There are few things that we can say with confidence when it comes to FX markets, especially when trying to anticipate market movements. However, one that we can more readily predict, is that every time Mervyn King takes to the stand, GBP dies a little inside and yesterday was no different. GBP dropped as he entered the room, perhaps the markets didn’t care for his choice of tie.

Having watched the press conference, one thing I did notice was the choice of language used to describe the UK’s outlook. The use of words like sustained, persistent, subdued were all used in reference to low and negative growth. While in the past we have had to listen to politicians/economists throw in their two cents as to the state of the economy, there was a real sense of prolonged pain and deterioration.

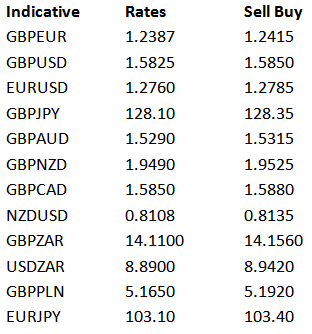

He stood behind the validity and effectiveness of the QE programme, confirming that it was still the weapon of choice. He was clear to point out that the success of QE was down to timing and not quantity. The appreciation of the pound and the unfavourable external environment were the main culprits. In a nutshell – the future is grim and the UK isn’t pulling itself out of this hole anytime soon with Q4 contraction now likely. GBPUSD and GBPEUR dropped to a new 11 week and 3 week low respectively.

Minutes from the last Fed meeting were also released yesterday, which highlighted the plans to support its QE programme by extending Operation Twist. As expected the Fed and its monetary tool belt will take a back seat while the fiscal cliff is tackled by the government. Obama gave a speech yesterday stating that the government was making good progress in tackling policy changes.

US retail sales were slightly worse than expected for October due to the hurricane, but little attention will be paid to the decline. US inflation, due today, is likely to rise following in the footsteps of the UK. Jobless claims this afternoon could push USD lower to the low 1.58’s against the pound.

GDP and inflation for the EZ are expected to hold strong this morning, building on the steady GDP figures already released earlier for Spain and Italy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BOE Inflation Report Paints A Grim Picture For The UK

Published 11/15/2012, 05:45 AM

Updated 07/09/2023, 06:31 AM

BOE Inflation Report Paints A Grim Picture For The UK

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.