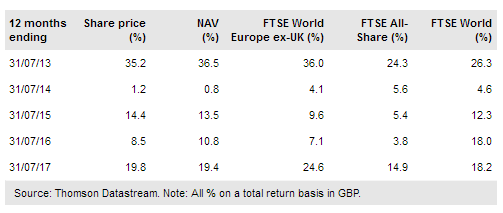

Blackrock (NYSE:BLK) Greater Europe Inv Tst (LON:BRGE) aims to generate capital growth from a relatively concentrated portfolio invested across the greater European region. In June 2017, it was announced that Stefan Gries would replace Vincent Devlin as co-manager. He will continue to adopt BRGE’s flexible bottom-up stock selection approach, drawing on the wider resources of BlackRock’s European and emerging markets equity teams, but is reducing the number of holdings and intends opportunistically to make fuller use of the emerging European allocation. The trust is referenced against the FTSE World Europe ex-UK index and its NAV total return has outperformed over three and 10 years and is broadly in line over five years, while lagging over the last 12 months. Although the primary aim is capital growth, BRGE has a progressive dividend policy. Its current dividend yield is 1.7%, which is in line with its peer group average.

Investment strategy: Structured bottom-up process

Co-managers Gries and Sam Vecht are able to draw on the resources of BlackRock’s experienced investment teams to select a concentrated portfolio of stocks in both developed and emerging Europe. Idea generation is the first step of the process, driven by the knowledge of the investment team, which conducts more than 1,000 company meetings a year. Potential investments form a research pipeline to ensure the best ideas are implemented in the most efficient manner.

To read the entire report Please click on the pdf File Below: