Issues with revenue recognition have led to the reversal of two contracts worth £2.9m in FY17, reducing expected growth from 40% to 29%. We have revised our FY17 estimates accordingly, resulting in a 76% cut to our FY17 EPS forecast. We have withdrawn our FY18 and FY19 forecasts pending clarity on underlying growth rates. The CEO has resigned; interim CFO Simon Herrick will also take on the CEO role until a new CEO is appointed.

Contracts worth £2.9m reversed

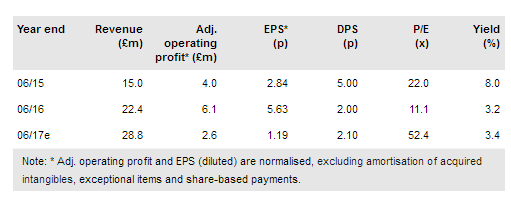

Blancco (LON:BLTGB) has announced that it has reversed two contracts worth £2.9m that were booked in FY17. It now expects to report revenue growth of 29% for FY17 (15% constant currency), EBITDA of at least £4.1m and adjusted operating profit of at least £2.6m. We have reduced our revenue forecast for FY17 by 8.5% to £28.8m, resulting in adjusted operating profit of £2.6m and normalised EPS of 1.19p.

The company does not expect this to have an impact on the year-end cash balance, although we expect it to reduce operating cash flow in FY18. It has been difficult to assess underlying organic growth rates due to acquisitions, currency effects, the recent provision against overdue receivables and now these contract reversals. We have therefore withdrawn our FY18 and FY19 forecasts pending further information on underlying growth rates when FY17 results are released on 3 October.

To read the entire report please click on the pdf file below: