Call Buying Popular Ahead Of Earniings

Boeing Co. (NYSE:BA) is scheduled to report first-quarter earnings before the open tomorrow. The aerospace giant will hope to avoid the fate of sector peer Lockheed Martin Corporation (NYSE:LMT), which is lower today despite an upbeat earnings report. Ahead of the event, options traders are flocking to BA calls, hoping for a repeat post-earnings performance.

BA stock has a strong earnings history, enjoying a positive earnings reaction in six of the last eight quarters, including a 4.9% pop in January. In the last two years overall, the equity has averaged a 3.9% move the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 6.4% one-day move, per implied volatility data.

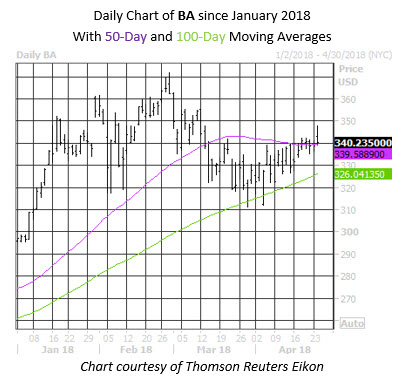

A move of similar proportion would put Boeing stock back near the $360 level for the first time since its late-February record high of $371.60. Since then, however, the shares pulled back, although the dip was contained by their ascending 100-day moving average. At last check, BA was up 0.9% to trade at $342.10 today, recently reclaiming the 50-day moving average, as well.

The security has seen plenty of call buying in the options pits lately. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE) and NASDAQ OMX PHLX (PHLX), the 10-day call/put volume ratio of 1.33 ranks in the elevated 71st percentile of its annual range.

Shifting gears to today, call buying continues to ramp up. Over 22,000 calls have changed hands, double the expected amount and volume is pacing for the 94th percentile of its annual range. New positions are being opened at the weekly 4/27 355-strike call, the most popular contract today.

With earnings imminent, Boeing found itself on a list of stocks with a high Schaeffer's Volatility Scorecards (SVS) that report earnings soon. Boeing's SVS of 92 (out of 100) indicates the stock has regularly made bigger moves on the charts over the past year, compared to what the options market was expecting.