BOC held rates as expected, although their statement was optimistic enough to send the Canadian dollar sharply higher.

The statement was indeed one of optimism, although not hawkish as there is clearly no bias to raise rates. But with a relatively high OCR of 1.75%, it leaves BOC vulnerable to easing in 2020 if data turns against their forecasts. Particularly if trade talks sour. Going forward, we’ll be keeping a close eye on consumer spending and housing activity as they’ll likely hold the key as to whether they’ll remain neutral or seek to ease in the future.

Summary of BOC statement:

Whilst the positive outlook was clearly a major factor in CAD strength, firmer oil prices also played a part too after a surprise inventory drawdown. WTI enjoyed its most bullish session since September’s oil spike and, if forward returns are to be believed, we could see oil prices rally in mid-December as historically they have rebounded 3-months after a price spike.

Technically, WTI sits just below 58.77 resistance within a bullish channel. It’s clearly a pivotal level as it has acted as both support and resistance in recent months, so with prices stalling beneath it, bears could be tempted to fade into move (at least over the near-term). Yet if prices break above 58.77 we’re in a new range and this could likely further support CAD strength.

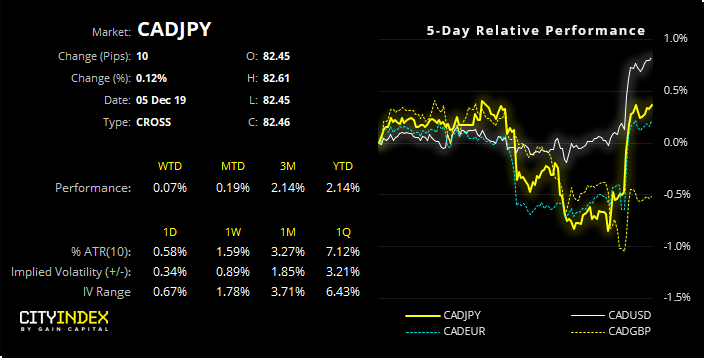

CAD/JPY: There have been a few twists and turns along the way, but the bullish wedge pattern remains in play. We have been following CAD/JPY closely has it drifted towards the August trendline, as it was either going to bounce off the trendline and confirm the wedge or invalidate both. Whilst the bounce did occur, bearish price action this week looked set to invalidate the wedge, only to see bullish range expansion take it back up to Monday’s high in breakneck speed.

For now, momentum favors the bull-cap so we’re looking for a break higher.