The United States, France, and the United Kingdom have carried out a series of airstrikes on the war-torn country of Syria. They have specifically targeted facilities that enable the Asaad Regime to carry out chem-warfare attacks.

In a place where things seemed like they couldn't get any worse, this latest escalation is rather significant as it brings in new players who were previously on the sidelines.

Some of the more active players like Russia and Iran are not very happy to have the additional company.

The markets, for their part, seem to be largely unphased by all of this. Stocks have come down slightly but there hasn't been a massive rush to safe-haven assets as one might expect.

Today's Highlights

Earnings Underway

Ruble Divergence

BTC's Path to 250K

Please note: All data, figures & graphs are valid as of April 16th. All trading carries risk. Only risk capital you're prepared to lose.

Traditional Markets

Earnings season has kicked off on Wall Street and this should be a great one. Thanks to Donald Trump's tax cuts and additional stimulus, corporate earnings should be through the roof.

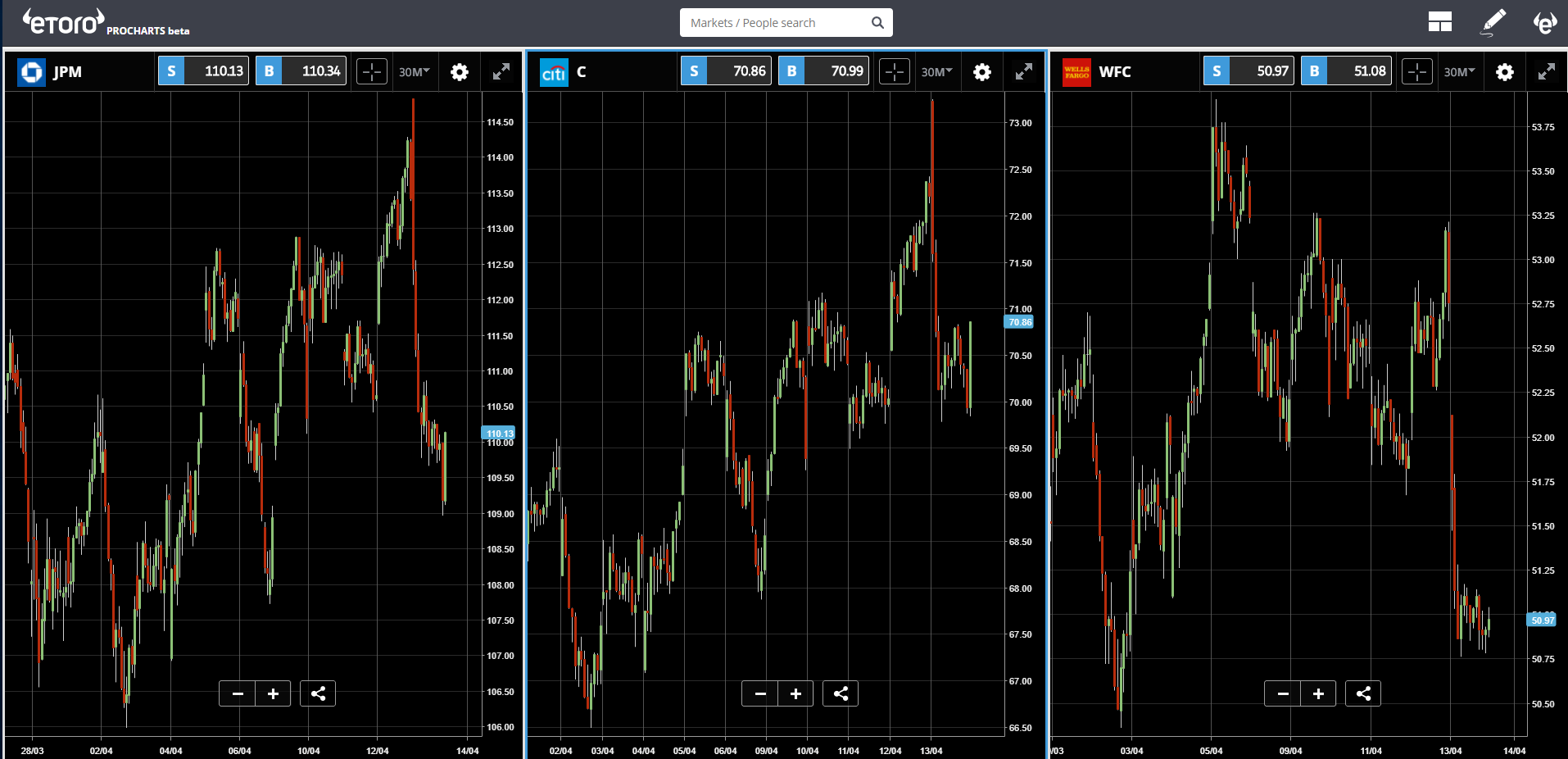

@TheBigBanks who reported on Friday have smashed expectations with JP Morgan's profits rising 35% in the first quarter, Citigroup Inc (NYSE:C) raising their earnings per share by 24%, and Wells Fargo (NYSE:WFC) seeing profits rise despite a new scandal.

