Economic discussions are interesting to me even though very little being stated as fact is provable except in theory. Much of what you may believe as fact is actually opinion based on extrapolated data points that gels with your already preset views. We blame our muddle-along economic growth on trade balances, Obama or Bush (depending on your political appetite), poor wages, inequality, banks, education system, too little (or too much) government spending, regulations, high debt levels, the 0.1%, too low (or high) interest rates, bankers, taxes, China, global warming, .....

Follow up:

And yes, I am more guilty than most in spouting potential reasons - as everyone "knows" there must be major dynamics causing this poor growth cycle. Much of what I read does much more than identify an effect of poor economic growth - and suggesting the effect is the cause. Quite a few "studies" then try to address the problem by treating the effect. A parallel would be treating a yellow skin condition with skin bleach (apparently there are as many as 10 different ailments which cause yellow skin - but remember medicine is a true science while economics only presents the illusion of being a science by using fancy models).

Is it a mistake to BELIEVE there is a single specific cause? Is it a mistake to believe political dogma can be advanced by economic action when there is no clear understanding of the consequences of meddling with economic dynamics? What if the "good" economic growth we have witnessed earlier in our lives was unusual? What if we are now seeing is NORMAL?

Further, I submit:

-

It is not a single dynamic but the interaction between many dynamics which combine together to grow or contract an economy;

-

A growing dynamic in one situation may combine with other dynamics to cause an economy to expand, but in another time frame the growing dynamic combines with other dynamics and the opposite occurs;

-

If a dynamic is studied and the study concludes it is a positive dynamic - should you conclude that there is no point where growth of this dynamic will be damaging the economy?;

-

Each economy has a different set of dynamics and the effect of a specific dynamic in one economy may be different in another; and,

-

Economic models often treat the economy of an individual country's economy as if all other countries do not exist.

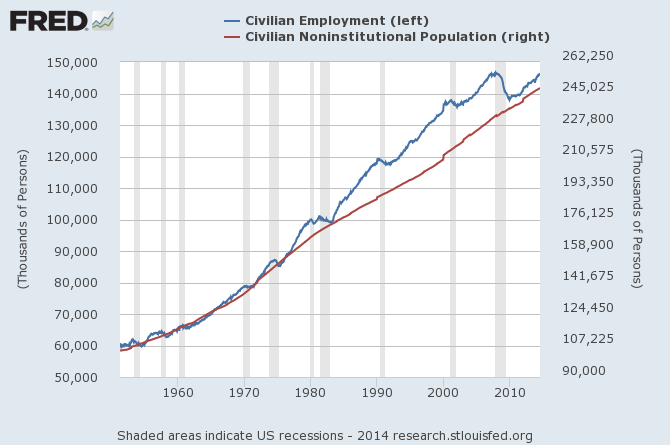

Consider the premise that for an advanced economy real (inflation adjusted) growth should roughly the rate of growth of the population which is approximately 1% per year. An economy with a contracting population likely is contracting also. As there were always maintenance and new product costs in the previous period - these costs too should grow approximately this 1%. If this is remotely true, than the growth we are currently seeing may still too high. What if the problem is the way we measure economic growth - what if our concept of the way economic growth is measured is incorrect and actually measuring more growth than occurs? Or what if we are measuring inflation incorrectly (meaning inflation is higher than estimated) - which in turn would make our measurements of real economic growth too high?

I have stated in previous posts that the lower economic growth today was caused by an absence of jobs. This remains true - but isn't this an EFFECT (and not the cause)? However, could it be that since 1980 the USA has been in abnormal jobs bubble, and now has reset to mean historical growth? Should we base a "normal" jobs situation on pre-1980 jobs growth?

Do not to fall in love with your economic opinion. Look for data which disagrees with your opinion - and then adjust your opinion continually as you learn or understand more. Be careful in believing there are absolute truths in economics as it is likely you do not realize all the accompanying negative consequences - or the interactions with all of the other economic dynamics.

Progress is impossible without change, and those who cannot change their minds cannot change anything.

Other Economic News this Week:

The Econintersect Economic Index for August 2014 is showing our index at a 3 year high. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption although data is now showing consumer income and expenditures growth are similar. The GDP expansion of 4% in 2Q2014 is overstated as 2.1% of the growth would be making up for the contraction in 1Q2014, and 1.7% of the growth is due to an inventory build.

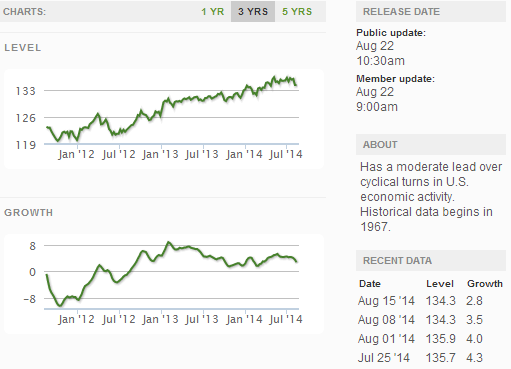

The ECRI WLI growth index value has been weakly in positive territory for almost two years. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

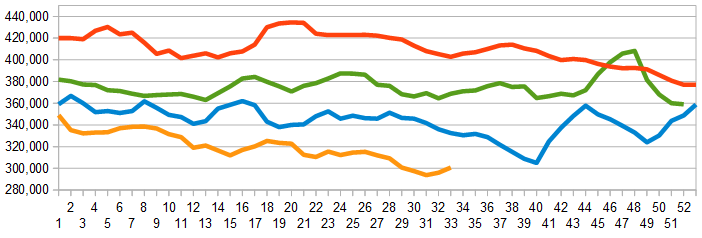

The market was expecting the weekly initial unemployment claims at 300,000 to 315,000 (consensus 300,000) vs the 298,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 296,000 (reported last week as 295,750) to 300,750.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Korea-based Daehan Shipbuilding Co. filed for Chapter 15 protection

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: