Investing.com’s stocks of the week

Good Morning:

In some of the saddest corporate news in a long time-Eastman Kodak Co filed for bankruptcy protection from creditors this morning.

Kodak revolutionized photography-when it introduced the “Brownie Camera” over 100 years ago. As the world moved to digital technology for cameras-Kodak was stuck with their film technology-and was never able to jump into the digital marketplace. R.I.P.

Spain and France had very solid results and participation during today’s bond auctions.

European sovereigns will need to sell some $1 Trillion euros worth of debt this year-and we hope that the markets will be able to absorb all of this debt. If it is priced right-the buyers will show up.

Today we have data on CPI and Philly Fed. We will also see data on jobless claims-which came very close to the majic 400K number last week. It is expected to fall below 390K this morning.

Claims the big surprise. Dollar moves higher initially but stalls

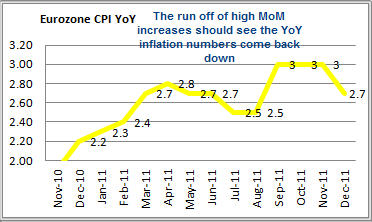

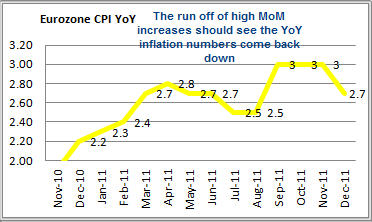

The much better than expected Initial Claims (lowest since April 2008) gave the dollar a boost, but the move down seems to have stalled. The EURUSD is up around .44% today – just behind the strength of the CHF. Optimism that a Greek bond restructuring and a better Spanish bond auction are the reasons for the uptick.

From a technical perspective, the pair broke above the daily channel trendline in early Asian trading and has not looked back (1.2848 is the trendline today). The range is still narrow on the day at 88 pips and could see an extension. The 1.2945 level is an upside target (low from Mid December).

EUR/USD" title="EUR/USD" width="580" height="420" />

EUR/USD" title="EUR/USD" width="580" height="420" />

The shorter 5 minute charts is giving mixed signs. The price broke lower on the news but rebounded. The rebound came up short of the high and the price has rotated back down. Market action is more balanced. You have to respect the upside bias but take the need to take out the 1.2925 will be needed to keep the buyers content. On the downside the 1.2892 is the break point on the downside today. A move below this level should lead to further selling potential for the pair.

EUR/USD M5" title="EUR/USD M5" width="580" height="420" />

EUR/USD M5" title="EUR/USD M5" width="580" height="420" />

EURUSD falls to 100 hour MA /50% retracement. Philadelphia Fed Index awaited.

The EURUSD fell below trendline and then the 38.2% retracement as it moved to the 100 bar and 50% retracement of the days range. The range remains narrow for the pair. The market is subject to headline news from Greece. This keeps the market on edge. The Philadelphia Fed Index is due out at 10 AM. Expectations are for a rise to 10.3 from 6.8 last month.

The Euro situation has the markets down

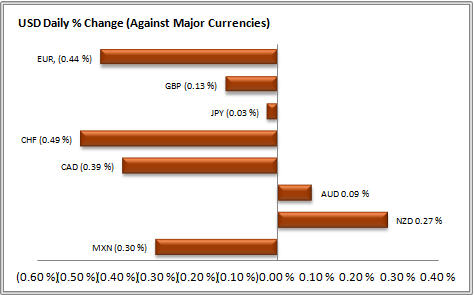

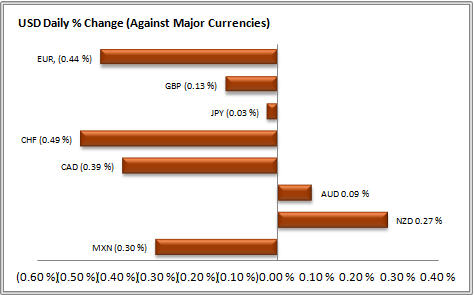

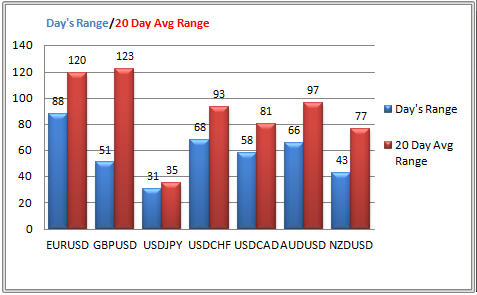

Normally I would look a the chart above and get excited about the prospect for a move. The ranges for the day are well below the average range over the last 20 trading days in all the currency pairs. The GBPUSD has a range of 51 pips versus an average of 123 pips. Let’s get ready to move.

Although I will always keep an eye open for a move, the dynamics in the Eurozone has the market thinking short term as headline news can switch the tide in an instant. The Greece restructuring is old, replayed news but can be new news in an instant. That story is coming to an end as it is time to either come to an agreement, force an agreement or simply default. Time will tell but bond payments are coming in due and so is the next tranche from the IMF/EU. Another thing that is dominating is the near daily auctions that will occur. So far with the new money slushing around from the ECB, with more to come in February, it is the ECBs way to say “It is ok to take the money, buy bonds and recapitalize with the carry profits while keeping borrowing rates lower for the borrowers like Spain and Italy.” Sure the ECB officials will remind everyone it is not forever, but will they take the punch bowl away so soon? Not likely. With pressure on the countries to continue to make budget cuts, the ECB is thinking this is the right time to flood the system with money. These themes tend to send the EURUSD higher – at least when there is nothing else to focus on.

