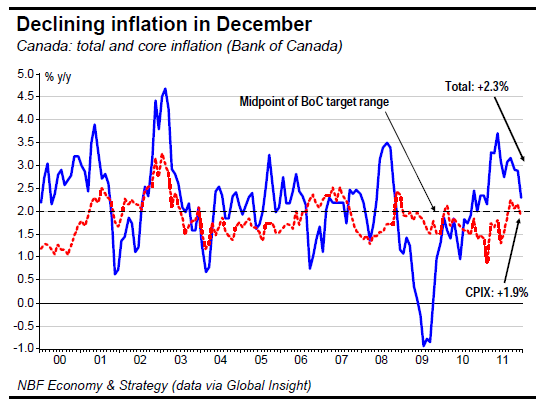

To no one’s surprise, the Bank of Canada left its overnight rate unchanged at 1% at its January ratesetting date. In Governor Carney’s view, the global economic outlook has deteriorated further since October because of the European sovereign-debt crisis. While acknowledging that the U.S. economy has surprised on the upside, the BoC still thinks its growth will moderate, from 2.4% in 2011 to 2.0% in 2012 and 2.2% in 2013. The 2013 forecast assumes that fiscal retrenchment will subtract about 2.5% from U.S. real GDP in that year. In our view, there is much uncertainty in that assumption. We think the next U.S. administration will seek to smooth out the impact of deficit reduction on the economy, phasing it in over time and mitigating the fiscal drag assumed by the BoC in 2013. For Canada, the Bank revised its estimate of 2011 GDP growth up to 2.4% (from 2.1% in October) on account of a second half much better than expected. For 2012 the BoC revised its growth projection up a tick to 2%, for 2013 down a tick to 2.8%. Core inflation is projected by the Bank to moderate through 2012 to just below 2%.

The central bank acknowledged that the economy is operating with less slack than previously assumed and now expects the output gap to close in 2013Q3. Finally, according to the BoC, favourable financing conditions are likely to support consumption and in the process lift household debt even more.

Governor Carney’s view that household debt and home prices have been a risk to Canadian financial stability for quite some time now raises the question of how long the Bank will rely solely on adjustments to the rules for government-backed insured mortgages to keep households from imprudent risk-taking.

In our view, monetary policy will have to play a role at some point because the process has been fuelled by a prolonged period of low interest rates. That said, the Bank of Canada in its risk management role must also weigh the likely effect of its decisions on the loonie and what that would mean for our competitiveness in international markets.

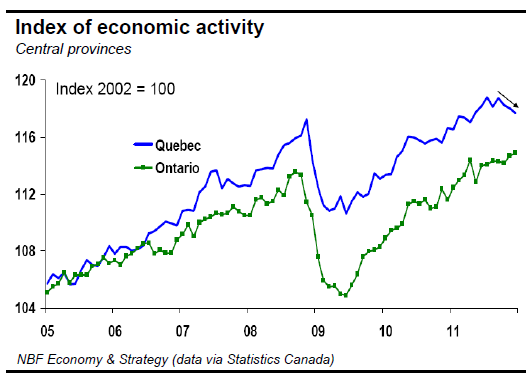

In light of the monetary policy stance of our largest trading partner and of developments in Europe, the consequences of the different tail risks the Bank is facing suggest that to err on the side of monetary accommodation remains the lesser evil. This argument is strengthened by the sputtering of the labour market in December and an apparent loss of economic momentum in Quebec and Ontario (see our Weekly Economic Letter of January 23).

In 2012, however, external trade could surprise the Bank by becoming a net contributor to growth on the back of better fundamentals in the U.S. labour and housing markets. With the output gap closing somewhat faster than currently expected, a change in the BoC’s policy stance in the second half of 2013 cannot be excluded at this point.

Bottom line: The overnight rate is likely to remain at the current near-historic low for some time. The BoC noted once more in its January MPR that its inflation projection “includes a gradual reduction in monetary stimulus over the projection horizon.” At this point, we see that as meaning rate hikes in the third quarter of 2013.

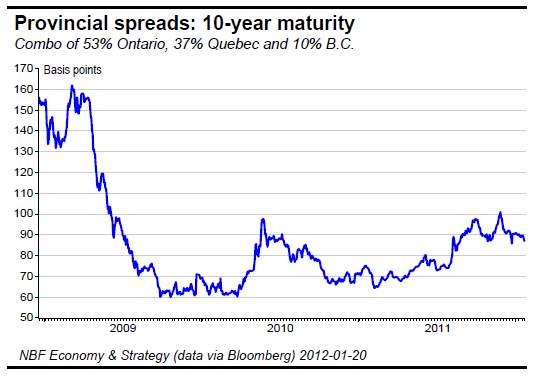

Yield spreads on provincial bonds have of course not been immune to the risk-on/risk-off environment driven by the evolution of the euro-zone sovereign-debt situation. Although spreads have been trending narrower in recent weeks, we do not want to get too excited. Quebec employment has surprised on the downside. Moody’s decision in December to put Ontario on credit watch, with a decision to follow the province’s next budget, is a further counsel of prudence.

