S&P cuts Brazil’s credit rating to junk

Only six weeks after lowering Brazil’s investment grade outlook to negative, Standard & Poor’s cut Brazil’s credit rating to BB+ from BBB- as the government keeps readjusting its fiscal target. We anticipated a downgrade of Brazil’s sovereign debt, but the timing surprises us. Moody’s just downgraded Brazil’s rating by one notch to Baa3 from Baa2 on August 11th, while S&P put it on negative outlook on July 28th. However, we believe there is a solid, fundamental rationale behind the aggressive downgrades.

Over the last few weeks the political and economic situation has deteriorated faster than anticipated. Dilma Rousseff’s ruling coalition is falling apart while the congress is undeniably sidestepping the cutting of expenses, instead using watered down measures devised by Joaquim Levy.

In the wake of the downgrade, Brazilian markets will feel the heat on Thursday. The speed of the downgrade to junk will surely make even the most optimistic investor turn cautious. Investors are expected to unload stocks from their portfolio while the Brazilian real will likely depreciate significantly, especially against the US dollar. As a first step, USD/BRL should rapidly reach the 4.00 threshold and we wouldn’t be surprised if we start to see new record highs as a consequence.

On a more positive note, the downgrade may act as an electroshock for Brazilian politicians. Major reform overhauls are needed to set the Brazilian economy on the road to growth; politicians cannot turn a blind eye forever as concrete actions are needed to address the fiscal budget. Finally, now may be the right time to start considering Joaquim Levy’s proposals before it is too late.

BoE meeting

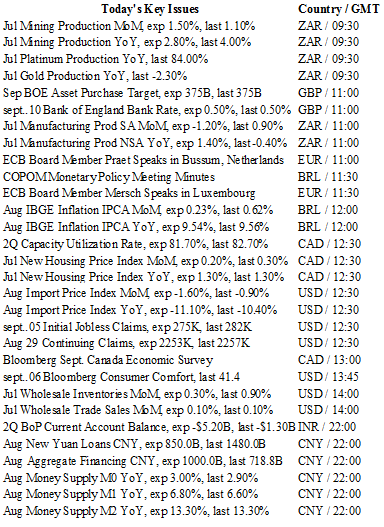

It is likely that the Bank of England will leave its rate unchanged today. We think that policymakers are not only considering domestic conditions, but also global conditions. Markets are currently driven by the next U.S. Fed rate hike, China’s turmoil and lingering low oil prices.

Last BoE meeting has seen one member voting “yes” for a rate hike. We consider that there is no reason for others members, for the time being, to vote favourably. Nonetheless UK domestic conditions seems supporting a rate hike. Only inflation remains at concern, it printed at 0.1% year-on-year in August. On the other side, retail sales stands currently at 4.2% y/y despite a small decline in August. GDP is also on its way higher with a read at 0.7% for Q2.

What really concerns BoE members is that the global growth and productivity remain low. The WTI is holding below $50 a barrel on fears of China’s slowdown and on the current OPEC oversupply. It is likely that this negative outlook weigh on the decision to increase rates as UK may suffer from a slower global economy. Therefore, we consider that more supporting domestic data are expected by the Bank of England before making any move. We expect the GBP to strengthen against the EUR in the medium term. However, it is likely that BoE minutes show some dovish comments which would provide some positive traction to the single currency.

USD/CAD - Still Trading In Range

The Risk Today

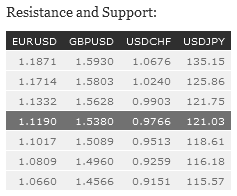

EUR/USD is moving higher. Hourly resistance is given at 1.1332 (01/09/2015 high) and stronger resistance lies at 1.1714 (24/08/2015 high). Support can be found at 1.1017 (18/08/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We have broken the resistance at 1.1534 (03/02/2015 reaction high). We are entering an upside momentum.

GBP/USD has bounced back at the 38.2% Fibonacci retracement support at 1.5409. Hourly resistance is given at 1.5443 (28/08/2015 high). However we think that the 61.8% Fibonacci retracement at 1.5087 is on target. We remain bearish on the pair. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is pushing higher. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is now consolidating. Hourly resistance at 0.9799 (17/08/2015 high) has been broken. Hourly support is given at 0.9513 (27/08/2015 low). On the very short-term term, the pair is setting higher highs. Therefore we remain bullish on the pair. In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).