The problem with that thinking is the restructuring could go horribly wrong and fall apart. Lets face it, it is easy to provide liquidity. It is more difficult to make budget cuts, balance budgets, stimulate the economy and do things like get bondholders to accept steeper haircuts on bonds.

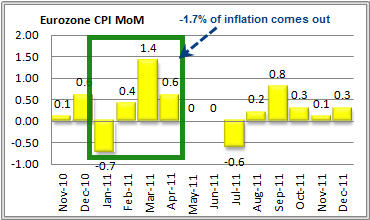

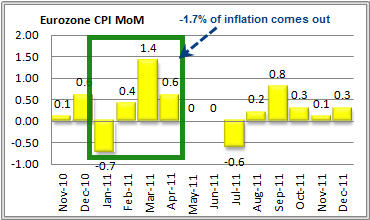

Another dynamic that will be in place down the road is the inflation picture in the EU. The chart below shows the MoM changes in the EU CPI. In the next 4 months a total of 1.7% will roll off from last year. Typically in January there is a reduction in prices as a result of sales. The real strides should be made in February, March and April when 2.4% comes off the table. When that happens, the ECB should have the inflation data moving their way over the next few months which allows them to focus on “fixing problems” rather than fighting inflation. Does the ECB ease? They could. They should have the mandate from the inflation perhaps even moving below the 2% threshold. This should lead to lower rates which should be negative for the EURUSD all things being equal.

In some of the saddest corporate news in a long time-Eastman Kodak Co filed for bankruptcy protection from creditors this morning.

Kodak revolutionized photography-when it introduced the “Brownie Camera” over 100 years ago. As the world moved to digital technology for cameras-Kodak was stuck with their film technology-and was never able to jump into the digital marketplace. R.I.P.

Spain and France had very solid results and participation during today’s bond auctions.

European sovereigns will need to sell some $1 Trillion euros worth of debt this year-and we hope that the markets will be able to absorb all of this debt. If it is priced right-the buyers will show up.

Today we have data on CPI and Philly Fed. We will also see data on jobless claims-which came very close to the majic 400K number last week. It is expected to fall below 390K this morning.

Claims the big surprise. Dollar moves higher initially but stalls

The much better than expected Initial Claims (lowest since April 2008) gave the dollar a boost, but the move down seems to have stalled. The EURUSD is up around .44% today – just behind the strength of the CHF. Optimism that a Greek bond restructuring and a better Spanish bond auction are the reasons for the uptick.

From a technical perspective, the pair broke above the daily channel trendline in early Asian trading and has not looked back (1.2848 is the trendline today). The range is still narrow on the day at 88 pips and could see an extension. The 1.2945 level is an upside target (low from Mid December).

EUR/USD" title="EUR/USD" width="580" height="420" />

EUR/USD" title="EUR/USD" width="580" height="420" />The shorter 5 minute charts is giving mixed signs. The price broke lower on the news but rebounded. The rebound came up short of the high and the price has rotated back down. Market action is more balanced. You have to respect the upside bias but take the need to take out the 1.2925 will be needed to keep the buyers content. On the downside the 1.2892 is the break point on the downside today. A move below this level should lead to further selling potential for the pair.

EUR/USD M5" title="EUR/USD M5" width="580" height="420" />

EUR/USD M5" title="EUR/USD M5" width="580" height="420" />EURUSD falls to 100 hour MA /50% retracement. Philadelphia Fed Index awaited.

The EURUSD fell below trendline and then the 38.2% retracement as it moved to the 100 bar and 50% retracement of the days range. The range remains narrow for the pair. The market is subject to headline news from Greece. This keeps the market on edge. The Philadelphia Fed Index is due out at 10 AM. Expectations are for a rise to 10.3 from 6.8 last month.

The Euro situation has the markets down

Normally I would look a the chart above and get excited about the prospect for a move. The ranges for the day are well below the average range over the last 20 trading days in all the currency pairs. The GBPUSD has a range of 51 pips versus an average of 123 pips. Let’s get ready to move.

Although I will always keep an eye open for a move, the dynamics in the Eurozone has the market thinking short term as headline news can switch the tide in an instant. The Greece restructuring is old, replayed news but can be new news in an instant. That story is coming to an end as it is time to either come to an agreement, force an agreement or simply default. Time will tell but bond payments are coming in due and so is the next tranche from the IMF/EU. Another thing that is dominating is the near daily auctions that will occur. So far with the new money slushing around from the ECB, with more to come in February, it is the ECBs way to say “It is ok to take the money, buy bonds and recapitalize with the carry profits while keeping borrowing rates lower for the borrowers like Spain and Italy.” Sure the ECB officials will remind everyone it is not forever, but will they take the punch bowl away so soon? Not likely. With pressure on the countries to continue to make budget cuts, the ECB is thinking this is the right time to flood the system with money. These themes tend to send the EURUSD higher – at least when there is nothing else to focus on.

The problem with that thinking is the restructuring could go horribly wrong and fall apart. Lets face it, it is easy to provide liquidity. It is more difficult to make budget cuts, balance budgets, stimulate the economy and do things like get bondholders to accept steeper haircuts on bonds.

Another dynamic that will be in place down the road is the inflation picture in the EU. The chart below shows the MoM changes in the EU CPI. In the next 4 months a total of 1.7% will roll off from last year. Typically in January there is a reduction in prices as a result of sales. The real strides should be made in February, March and April when 2.4% comes off the table. When that happens, the ECB should have the inflation data moving their way over the next few months which allows them to focus on “fixing problems” rather than fighting inflation. Does the ECB ease? They could. They should have the mandate from the inflation perhaps even moving below the 2% threshold. This should lead to lower rates which should be negative for the EURUSD all things being equal.