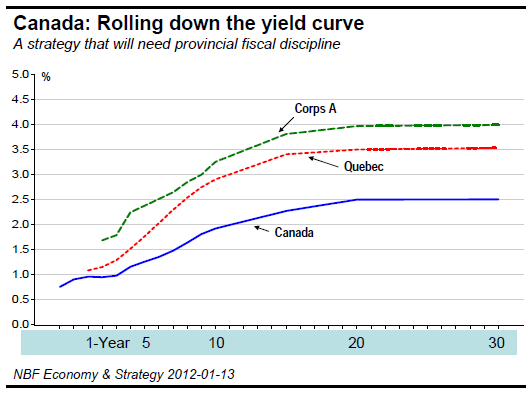

Under these conditions we do not want to be overweight in long provincial bonds. Still, we do see value in spread products maturing in 7 to 8 years. They provide an opportunity to benefit from rolling down the yield curve.

… and in Europe

According to a Financial Times report, large Italian banks borrowed more than €50 billion when the ECB made three-year money available through its LTRO program in December. This was reported to cover 90% of their funding needs for 2012. On February 28 the ECB is to make available a second tranche of threeyear money.

Some enthusiastic supporters of the scheme argued that by doing so the ECB is effectively bailing out not only the entire EU banking system but many private sovereign-bond creditors. Even pundits of more moderate inclination will recognize that the ECB initiative has considerably reduced the risk of the eurozone banking system grinding to a halt in Q1. Banks have large volumes of debt to roll over in this quarter and poor market conditions could have caused significant disruption.

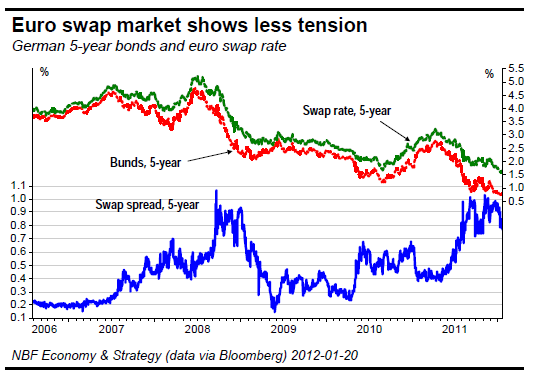

Swap spreads in the euro market have shown a tendency to stabilize or improve since November. ECB actions, the December EU summit with its serious discussion of a new fiscal compact, and the changing of the guard in the Italian government all contributed to improving the underlying tone of the swap market. This is significant since, as Peter Boone and Simon Johnson of the Peterson Institute for International Economics have pointed out, financial institutions use this market to adjust their interest-rate risk. In their view, the size and importance of the euro swap market means that Europe’s financial system would be at risk of systemic collapse if this market were to run into trouble.

Since swap rates represent the average rate paid on euro-denominated interbank loans by 44 of Europe’s banks, the narrowing of swap spreads represents a perception that bank credit risk is lessening.

That said, many potential pitfalls remain for the euro zone. At this writing an agreement on the coupon(s) of the new long-term debt to be exchanged against existing Greek bonds has yet to be reached. According to the Financial Times, the Institute of International Finance remained “hopeful and quite confident” that a deal could be reached to prevent a full-scale default by Greece when its bonds come due March 20. But it’s not a done deal and the clock is running.

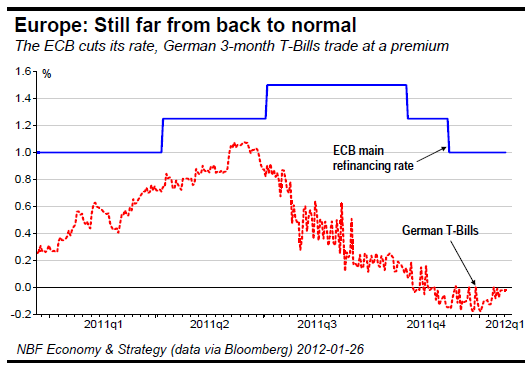

Many market participants are nervous enough about the situation in the short run that they are willing to buy German T-bills at a premium.

Over the medium term, the prospect of multiple years of weak economic growth in countries that must implement fiscal austerity, combined with the leverage of financial institutions, make an accident always possible despite the political resolve to keep European integration on track.

… and in the U.S.:

17 forecasts, but only 10 count

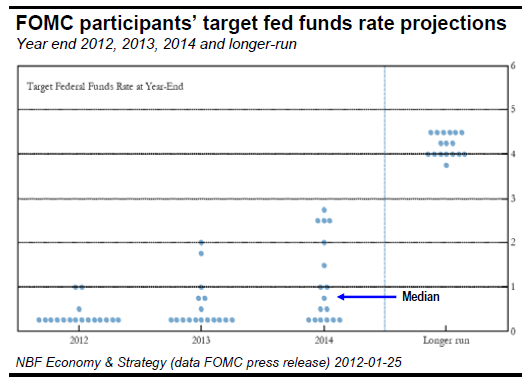

As expected, the FOMC left the target range for the fed funds rate at 0 to 0.25% at its January rate-setting meeting. Taking one more step toward transparency, the FOMC released the interest-rate projections of the twelve Federal Reserve Districts and five Governors of the Board. As can be seen in the following chart, most officials expect the target rate to remain low until year end 2014. The median projection for the target rate at that time is only 0.75%, with one official projecting 2.75% and six seeing today’s rate still in place. However, it should be noted that not all district presidents are voting members of the FOMC. Reflecting these views, the FOMC press release said the Committee sees economic conditions as "likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.” Since last August, the Fed had been saying “at least through mid-2013.”

