It might be a tad complicated and controversial, but Bitcoin, (BTC/USD) is all the rage these days.

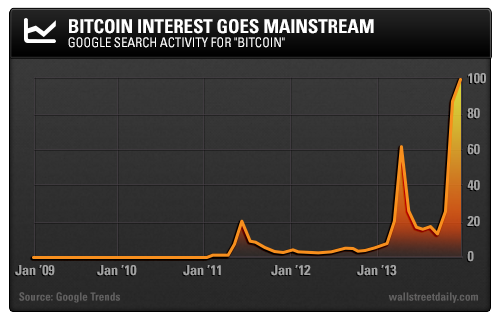

Don’t believe me? Just ask Google (GOOG).

Internet searches for “Bitcoin” literally went vertical in the last three months of 2013.

Of course, many of these inquiries are likely from people wondering what the hell a Bitcoin is. (If that’s you, check out this primer on Bitcoin from Wired Magazine.)

For those of you already in the know, you probably remember me labeling Bitcoins as an “insidious currency scam” back in May 2013.

Harsh words. And I certainly received some in return for such a characterization.

Nevertheless, I stand by my original assertion: Outside of being a curiosity and a speculation, there’s no future whatsoever for the cryptocurrency.

Now, in the past I tried to convince you of Bitcoin’s laughable potential by focusing on the digital currency’s weak economic underpinnings…

But I’ve learned my lesson.

It turns out that the currency’s real Achilles’ heel is a technological flaw. And on January 9, at precisely 3:00 AM, it was officially exposed.

So please, whatever you do, refrain from converting your life savings – or any meaningful amount of money – into Bitcoins. At least until you read this…

The Key to Bitcoins

Ever wonder how to spend a Bitcoin? Or how you keep people from stealing them? After all, they’re completely digital and can’t be stored under the mattress for safekeeping.

Well, the way Bitcoin was set up to work is for all the accounting to be handled online (and publicly) with cryptography keys. Every time someone tries to spend a Bitcoin, a network of peer-to-peer computers – known as Bitcoin miners – must verify the authenticity of each transaction.

They do so by completing a series of complex calculations. Why in the world would these miners be interested in providing such verification services? Because there’s money in it, of course.

The reward for a miner completing the calculations before anyone else is about 25 Bitcoins. At current prices, that works out to roughly $23,000. (Not bad. Makes you think all the money can be made by being a miner, huh?)

At first, completing these mining calculations was pretty easy. A standard desktop or laptop computer could handle the task.

With the way Bitcoin is set up, though, the calculations get progressively more difficult.

Nowadays, specialized computers, designed to do nothing but mine Bitcoins, are required to do the work. The demand for such computers has prompted a rash of new startups, including HashFast, KnCMiner and Butterfly Labs.

These computers pack some serious power. As HashFast’s Eduardo deCastro says, “It would take 70,000 of Intel’s (INTC) fastest chips to match one of ours.”

But that kind of computing muscle comes with a price – upwards of $15,000 per unit (and counting), in some cases.

And therein lies the key to Bitcoin’s fatal flaw…

A Doomsday Scenario Approaches

Bitcoin’s original inventor had a specific reason for spreading the work across so many computers.

With thousands upon thousands of “independent” miners handling all the verifications, it made manipulation or fraudulent activities impossible.

After all, with no government oversight or central database, preventing fraud is an absolute must for Bitcoin.

However, as the cost of Bitcoin mining goes up, along with the complexity of the calculations, miners are pooling their resources.

They’re banding together to create virtual supercomputers, and then sharing in the spoils.

And this unexpected development for the cryptocurrency just led to a serious problem…

At 3:00 AM on January 9, a mining collective known as GHash.IO accounted for 45% of all Bitcoin computing power. A mere six percentage points more, and the collective would have controlled a majority of the computing power – effectively hijacking Bitcoin as a result.

With more than 50% control, they’d have the ability to confirm all Bitcoin transactions on their own. And suddenly, the potential for manipulation and fraud would immediately exist.

Quartz’s Chris Mims describes the situation as such: “Imagine that tomorrow, a single corporate entity gained the ability to clone all of its dollars, and then immediately went on an asset buying spree. To say that it would undermine trust in the U.S. dollar would be an understatement. That’s what could happen to Bitcoin.”

Double spending. False confirmations. Reversing transactions. They all become possible in the hands of a nefarious collective.

Close Enough

Of course, Bitcoin fanatics swear that a collective would never be able to obtain a majority and thereby (technologically) break Bitcoin.

Didn’t their mommas ever tell them, “Never say ‘never’”?

GHash.IO got shockingly close to a majority. Close enough to prove that it’s a distinct possibility, not a remote one.

By no means was this an anomaly, unlikely to ever occur again, either. In fact, last spring, the BTC Guild pulled off a similar feat.

Heck, research out of Cornell suggests that hijacking Bitcoin with as little as 33% of the global computational power could be possible.

Still think an unknown group would never be able to take control of the entire network? Maybe a confession from an insider will finally change your mind…

Benjamin Gorlick – COO of Bitcoin mining collective, Cloud Hashing – recently told Business Insider that “if someone was developing the technology behind the scenes, then launched it all at once, it would be bad.”

I think that’s putting it mildly. Especially if you happened to own any Bitcoins when it happened.

Bottom line: All the hype surrounding Bitcoin is a dead giveaway that you should be suspicious. Forget all the economic arguments against the currency, though. The biggest risk is a technological one.

Add in the neck-snapping volatility, and you’re telling me this is the future of money? Keep dreaming! It’s little more than a wild speculation. One with a fatal flaw, at that.

Trade it at your own risk. But definitely don’t treat it as an up-and-coming alternative to the almighty dollar.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin’s Fatal Flaw

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.