Have you been eager to see how The Blackstone Group L.P. (NYSE:BX) performed in Q2 in comparison with the market expectations? Let’s quickly scan through the key facts from this New York-based premier global investment and advisory firm’s earnings release this morning:

An Earnings Lag

Blackstone came out with economic net income of 59 cents per share, which lagged the Zacks Consensus Estimate of 60 cents.

Higher expenses were primarily responsible for the earnings lag.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for Blackstone depicted optimism prior to the earnings release. The Zacks Consensus Estimate has moved 1.7% upward over the last 7 days.

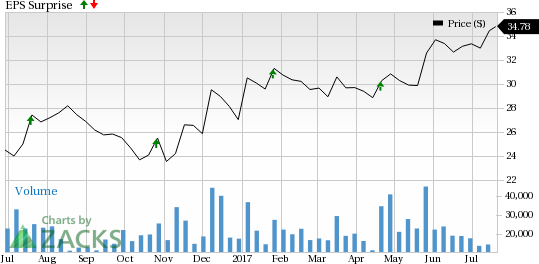

Also, Blackstone has a decent earnings surprise history. Before posting the earnings lag in Q2, the company delivered positive surprises in each of the four trailing quarters.

Revenue Came In Better Than Expected

Blackstone posted total revenues (on a GAAP basis) of $1.55 billion, which outpaced the Zacks Consensus Estimate of $1.42 billion. Further, the figure increased 30% from the prior-year quarter.

Key Stats to Note:

- Total assets under management (“AUM”) stood at $371.1 billion as of Jun 30, 2017.

- Inflows were $12.1 billion in the quarter.

- Total Dry Powder was $90 billion.

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #3 (Hold) for Blackstone. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look unfavorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Check back later for our full write up on this Blackstone earnings report!

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

The Blackstone Group L.P. (BX): Free Stock Analysis Report

Original post