Why Is Trudeau Intent on Attacking Job Creating Small Business? Are 100 year bonds the wave of the future?

Credit Markets

Snippet form September 21, 2017 Pivotal Events

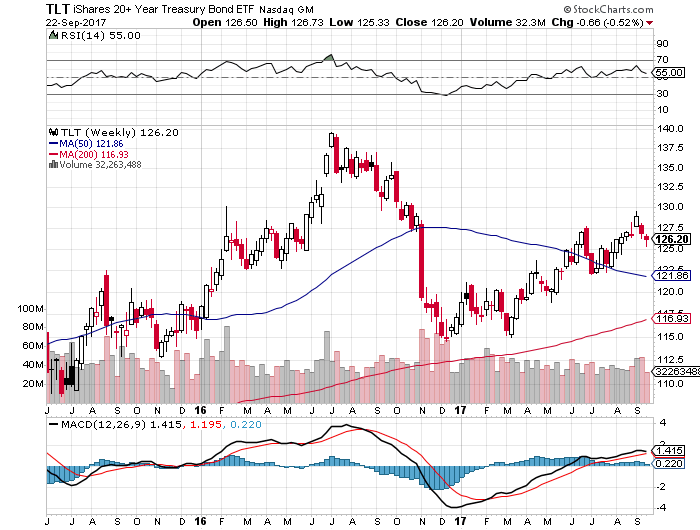

The long bond (NASDAQ:TLT) soared to 129.57, which somewhat exceeded our target of the 128 level. The initial slide was to 125.33 where it registered a Springboard Buy. So far the rally has made it to 126. The favorable seasonal will soon be over when long-dated Treasuries can decline in price. Perhaps into November.

The firmer price for crude has been helping SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK). The disaster low was 31.27 in February 2016 and the rally made it to 37.22 in February and corrected to 36.19. The next high was 37.46 in July. The decline to 36.68 in August was tied to the crude’s weakness. JNK has bounced to 37.24 and staying above the 50-Day ma.

At 37.14 now, sliding below the 50-Day at 37.12 would set a downtrend that could become serious.

This has narrowed the CCC spread from 9.05% to 8.51%. It looks like the Second Breakout to widening will take another attempt.

This is always a day late, but in looking at the JNK/TLT and NYSE:HYG/TLT, there has been two days of widening.