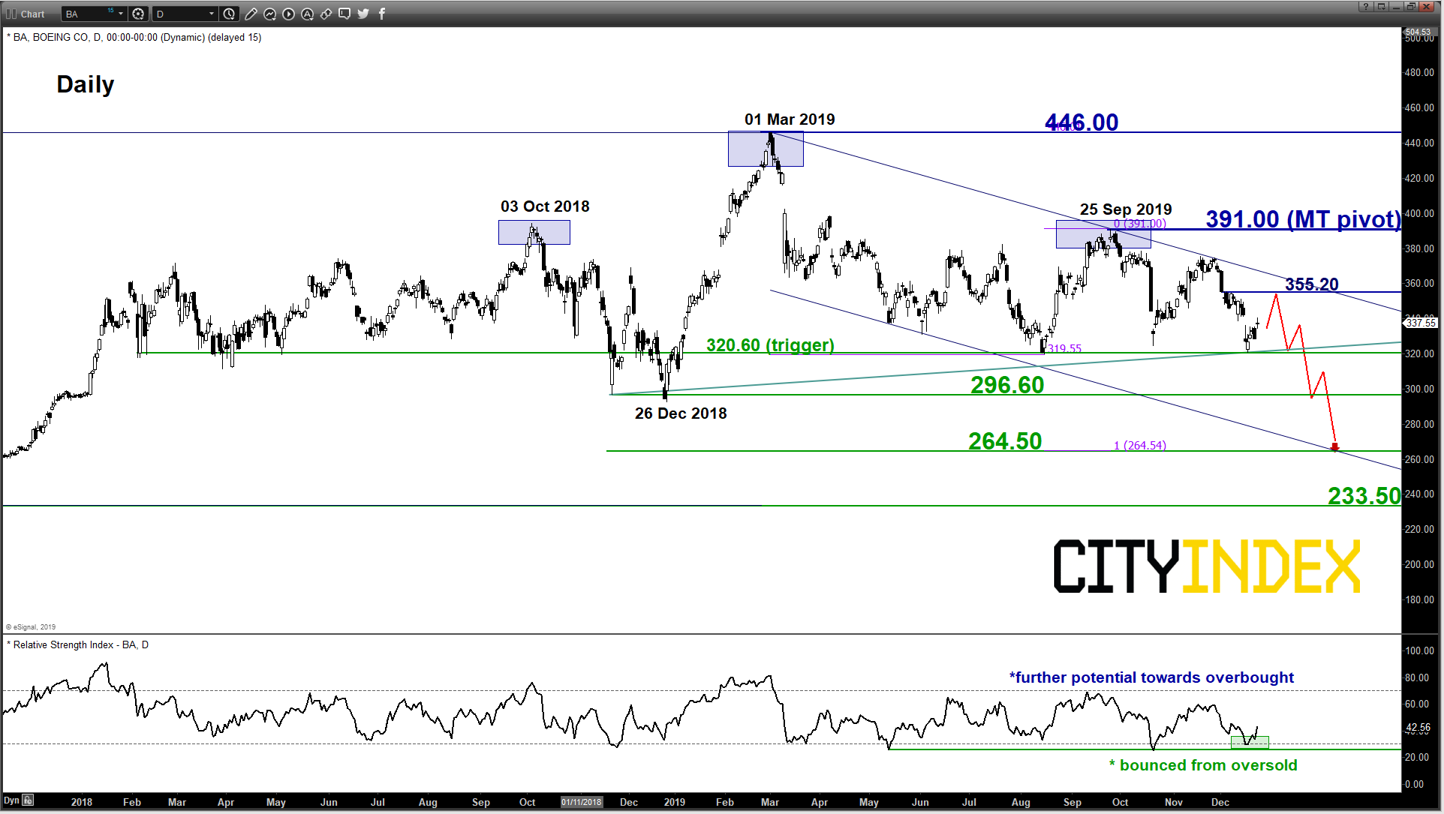

Key Levels (1 to 3 months)

Intermediate resistance: 355.20

Pivot (key resistance): 391.00

Supports: 320.60, 296.60 & 264.50

Next resistance: 446.00

Directional Bias (1 to 3 months)

The share price of Boeing rallied by 2.91% yesterday, with the sudden resignation of CEO Dennis Muilenburg after four weeks of consecutive decline of 14%, driven by the fallout from its 737 MAX crisis and the recent failed space travel mission on its unmanned Starliner capsule. Safety lapses in the 737 MAX model had led to fatal crashes in 2018 and 2019 and left Boeing (NYSE:BA) in the centre of regulatory and public scrutiny. Chief Financial Officer Greg Smith will serve as interim CEO until Chairman David Calhoun takes over as CEO effective Jan. 13, 2020.

However, technical analysis on the share price of Boeing is not advocating for a bullish “Bottoming” phase at this juncture.

Bearish bias in any bounces below 391.00 key medium-term pivotal resistance and a break with a daily close below 320.60 reinforces the start of a potential multi-week corrective decline sequence to target the next supports at 296.60 and 264.50.

On the other hand, a clearance with a daily close above 391.00 invalidates the bearish scenario for a push up to retest the current all-time high level of 446.00.

Key elements

- Since its 446.01 all-time high printed on 01 Mar 2019, Boeing has traced out a major bearish topping configuration, “Head & Shoulders” after a stellar up move of 335% from its February 2016 swing low of 102.10.