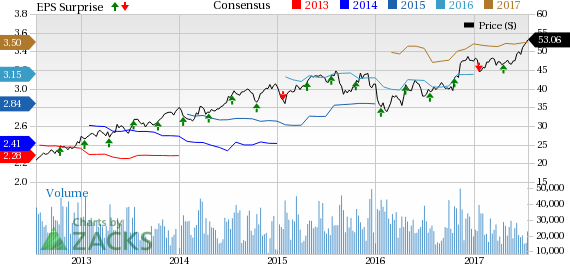

The Bank of New York Mellon Corporation’s (NYSE:BK) second-quarter 2017 earnings per share of 88 cents surpassed the Zacks Consensus Estimate of 84 cents. The figure also came 17% higher than the prior-year quarter tally.

Better-than-expected results were driven by higher revenues and benefit from provisions. Also, assets under management (AUM) reflected growth. However, a slight rise in expenses acted as a headwind.

Net income applicable to common shareholders came in at $926 million, up 12% year over year.

Revenues Improve, Costs Rise

Total revenue (non-GAAP) for the quarter increased 5% year over year to $3.95 billion. Further, the figure beat the Zacks Consensus Estimate of $3.85 billion.

Net interest revenue, on a fully taxable equivalent basis, was $838 million, up 7% year over year. The rise was driven by higher interest rates and lower premium amortization, partly offset by a fall in average interest-earning assets and higher average long-term debt.

Additionally, net interest margin grew 18 basis points to 1.16%.

Total fee and other revenues increased 4% from the prior-year quarter to $3.12 billion. The rise was mainly driven by higher total investment services fees, and investment management and performance fees.

Total non-interest expenses (non-GAAP) amounted to $2.59 billion, up 1% year over year. This reflects a rise in expenses in nearly all categories, except net occupancy costs, business development expenses, sub-custodian costs and amortization of intangible assets.

Strong Asset Position

As of Jun 30, 2017, AUM was $1.77 trillion, up 6% year over year. This reflected higher market values and net inflows, partly offset by the unfavorable impact of a stronger U.S. dollar (principally versus the British pound).

Moreover, assets under custody and administration of $31.1 trillion were up 5% year over year. Higher market values largely drove the rise.

Credit Quality: A Mixed Bag

Non-performing assets declined 6.5% year over year to $100 million. Further, provision for credit losses was a benefit of $7 million compared with benefit of $9 million in the year-ago quarter.

However, allowance for loan losses increased 4% year over year to $164 million.

Capital Ratios Improve

As of Jun 30, 2017, common equity Tier-1 ratio (Standardized Basel 3 fully phased-in) came in at 11.4% compared with 11.3% as of Dec 31, 2016. Leverage capital ratio was 6.7%, up from 6.6% in the prior-quarter level.

Share Repurchase

During the reported quarter, BNY Mellon bought back 11 million shares for $506 million.

Dividend Hike

Concurrently, BNY Mellon announced quarterly dividend of 24 cents per share, representing 26% increase from the prior payout. The dividend will be paid on Aug 11 to shareholders on record as of Aug 1.

Our Viewpoint

BNY Mellon’s restructuring initiatives and inorganic growth strategy will go a long way in supporting its bottom line. Further, its efficient expense management, strong global reach and gradually easing margin pressure are expected to support profitability in the long run.

However, concentration risks arising from significant dependence on fee-based income along with regulatory restrictions remain matters of concern for the company in the near term.

Currently, BNY Mellon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other major regional banks, SunTrust Banks, Inc. (NYSE:STI) and Fifth Third Bancorp (NASDAQ:FITB) are slated to announce second-quarter 2017 results on Jul 21, while State Street Corp. (NYSE:STT) will report on Jul 26.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

SunTrust Banks, Inc. (STI): Free Stock Analysis Report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Bank Of New York Mellon Corporation (The) (BK): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

Original post