Black Hills Corporation (NYSE:BKH) reported second-quarter 2017 adjusted earnings of 41 cents per share, missing the Zacks Consensus Estimate of 51 cents by 19.6%. However, on a year-over-year basis earnings increased 5.1%.

Increased earnings in the second quarter can be attributed to benefit arising out of electric utilities from new generation and transmission investments as well as strong industrial sales.

Total Revenue

In second-quarter 2017, Black Hills’ total revenues of $348 million missed the Zacks Consensus Estimate of $372 million by 6.5%. However, revenues were up 14.3% from $325.4 million in the prior-year quarter.

Quarterly Highlights

During the second quarter, Black Hills cost of fuel, purchased power and gas amounted to $98.2 million, increased 16.2% year over year from $84.5 million.

The company’s operating and maintenance expenses amounted to $132.3 million reflecting a marginal decrease of 0.5% year over year.

Operating income in the reported quarter increased 95.2% year over year to $68.9 million.

Interest expenses increased 1.5% year over year to $34.1 million.

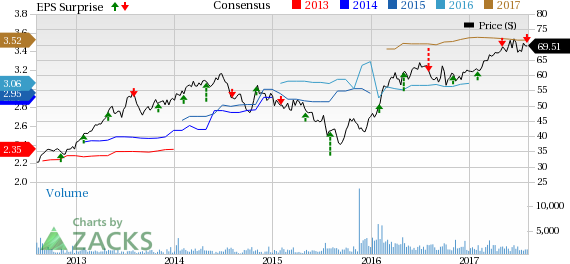

Black Hills Corporation Price, Consensus and EPS Surprise

Guidance

Black Hills narrowed guidance for 2017 earnings per share to the range of $3.45–$3.60 from $3.45–$3.65. The slashed guidance reflects unfavorable weather during the first half of the year and additional diluted shares from equity units issued in Nov 2015.

Performance of Other Utilities

Among other players from the industry that have reported their second-quarter earnings, both WEC Energy Group (NYSE:WEC) and Xcel Energy Inc. (NYSE:XEL) beat the Zacks Consensus Estimate, while FirstEnergy Corporation (NYSE:FE) reported earnings on par with the Zacks Consensus Estimate.

Zacks Rank

Black Hills carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Black Hills Corporation (BKH): Free Stock Analysis Report

Original post

Zacks Investment Research