Forex News and Events

The BoE hawkish camp empties as lower inflation environment no more justifies an upside move on rates, stated the minutes of January 7-8th MPC meeting. GBP/USD remains under pressure despite technicals favorable for a bullish consolidation. In Turkey, the lira traders remain skeptical on political pressures, while the carry flows keep the TRY-sell-off limited despite yesterday’s decision to cut the benchmark rate by a surprise 50 basis points.

BoE votes 9-0 to keep rates at low levels

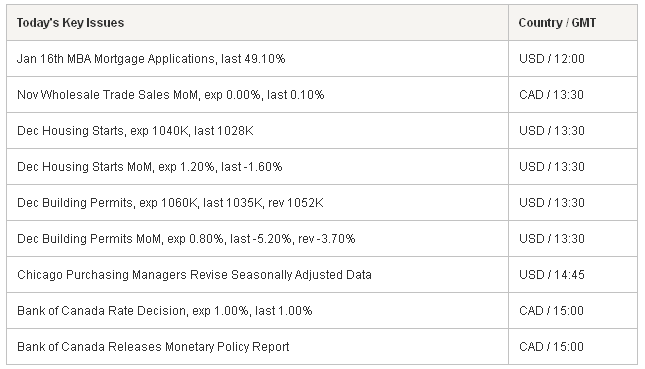

The BoE minutes showed all nine members voted to maintain the bank rate at the historical low of 0.50% in January 7-8th meeting given the moderate inflation outlook. Weale and McCafferty, who were in favor of 25 bp increase since August, stepped in dovish camp considering disinflation environment no more appropriate for a rate hike. “The fall in near-term inflation might become more persistent if it lowered inflation expectations, pay and other cost growth in a way that became self-perpetuating” stated the minutes. Released at the same time, encouraging jobs data (lower unemployment rate, higher earnings in Nov, combined to lower jobless claims in Dec) has been left aside. GBP/USD tumbled down to 1.5077 post minutes. Daily close above 1.5096 will send the MACD in the green zone, while failure to break above 1.5269/67 (Jan 14/15th highs respectively) should suggest renewed pressures toward 1.50 support. Decent vanilla puts trail below 1.5055 and should weigh on the cable if trapped below this level.

Lira still attractive for carry trades in moderate volatility environment

No one was surprised yesterday as the Central Bank of Turkey cut the benchmark repo rate by 50 basis points to 7.75%. The overnight corridor has been kept unchanged at 7.50% - 11.25%. The lower oil and commodity prices, the expectations for further cool-off in inflation, the negative rates in Switzerland, the anticipations for further expansion in the eurozone, the surprise action in India (based on similar motives), combined to political pressures have played big in CBT decision to cut rates. The step toward a growth-friendly policy given the favorable macro conditions should be welcomed by investors. However, all above-stated factors (justifying reasons) are external to Turkey’s fundamentals and we remain skeptical on the stability of the environment in the mid-term. This being said, the CBT kept its cautious tone on the accompanying statement, stating that the upcoming decisions will depend on inflation outlook, while the policy should remain tight via near-flat curve. Turkey Minister of Science, Industry and Technology Isik said the rate cut did not meet expectations as the government’s will is to push the real rates to zero. Given the upcoming general elections however, we believe that the risk premium that investors will demand on TRY investments due to political jitters should certainly limit the downside potential on TRY rates. The zero interest rate frame is therefore difficult to achieve as it would not reflect the risks that Turkish economy carries at least in the first two quarters of 2015. Investors should remain vigilant to trend reversals. As proven in the past, the lower rates are welcomed only until considered suddenly inconvenient. There lies the risk.

USD/TRY wrote-off knee-jerk gains, yet the BIST 100 index gap opened today and traded above 90’000 for the first time since May 2013 (the beginning of anti-government protests in Istanbul). With the ECB preparing to announce liquidity injection via sizeable QE, the dovish shift in the BoE stance and the speculations for a delay in first Fed fund rate hike, the cheap money environment will likely keep the equities well in demand. Eyes shift to 93’000 levels on BIST 100, record high hit on May 2013. On the FX, the positive bias on USD/TRY is expected to remain for a day close above 2.3175 (MACD pivot). Key short-term resistance is seen at 1.3600, if cleared should open the way toward 2.4000/2.4146 all-time highs seen on Dec’14.

Verse EUR, the lira remains attractive as FX volatilities fell sharply and stabilized at 8.50% (1-month realized vol) over the past week. The 3-month cross currency basis witnesses the improved preference in carry flows for the lira. We look for interesting entry opportunities on short EUR/TRY, yet remain alert on volatility spikes given the risky nature of the carry strategies. Key supply zone is seen at distant 2.5848/2.6673 (2011 double top / Fibonacci 38.2% on May’13-Jan’14 rally).

The Risk Today

Luc Luyet

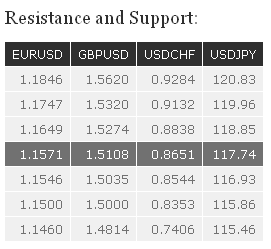

EUR/USD EUR/USD has broken the key support at 1.1640 and has moved below the psychological support at 1.1500, confirming persistent selling pressures. Hourly resistances can be found at 1.1649 (see also the declining trendline) and 1.1747 (intraday high). The hourly support at 1.1546 (19/01/2015 low) is challenged. Another hourly support lies at 1.1460. In the longer term, the break of the strong support area between 1.2043 (24/07/2012 low) and 1.1877 (07/06/2010 low) confirms the underlying bearish trend. The long-term symmetrical triangle favours further significant weakness. Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low), whereas a key resistance stands at 1.2252 (25/12/2014 high).

GBP/USD GBP/USD continues to move within the horizontal range defined by the support at 1.5035 and the resistance at 1.5274. In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5620 (31/12/2014 high). A full retracement of the 2013-2014 rise is expected. A psychological threshold lies at 1.5000, while a strong support stands at 1.4814 (09/07/2013 low).

USD/JPY USD/JPY has faded near the hourly resistance at 118.85 (13/01/2015 high), suggesting a pickup in selling pressures. Hourly supports can be found at 116.93 (19/01/2015 low) and 115.86 (16/01/2015 low). Another resistance lies at 119.32 (12/01/2015 high), while a key resistance stands at 119.96 (see also the declining channel). A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A major resistance stands at 124.14 (22/06/2007 high). A key support can be found at 115.46 (17/11/2014 low).

USD/CHF USD/CHF is trying to find a new equilibrium after the SNB's announcement. Hourly supports can now be found at 0.8544 (19/01/2015 low) and 0.8353 (intraday low). An hourly resistance now lies at 0.8838. A key resistance stands at 0.9132 (intraday high). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. Given that the subsequent panic has not broken the strong support at 0.7071 (09/08/2011 low), this level should hold in the next months. A medium-term sideways move between the key support at 0.8353 and the key resistance at 0.9132 is favoured.