BlackBerry Ltd (NYSE:BB) will report fiscal-year earnings ahead of the bell tomorrow. Prior to the announcement, options traders are betting bullishly on the smartphone provider, with BB options flying off the shelves at an accelerated clip today.

BlackBerry stock fell 8.8% the session after the company reported earnings in late June. Nevertheless, nearly 9,000 calls have changed hands so far today -- two times the norm. While absolute put volume is running lighter, the roughly 3,000 contracts traded thus far represents four times the average intraday pace.

Most active is BB's weekly 10/4 7.50-strike call, where a block of 1,000 contracts was likely purchased to open for 35 cents apiece, or $35,000 total (number of contracts x 100 shares per contract x premium paid). By buying the calls to open, the speculator will begin to make money if BB stock tops $7.85 (strike plus premium paid) by the close on Friday, Oct. 4, when the options expire. If the equity remains below the strike, the trader will forfeit the entire $35,000 paid to enter the trade.

However, the appetite for bullish BlackBerry bets has been growing even before today. On the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and and NASDAQ OMX PHLX (PHLX), options buyers have picked up nearly 32 BB calls for every put during the past two weeks. The resulting 10-day call/put volume ratio of 31.52 ranks in the 89th percentile of its annual range, pointing to a more optimistic-than-usual tilt among premium buyers recently.

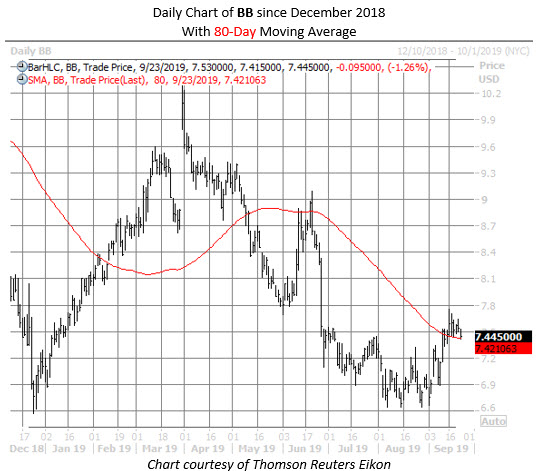

Since flirting with year-to-date lows around $6.60 in August, BlackBerry stock has rebounded more than 8% so far in September. The security is down 1.3% today to trade at $7.44, but is attempting to maintain a recent perch atop its 80-day moving average -- a trendline that limited BB's rally attempt in June.