Investing.com’s stocks of the week

Credit Markets

Snippet from January 4, Pivotal Events

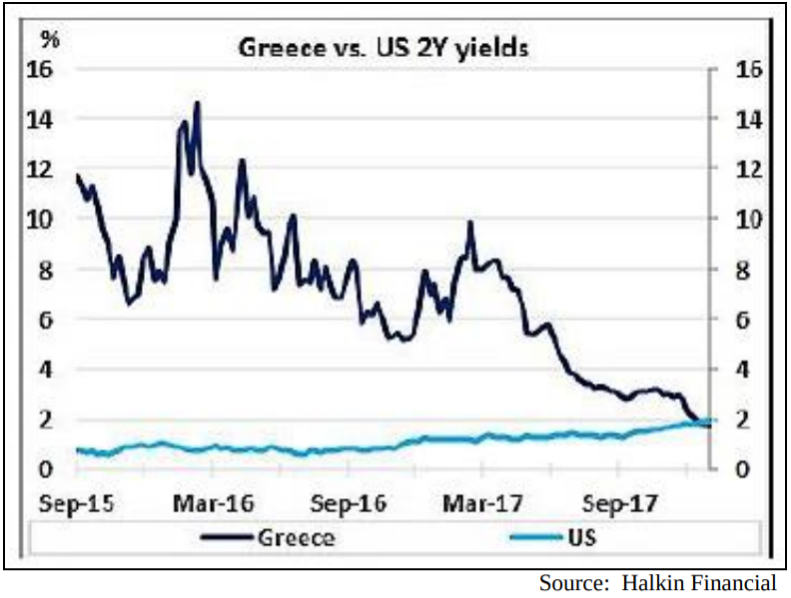

As widely reviewed, the Treasury yield curve has been flattening, which is positive for the general stock market.

Within this, the T-Bill rate has been rising strongly. Yesterday, a former Fed official stated that he was concerned about rising short rates. History records that so long as such rates are going up the boom is on.

When the T-Bill rate turns down it will provide a warning on the longevity of the party.

In 2007, the 3-Month turned down in April, and really declined in late-July. The S&P peaked in that fateful October. During that summer, the establishment claimed that nothing could go wrong – because the Fed would cut the administered rate – of course with perfect timing. As we emphasized then, short-dated market rates of interest go up in a boom and down in the contraction.

Credit spreads have narrowed a little lately which is also a plus for the stock markets.

The last rally we called for in the long bond (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) was to the 128 level and it made it to 128.31. That was in the middle of December and the decline has been to 123.69. Now at 127, it can trade sideways for a number of weeks. Getting below the 50-Day ma at 125.40 would turn the action down.