For those who have never sat on a beach and watched the ocean tide come in, it’s a practice I wholeheartedly recommend. The gradual rise in overall water levels is almost imperceptible, but as each wave recedes, another one rises to take its place and extend the peak water level ever-so-slightly. Perhaps it’s the unusually early blizzard bombarding our Michigan office today, but it’s particularly difficult for me to shake the image of sitting on warm, sandy beach, watching the ocean tide gradually roll in.

As I was daydreaming my way through the treacherous morning commute, it occurred to me that the rising ocean tide is a perfect metaphor for recent uptrend in the US Dollar. The uptrend has not come in one big wave, rather a series of idiosyncratic developments that have pushed the dollar up against each major currency individually. Just as one wave of dollar buying begins to recede, another wave rises to take its place and push the trend to new highs. This is the essence of the technical theme of rotation, which is the lifeblood of any prolonged trend.

In prolonged trends like this, successful FX traders are in tune with where each major currency pair is within the rotational framework. By rotating out of currency pairs (waves) that are reaching their apex and into pairs that are just gaining momentum, traders can take maximum advantage of any trend. So where does each pair stand right now?

Consolidating Currencies (“Receding Waves”)

Some of the currencies that have seen the strongest moves toward USD strength of late may be due for a counter-trend move or short-term consolidation before seeing their next wave of dollar buying. In my view, currencies like the euro and swiss franc fall into this category; after seeing extended moves to multi-year lows against the USD dollar, these European currencies may see a short period of consolidation before their next leg lower against the dollar. Traders looking to take advantage of continued strength in the buck may want to focus their attention on other currencies for now.

Source: FOREX.com

Mid-Trend Currencies (“Waves Currently Coming In”)

There are two widely-followed currrencies that are in the midst of a big drop against the US dollar. The most obvious candidate is USD/JPY, which has gained nearly 1200 pips in the last month. As we go to press, the USD/JPY rally is looking a bit “long in the tooth,” but with Japanese PM Abe calling for a snap election and delaying next year’s sales tax hike, USD/JPY’s rally could certainly extend further from here.

Similarly, the selloff in the British pound is gaining steam after last week’s dovish Quarterly Inflation Report from BOE (see here, here and here for more). With GBP/USD breaking below the 61.8% Fibonacci retracement of its July 2013-July 2014 rally at 1.5720 and the daily MACD rolling over once again, an extension of the recent bearish swing seems likely. While these two currency pairs may offer immediate opportunities for traders looking to play the USD rally theme, readers should watch for signs that the trends are reaching extreme levels and due for a reversal.

Source: FOREX.com

Currencies Set Resume Selloff (“The Next Waves”)

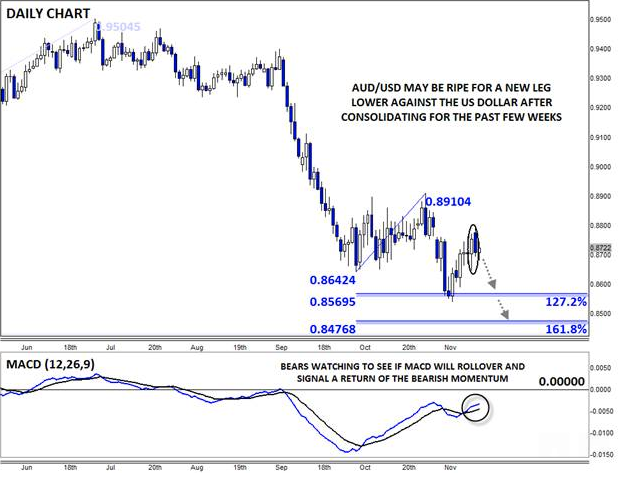

The strongest candidates to lead the next wave of USD strength are the commodity dollars. After consolidating the past few weeks, currencies like the Canadian, Australian, and New Zealand dollar are ripe for another leg lower against the world’s reserve currency, especially with lackluster data coming out of commodity-dependent China last week.

We covered the bullish trend in USD/CAD extensively last week (see “USD/CAD: US Maintains Upper Hand in Battle for 49th Parallel Supremacy” for more), but the recent price action in AUD/USD may hint at another leg of weakness in the Aussie. Rates carved out a clear Dark Cloud Cover* candle yesterday, signaling a shift from buying to selling pressure and potentially marking a near-term top in the market. AUD/USD bears will now watch for the pair’s daily MACD to rollover, signaling a return of the bearish momentum and a possible drop back to the 4-year low at .8550 or below.

* A Dark Cloud Cover is formed when one candle opens near the top of the previous candle’s range, but sellers step in and push rates down to close in the lower half of the previous candle’s range. It suggests a potential trend reversal.

Source: FOREX.com

Of course, the tide eventually goes back out, and the dollar uptrend will eventually come to an end, but as long as we continue to see a regular rotation between major currencies showing weakness against the greenback (higher and higher waves), the prudent course of action remains to follow the established trend toward dollar strength.

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom).