Nowadays the forex market cannot be choosy; it will take any volatility that's on offer. Today's currency moves have mostly been guided by Central Bank decisions and rhetoric. The BoJ and BoE in their respective jurisdictions have not failed. Each of their currencies have received support, whether they like it or not, influenced by the potential or lack there of a change in future monetary policy. The BoE's support is a tad different as the market was looking for MPC dissent rather than uniformity and they have not been disappointed.

For some BoE members, the time for raising interest rates in the UK is getting closer. Today's highly anticipated release of the minutes indicate that the nine-member panel voted unanimously to keep the benchmark interest rate at a low +0.5% and the size of its bond portfolio at £375 billion pounds. However, the minutes also recorded that there was a range of views from the MPC members over how much 'slack' there was in the labor market "to bear down on inflation and what the best strategy is for eventually raising interest rates." The minutes show divisions on estimates of spare capacity. "The committee would continue to refine its views as the economy evolved, and for some members the monetary policy decision was becoming more balanced." This is definitely a sign that some officials are moving closer to reassessing their ultra low rate policy stance.

The BoE's Governor Carney has gone out of his way to stress that he is in no rush to tighten UK monetary policy, citing the aged old Central Bank reasons that inflation remains subdued and wage growth weak. There are too many individuals still unemployed and underemployed. The fixed income market continues to price in the first rate hike in early Q1, 2015. However, today's minutes suggest that a minority could begin pushing for an earlier rate hike, perhaps as soon as the end of this year, especially if the economy continues to grow as strongly. BoE staff predictions expect the economy to expand at a faster pace in Q2 (+0.9%) than in Q1 (+0.8%). The potential dissenters believe that to meet the Central Banks aim of lifting rates "gradually," the earlier the BoE needs to start.

Providing support for stronger UK growth is today's April retail sales print. It has come in considerably stronger than expected, the strongest in a decade, with a +1.3% headline print compared to +0.5% expected. Ex-fuel, the gain was +1.8% compared to +0.5% forecasted with an upward revision to the previous months print as well. It was the strongest year-on-year gain since May 2004 growing +6.9%. Along with the first set of minutes under the forward guidance II framework the market should be expecting the 'hawks' to get louder, especially with more economic prints like this morning's.

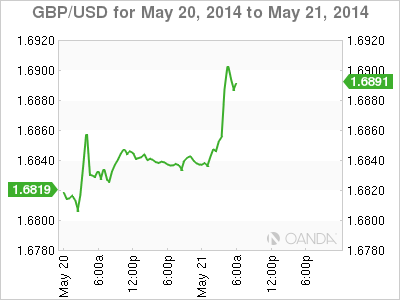

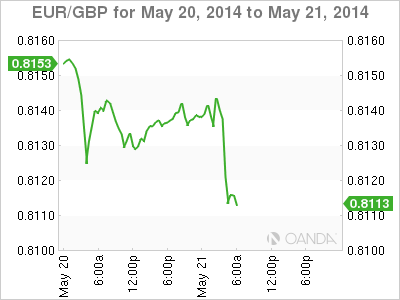

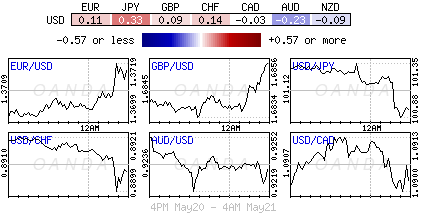

With respect to GBP/USD, it's about "buying the rumors and sell the fact." Cable's initial reaction was to extend gains north on a very strong UK sales print (£1.6922 – 12-day high). Against the EUR, sterling managed to hit a fresh 16-month high of £0.8103. However, profit taking on long positions has helped to deflate cable from its highs to current support levels (£1.6885). For now, the market can expect GBP bulls to run into some pre-£1.70 resistance around £1.6939 and £1.6975.

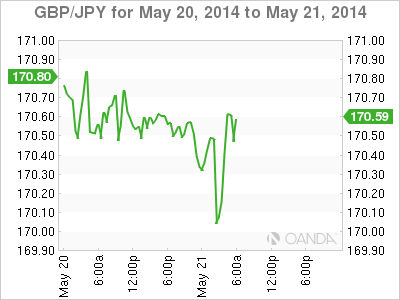

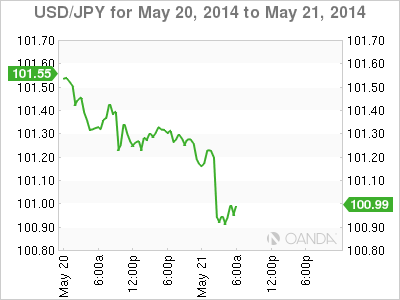

So far, the yen has been the other big shaker in the overnight session. The JPY managed to climb to a three-month high (¥100.81) earlier this morning after the BoJ concluded its own policy meeting by signaling that it saw little need to implement further monetary stimulus any time soon. The yen, which tends to gain in times of stress, has this week been the risk-off currency must have, particularly against the risk currencies such as the Aussie and Kiwi (trading at a two-month low AUD/JPY 93.22 and NZD/JPY 86.58). The currency continues to be supported by investor's broad retreat from riskier assets. The lack of policy action and no hints of further additional easing from Governor Kuroda will continue to provide short-term support for the yen. However, do not underestimate Kuroda, who sees no reason why the yen should be strengthening – he and his fellow policy makers remain on alert following the recent gains in the currency. He is the Central Banker that has supported using Yen for funding the "carry trade." A strong yen does not make Japan's export driven economy competitive. The yen's recent strength brings February's base ¥100.75 into sight and will now maintain a strong intraday resistance target at ¥101.15. Original post

Original post