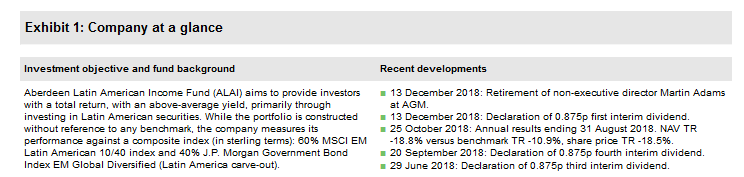

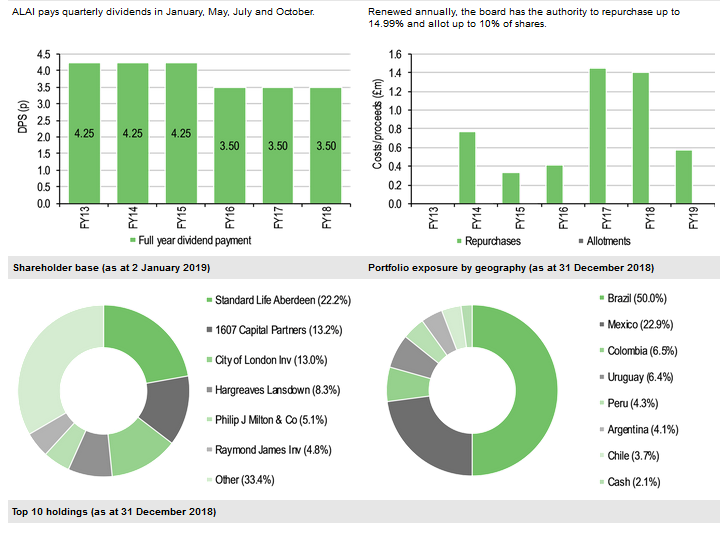

Aberdeen Latin American Income Fund (ALAI) gives investors exposure to both Latin American equities and government debt, and offers a 4.9% dividend yield. The company is managed by Aberdeen Standard Investments’ (ASI) global emerging markets equities and emerging market debt teams.

They are cautiously optimistic on the prospects for Latin America in 2019 (favouring the region above other emerging markets), following a series of headwinds in 2018, including a stronger U.S. dollar, rising interest rates, commodity price volatility and a number of important elections.

The managers note that commodity prices are stabilising, there is potential for a weaker U.S. currency as the benefits from stimuli and tax cuts fade, and inflation in Latin America is moderating so central banks are more dovish. An improving economic environment in Brazil could contribute towards more robust earnings estimates and higher equity valuations in the region.

Investment strategy: Equities and fixed income

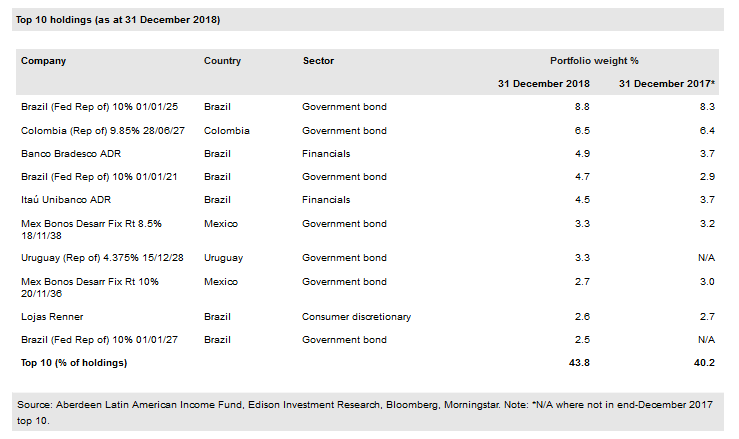

ASI employs a team-based approach to investment, seeking high-quality securities at a reasonable price. Equities are selected following thorough fundamental research, and meeting with company managements is a key element of the investment process.

The equity portion of ALAI’s portfolio is tilted towards domestic consumer stocks, which have good potential to grow alongside economies in the region. Analysis of fixed income securities is also conducted on a bottom-up basis, with emphasis on the perceived prospects of individual countries.

Market outlook: Coming off a tough 2018

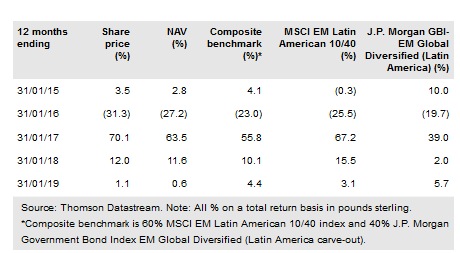

There were a series of macro events in 2018 that created serious headwinds for Latin America and other emerging markets. Many of these issues appear to be abating; in addition, valuations in the region look relatively attractive, which may provide opportunities for investors looking to diversify exposure away from developed markets, where prospects may be less favourable.

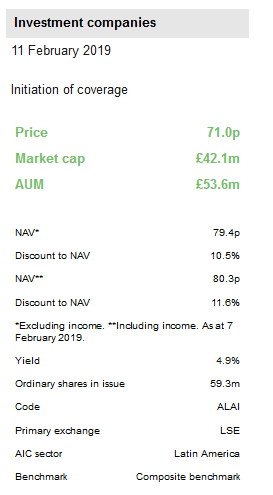

Valuation: Double-digit discount and 4.9% yield

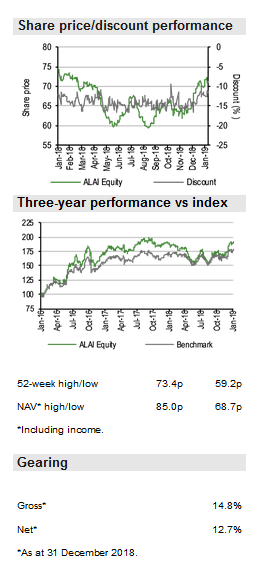

ALAI is currently trading at a 11.6% discount to cum-income NAV, which compares with the 9.3% to 16.7% range over the last 12 months, and the range of average discounts over the last one, three and five years of 11.7% to 14.0%. The company has maintained its annual distribution for the last three financial years and currently offers a dividend yield of 4.9%.