A look at FOMC projections for the unemployment rate goes far to explain the change in FOMC participants’ view of the appropriate target rate. Last April their

central forecast was for unemployment between 6.8% and 7.2% in the fourth quarter of 2013. Nine months latter, they see that range being reached only in the fourth quarter of 2014. In other words, the labour market needs monetary policy support longer.

Moreover, the Committee expects that over the next three years, inflation will run below the rate consistent with its dual mandate. On that front, the Fed also innovated in January by making its long-term inflation target explicit, as its chairman Ben Bernanke had long advocated. Now it’s official: 2% is the rate the Fed sees as consistent with its dual mandate of price stability and maximum employment. As for the latter objective, the longer-run projection suggests that the FOMC thinks unemployment should trend to a range of 5.2% to 6%.

In the press conference that followed the FOMC announcement, Mr. Bernanke took the opportunity to say that “at least through late 2014” was not an unconditional pledge and this assessment of the appropriate target rate could change over time. If the situation worsens, the chairman said, even QE3 could be a possibility. On the other hand, rate hikes could come somewhat earlier if economic conditions warrant. Time will tell.

And where would we have put our dot on the chart showing the fed funds rate projections of FOMC participants? Given our outlook for the economy, we share the view of the Fed governor or district president who put the appropriate rate at 1.5% by the end of 2014. Assuming a gradual reduction of monetary stimulus over the forecast horizon, that year-end target would be consistent with a first rate hike around June 2014. This is six months later than our previous forecast.

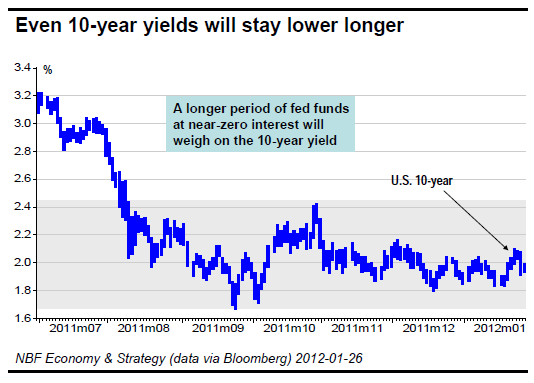

Even if economic data comes in somewhat stronger than expected, the Fed’s extension of the period over which it expects the fed funds rate to remain near zero will keep the front end of the yield curve well-anchored. Weak data or more strains in global financial markets, on the other hand, would put downside pressure on the10-year yield.

Bottom line: For the time being, it appears that the lifespan of the range in which 10-year Treasuries have traded since August has just been extended. Moreover, while we thought they would be trading around 2.18% by quarter end, we now see current fair value at around 1.98%. Fair value is still likely to drift higher over time, but more slowly than originally estimated. Last month, we were looking for 10-year Treasuries to trade around 2.62% by year end. At this writing, 2.36% seems reasonable. As in our previous forecast, this outlook assumes that the European threat will be contained and that U.S. politicians will not throw more sand in the gears.

With the BoC disinclined to raise rates anytime soon and Canada a member of the select group of countries rated AAA by Standard and Poor’s, we expect 10-year Canadas to follow the lead of the senior market south of the border.

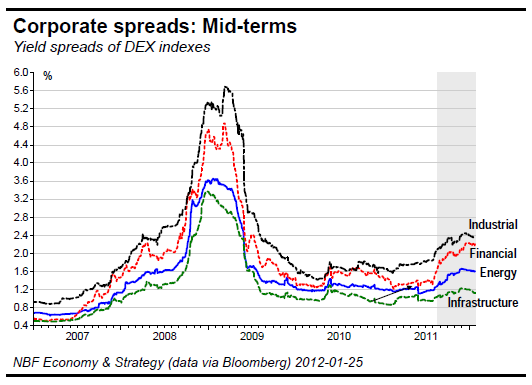

An extended period of low interest rates will obviously have different implications for corporate profits depending on whether you are a life insurance company or a heavy-industrial producer. Last August, we recommended lowering portfolio beta. Since then, corporate spreads have widened significantly.

Though we acknowledge that the European threat is far from resolved, the current stance of monetary policy in North America inclines us to dip our toe into the corporate bond market. We recommend selective addition to the nonfinancial corporate exposure of the portfolio. To accomplish this we would sell equal amounts of provincials and Canadas.

Duration could be extended marginally by a switch of some short bonds to five-year maturities.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BOC Still Nervous About Potential Spillover From Europe

Published 01/31/2012, 12:44 AM

Updated 05/14/2017, 06:45 AM

BOC Still Nervous About Potential Spillover From Europe

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.