Investing.com’s stocks of the week

Forex News and Events

BoE to stand by

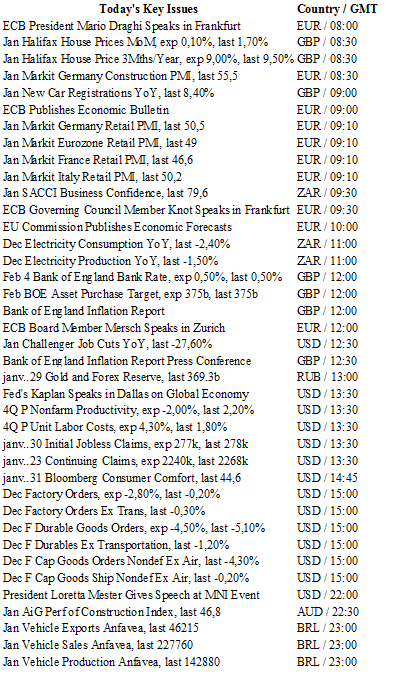

Today it’s BoE Super Thursday meeting will likely be a non-event as the Monetary Policy Committee will most likely vote to leave the key rate unchanged at 0.5%, with an 8-1 vote. The interesting will come afterward when Governor Carney will present the BoE quarterly forecast and provide insight about the BoE’s thinking. A lot has changed since the last quarterly meeting back in November. Crude oil kept heading south, market volatility surged massively, UK’s inflation pressures remained subdued and global uncertainty surged as market focused China’s growth outlook. This should naturally lead to lower revisions of growth and inflation forecast. A potential rate hike from the Bank of England has been pushed away in 2018 from 2017 a couple a weeks earlier. Some short moves on GBP crosses are therefore most likely this afternoon. GBP/USD continues its bull-run and is back above 1.46; be ready for a sharp correction in the event of dovish comments from Mark Carney.

Russia: Still willing to increase its forex reserves

Russia’s economic situation is concerning. 2015 GDP fell to 3.7% y/y in 2015, down from the slight rise of 0.6% in 2014. The country has also had to deal with a weakening currency, mostly due to the lingering low oil prices. The USD/RUB is now trading near its record of above 76 rubles for one dollar, meaning that gold in the Russian currency is very expensive. Recently, the price of gold and metals improved to a 3-month high.

Yet, in an effort to stabilize the Ruble, Russia will expand its Foreign-Exchange reserves (including gold). Today, Russia will disclose this amount for the period ending 29th January. Russia’s Central Bank head, Elvira Nabiullina has already made it clear that one of its primary objectives is to increase these reserve holdings up to $500 billion. For the time being, holdings only amount to 369.3billion.

For China, the challenge will be to know whether Russia is in fact capable of entirely backing its currency with gold. There is a deliberate strategy from Russia to remove the dollar from the Russian international exchanges. And this is why Russia needs more gold in order to gain credibility. Gold definitely represents confidence in a Central Bank. It would appear that the currency wars are still blazing!

Unlikely SNB action

The volatility in the recently yawn inducing EUR/CHF has fueled speculation of SNB intervention. We remain skeptical despite the fact FX intervention would be justified as Swiss inflation remains in deflationary territory and the economic outlook is gloomy. It’s more likely that macro events, including Euro strength are having a natural effect of sending EUR/CHF higher. We understand that the franc provides a safe-haven during geopolitical turmoil rather than central banks driven volatility. As expectations for the ECB to ease further (despite verbal comments), investors have rotated back into Europe from Switzerland. Perhaps the strongest suggestion that the SNB is actively trying to weaken the CHF has been the sudden jump in sight deposits by approximately CHF4.5bn since the start for the year. However, as major Swiss bank correctly points out that seasonality has a significant effect on sight deposits which can easily account for the variation. Given the worrying domestic fundamentals, the franc should continue to weaken making a rationale for a preemptive SNB dubious. Baring a risk “shock” we should see CHF weaken further and EUR/CHF trending higher.

GBP/USD - Bullish Breakout

The Risk Today

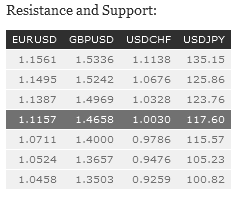

EUR/USD has exited the downtrend channel. Hourly support may be found at 1.0711 (05/01/2016 low). The road is now wide open toward resistance at 1.1387 (20/11/2015 high). . Yet, expected to show further consolidation. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD has exited the short-term uptrend channel. Hourly resistance can be found at 1.4969 (27/12/2015 high). Hourly support can be found at 1.4081 (21/01/2015 low). Expected to show further consolidation. The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is moving from 116.00 to 122.00. Hourly resistance lies at 123.76 (18/11/2015 high). Hourly support lies can be found at 115.98 (20/01/2016 low). Expected to show further increase toward resistance a 123.76. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is going back towards parity. Another hourly support is located at 0.9876 (14/12/2015 low) and hourly resistance can be found at 1.0328 (27/11/2015 high). Expected to show continued decline. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.