Boeing (NYSE:BA) was another stock I covered extensively in my most recent book Stock Trading & Investing using Volume Price Analysis. In the book, which was written towards the end of 2017, I wrote the following:

‘and so for BA, the longer term outlook remains bullish as we come to the end of 2017, with this stock set to continue higher as we move into 2018’

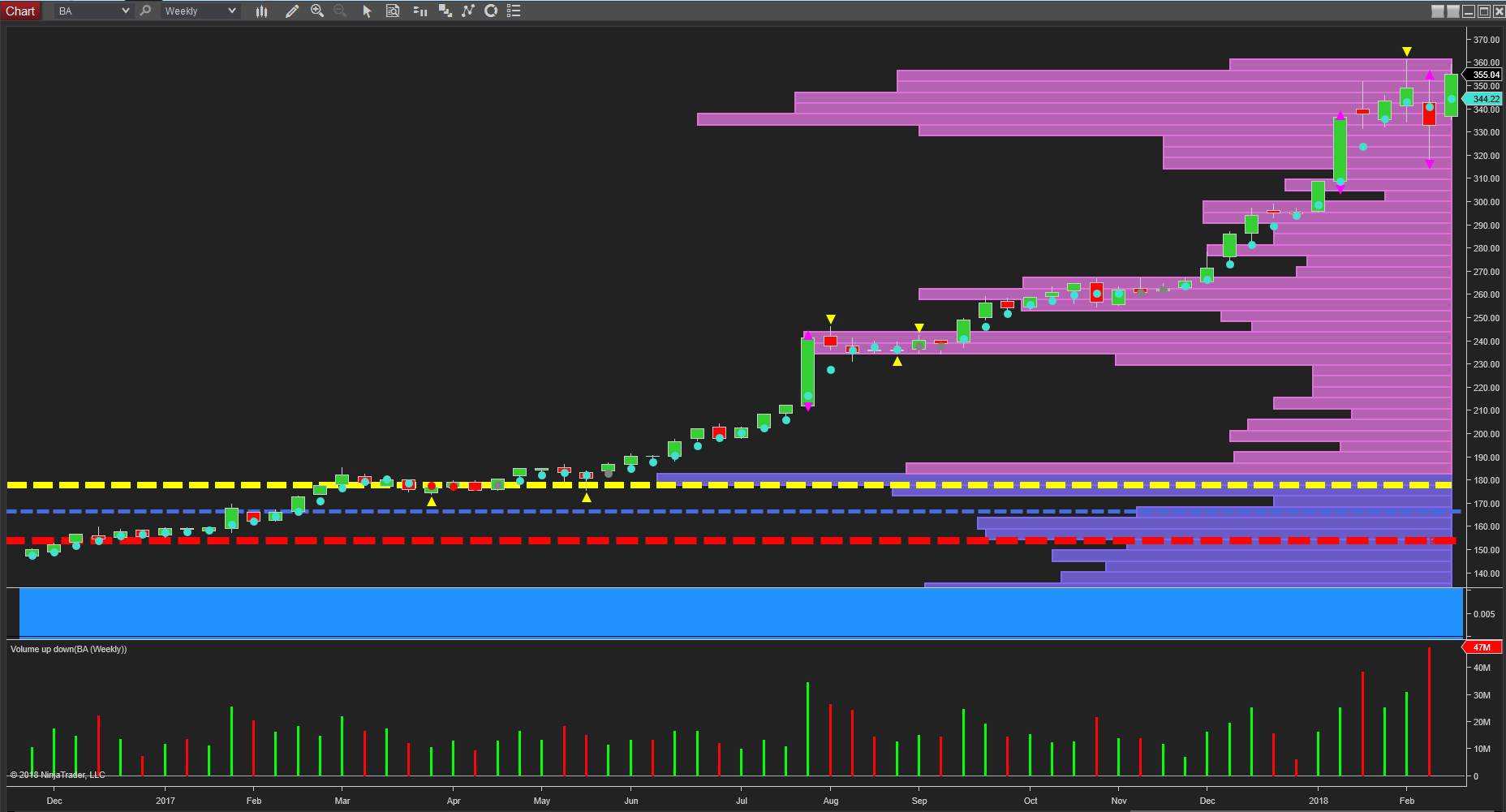

The stock at that time was trading at $265.55

And as we can see from the weekly chart the major correction in the primary indices has had a relatively ‘muted’ impact on the longer term bullish trend, and whilst the stock price did indeed spike lower, the price was relatively contained as BA traded in a range of $30 before closing as a doji candle. Last week’s candle simply reinforced the fact that bullish sentiment remains strong for the time being, and closing with a wide spread up candle almost regaining the highs of late January and closing at $355.04 ahead of the President Day’s Holiday.

Should the indices continue to recover, then expect to see further gains for this stock and a re-establishment of the longer term bullish trend once the $360 region is taken out on good volume.