- Are you eager to grab discounted stocks this Black Friday?

- In this article, we'll explore the criteria for setting filters to build a shortlist of undervalued stocks

- Along with the fundamentals, we will also discuss the criteria for basic technical analysis

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

- Financial health score exceeding 3.5/5

- Earnings per share (EPS) growth over the last 10 years surpassing 10%

- Return on invested capital (ROIC) exceeding 10%

- Discount to fair value of 25% or more

- A debt-to-equity ratio of less than 60%

- The relative strength of the sector relative to the market

- The relative strength of the individual stock relative to the sector

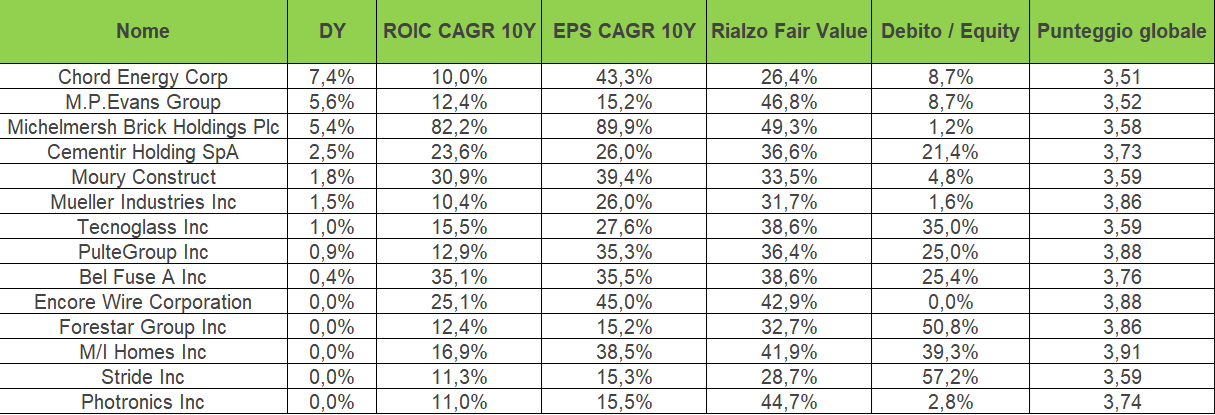

As we celebrate Black Friday, let's try and create a shortlist of high-quality and discounted stocks using InvestingPro's stock scanner. For this, we've chosen to filter stocks with the following characteristics:

We can see that the list includes 14 names (out of more than 160,000 in the database) that meet our criteria for discounted stocks. Obviously, this is only a starting point, but certainly a good start on which we can pursue further analysis.

For a more in-depth analysis, we can explore the technical charts to gauge the current trend. This allows us to identify stocks that are well-positioned from a fundamental and technical perspective.

A straightforward method involves incorporating a 30-period weekly moving average and assessing whether prices are above or below it.

We could filter further to see which of these stocks trade at a P/E ratio that is not excessive (e.g., between 6 and 17).

An additional element of evaluation could be sector analysis based these two factors:

All of these elements can help refine our shortlist further and hone in on our final buys. Once this groundwork is completed, the crucial phase is money management.

Determining the portfolio's weight, defining entry and exit strategies, and devising plans to navigate through various scenarios become paramount considerations once the stocks are chosen.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.