- Solid US jobless report underwhelms FX market

- Light US data week ahead to keep focus on ECB

- USDCAD bias is bullish

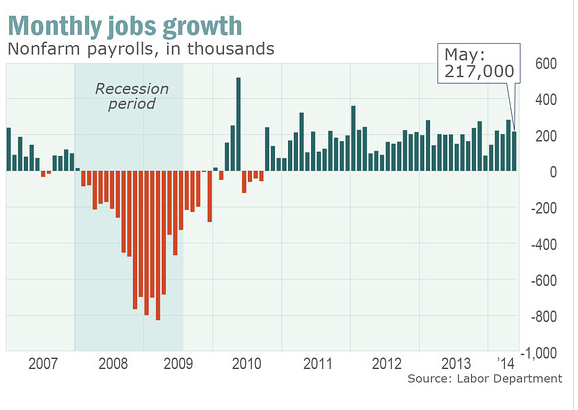

The US jobless report was solid. The gain of 217,000 jobs and the dip in the unemployment rate to 6.3 percent met the consensus forecasts yet FX traders seemed unimpressed. Perhaps they bought into the hype that the nice weather in May triggered a hiring frenzy. More than likely the FX markets are still suffering indigestion from the {{1|EUR/USD}} eeaction to the European Central Bank's rate cut and policy moves. The week is ending on a fizzle and a lack of top-tier data should result in another week of range trading.

The week that was The European Central Bank meeting was eagerly anticipated at the start of the week and it is still being dissected at the end of the week. As ECB announcements go, Thursday's statement was akin to news of the D-Day landings 70 years ago today. One was to liberate Europe from the scourge of Nazi invaders and the other was to liberate Europe from the scourge of deflation. For both of them, Day 1 results were mixed.

The week started with the US dollar squeaking out small gains on Monday, aided by soft Markit PMI reports in Europe and mixed US data. The entertainment came from the US Institute of Supply Management (ISM) which required three press releases to deliver what they believe was the correct reading of business conditions in the manufacturing sector. Tuesday, the Reserve Bank of Australia (RBA) left rates unchanged and issued a virtually identical statement to the one in May. Meanwhile, EUR/USD recouped the small losses from the day before on pre-ECB position jockeying. T

he Bank of Canada took center stage on Wednesday delivering a somewhat dovish statement causing the USD/CAD to jump. Thursday was "show time" in the Eurozone. The ECB did not disappoint. It cut rates, introduced negative deposit rates, lowered inflation forecasts and planned for another Long Term Refinancing Operation (LTRO).

The EUR/USD tanked initially and then a wave of profit taking sparked a rally that took the single currency 0.0060 points higher than where it was pre-ECB. In the words of legendary Canadian hockey broadcaster, Joe Bowen, "Holy Mackinaw". The week that will be The upcoming week will be a short one for many European countries, to wit, Whit Monday. It will also be a week lacking in top tier actionable data from America suggesting that further scrutiny of the ECB's policy action will be a key market driver. China unleashes a wave of data including Trade, CPI, PPI, Retail Sales and Urban Investment which will be closely watched by the commodity currency bloc traders. Sterling and sterling crosses will be the focus on Wednesday with the release of UK employment data. The Reserve Bank of New Zealand's (RBNZ) interest rate decision and policy statement is also on Wednesday. The RBNZ is widely expected to raise interest rates by 0.25 percent. The debate is whether or not the central bank indicates that this rate increase is the last increase for a while. Canadian dollar outlook This week's Bank of Canada (BoC) statement surprised many with its "glass half empty" view of Canadian economic growth prospects.

The BoC dismissed the latest rise in CPI stating that "it was largely due to the temporary effects of higher energy prices". It noted that the US economic rebound had "less underlying momentum". It also managed to cite a low Canadian dollar as an ingredient for economic growth which, to me, is a backhanded way of calling for a weaker Loonie.

The Canadian employment report was a tad less than stellar. In fact, the only positive part about it is that it met consensus forecasts. The unemployment rate nudged back to 7.0 percent from 6.9 percent previously and the economy created 25,800 jobs. Unfortunately these jobs were all part-time. The risk of a Canadian housing market bubble was a large Canadian dollar negative over the past two years. These risks seemed to have dissipated but a press release this morning from Canadian Mortgage and Housing Corporation (CMHC) may change that. CMHC announced that it was discontinuing financing of multi-unit condos, effective immediately. It appears that the CMHC is recognising risks that foreign investors had long worried about which may reinforce the floor on USDCAD.

On the other hand, bearish short-term the EUR/CAD technicals and bullish the CAD/JPY technicals may slow USD/CAD gains. The USD/CAD technical outlook The short-term the USD/CAD outlook is mixed while the currency pair is confined within a 1.0860-1.0960 trading range although the sentiment favours bullish USD/CAD.

A break of 1.0960 targets the 1.1040-50 area while a move through support in the 1.0840-60 area puts 1.0780 in play. The intraday technicals suggest that the uptrend from the May 30 low of 1.0822 was broken with the move back below 1.0925 yesterday supported by the multiple failures to take out resistance at 1.0960. The current setup remains consolidative while trading below 1.0940 but requires a move below 1.0905 to refocus on 1.0860. Range for next week 1.0905-1.1040.