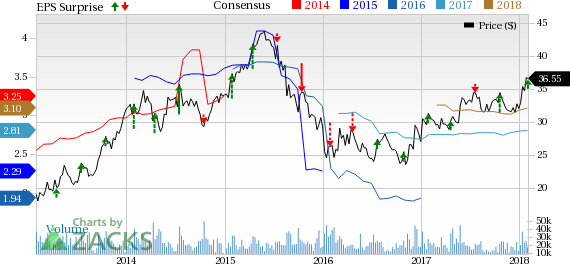

Shares of The Blackstone Group L.P. (NYSE:BX) gained nearly 2.1% in pre-market trading, following the release of its fourth-quarter 2017 results. Economic net income (ENI (MI:ENI)) of 71 cents per share topped the Zacks Consensus Estimate by a penny. Also, the figure was 4% above the prior-year quarter level.

Improvement in revenues largely boosted the results. Also, growth in assets under management (AUM), mainly driven by inflows, continued to impress. However, rise in expenses was a tailwind.

Blackstone reported ENI of $850.4 million in the fourth quarter, reflecting an increase of 5% year over year.

For 2017, ENI of $2.81 per share was in line with the Zacks Consensus Estimate. The figure was 41% above the prior-year level. Blackstone reported ENI of $3.38 billion, reflecting an increase 41% year over year.

Revenues & Costs Rise

Total revenues for the reported quarter (GAAP basis) increased 20% year over year to $1.88 billion, primarily driven by a rise in performance fees, total investment income as well as interest and dividend revenues. Also, the top line surpassed the Zacks Consensus Estimate of $1.81 billion.

For 2017, total revenues (GAAP basis) surged 39% year over year to $7.12 billion. The figure handily outpaced the Zacks Consensus Estimate of $6.47 billion.

Total expenses (GAAP basis) rose 22% year over year to $1.01 billion. The increase was primarily due to a rise in fund expenses and interest expenses.

Fee-earning AUM grew 21% year over year to $335.34 billion. Total AUM amounted to $434.13 billion as of Dec 31, 2017, up 18% year over year. The rise in total AUM was largely driven by $108 billion of inflows.

As of Dec 31, 2017, Blackstone had $5.1 billion in total cash, cash equivalents and corporate treasury investments.

Our Viewpoint

Blackstone remains well positioned to capitalize on the changing investment landscape by making long-term investments and augmenting its fund-raising abilities. However, increased dependence on management and advisory fees can affect the company’s financials in the near term.

Blackstone carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers

BlackRock, Inc.’s (NYSE:BLK) fourth-quarter 2017 adjusted earnings of $6.24 per share outpaced the Zacks Consensus Estimate of $6.08. Results benefited from an improvement in revenues, rise in AUM and steady long-term inflows. However, increase in operating expenses acted as a headwind.

Ameriprise Financial Inc.’s (NYSE:AMP) fourth-quarter 2017 adjusted operating earnings per share of $3.26 comfortably surpassed the Zacks Consensus Estimate of $3.09. Results benefited from an improvement in revenues as well as growth in AUM and assets under administration. However, rise in expenses acted as a headwind.

Invesco Ltd. (NYSE:IVZ) reported fourth-quarter 2017 adjusted earnings of 73 cents per share, outpacing the Zacks Consensus Estimate of 70 cents. Results were primarily supported by higher revenues and long-term net inflows. However, increase in operating expenses was an undermining factor.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Invesco PLC (IVZ): Free Stock Analysis Report

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Original post

Zacks Investment Research