- USD/CAD crumbling under weight of long dollar positions

- BoC decision is anyone's guess

- USDX rally will limit Canadian dollar gains

Bank of Canada rate decision ahead

The Bank of Canada (BoC) rate decision tomorrow has many traders and market participants on their toes. The BoC caught markets by surprise in January when rates were chopped by 0.25 bps. The statement implied that another cut was likely and that view was reinforced by other BoC officials afterwards. And just as consensus got comfortable with another rate reduction, Governor Stephen Poloz suggested that the BoC would bide its time assessing the impact of the move. What? No rate cut?

Poloz is to central bankers what Ron Burgundy is to anchormen. You never know what he will say next. Recent speeches by Poloz and other BoC staff on monetary policy resemble a back-alley shell game. You know a rate move is there but finding it is the problem.

Therefore, the USD/CAD floor in the 1.2380-1.2420 area should remain firmly in place until after the decision.

Canada GDP breathes life into Loonie

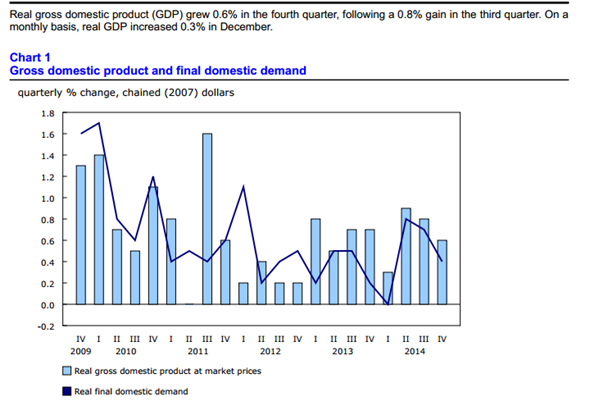

Today’s Canadian GDP data handily beat the forecasts and the Canadian dollar rallied. The annualised Q4 GDP rose 2.4% (Forecast 2.0%, Q3 3.2%) while the month over month data showed a 0.3% rise (Forecast 0.2%, previous negative 0.2%).

The USD/CAD plunge was likely more a factor of positioning rather than a wholesale shift in the outlook for the Canadian dollar. In fact, part of the Q4 growth was due to a buildup in inventories while exports of goods and services declined.

The report was probably more positive than negative but will be quickly forgotten as traders await the Bank of Canada (BoC) interest decision and statement tomorrow.

Source: Statistics Canada

USDX –Thwarting USD/CAD losses

Attempt to drive USD/CAD lower have been thwarted by developments in the US dollar index. The intraday downtrend in USDX from the January 95.87 peak ended with the move above 94.80 last Wednesday but the follow-through has lacked conviction. Until the January peak is history, the risk is for further 94.20-95.85 consolidation. If Friday’s US nonfarm payroll’s report doesn’t ignite a US dollar rally, the USDX top may hold until the March 17-18 Federal Reserve Open Market Committee meeting.

Source: Saxo Bank

Oil in driver’s seat of Loonie sedan

The short-term chart suggests that the oil price downtrend from the end of September is under assault and a decisive move in WTI above $51.20 may signal the start of a new rally and a test of 2015 resistance in the $54.20-40 area. A break of this area would point to further gains toward $60.00/bbl. USD/CAD moves would mirror those of oil. A break of WTI at $54.20 appears to coincide with USD/CAD breaking below support in the 1.2340-60 area, which would target 1.2050.

The technicals seem fairly clear cut, but as usual the fundamentals are murky. Part of the recent jump in prices is due to rival Libyan forces targeting oil terminals but that is more likely a knee jerk, opportunistic move rather than a shift in long term supply fundamentals.

There has been significant reductions in US shale producers’ capital expenditures which will do a lot in reducing the oil glut, but that is a long term effect and shouldn’t be effecting the short term price.

Bank of America (NYSE:BAC) is forecasting a drop to $32.00/bbl in WTI due to the fading effects of the heating oil season combined with US storage capacity close to maxing out. Crude stockpiles rose 8.43 million barrels to 434.1 million through February 20.

The Loonie may be tied to oil but oil is not tied to the Loonie. USD/CAD losses below 1.2340-60 will be difficult to sustain without a corresponding rally in WTI. On the other hand, USD/CAD rallies can and will occur even if WTI drifts around within the current $4450-$51.20 band, driven by diverging US and Canada economic fundamentals and interest rate differentials.

Source: Saxo Bank

USD/CAD technical outlook

A picture is worth a thousand words and the following chart tells the USD/CAD story very succinctly. It’s a buy in the 1.2350 area, a sell near 1.2800 and a coin toss in-between. The width of that trading band provides significant intraday trading opportunities, but until either side is broken, decisively, this currency pair is directionless. However, the uptrend from November remains intact while trading above 1.2110.

Source: Saxo Bank