As we can see from the charts above, the great earnings may have propped up the prices a bit but they certainly didn't send them flying.

It will be interesting to see how the season progresses and to what extent the reports are overshadowed by geopolitics and already high valuations in the market.

Russian Divergence

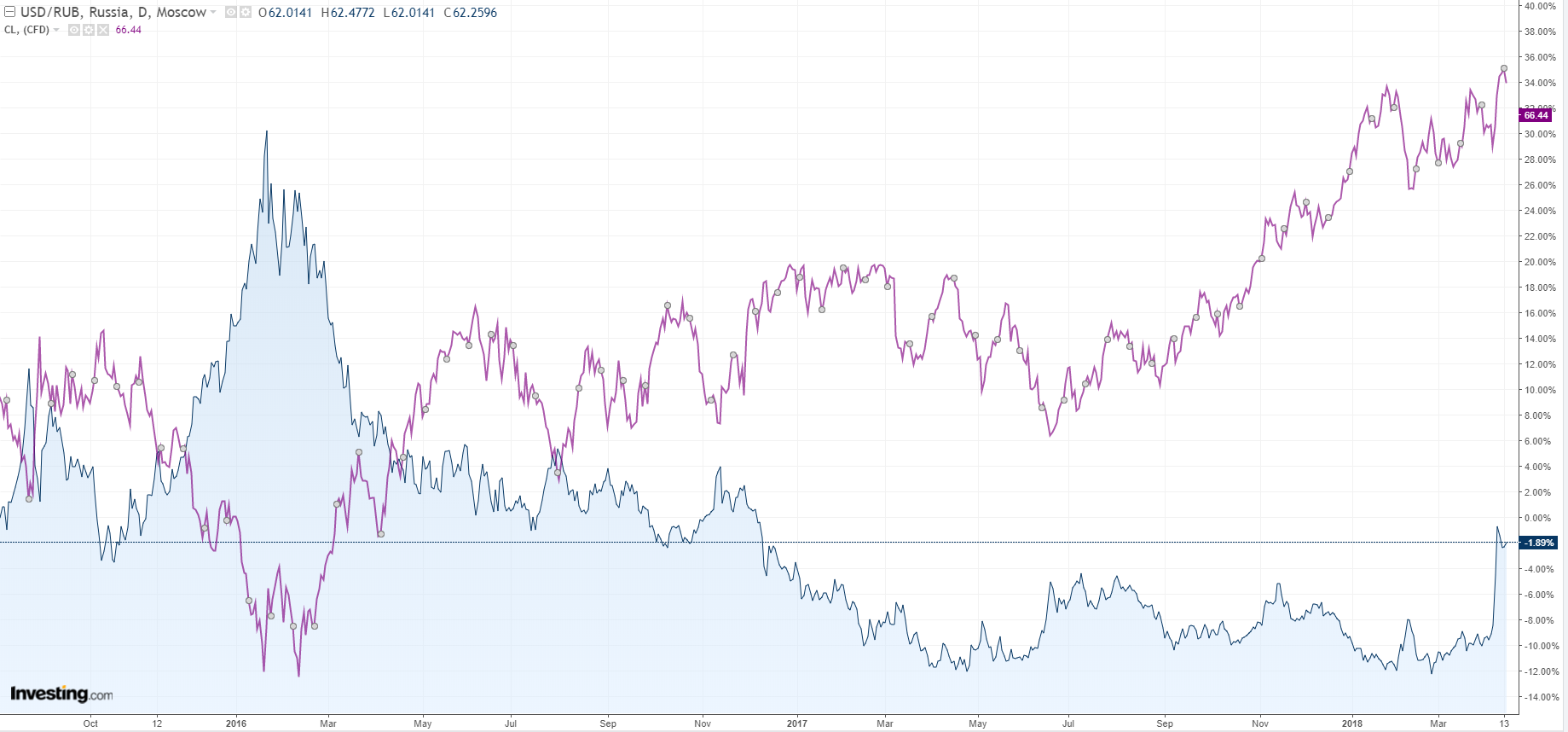

Traditionally, the Russian Ruble is most correlated with Crude Oil because it is the number one export from the country.

So we've seen before how a sharp rise in the price of Crude can affect a similar movement from the Russian Ruble. However, over the last week, we've seen them moving in opposite directions as the Ruble is under pressure by international forces and the supply of crude oil is under question.

When trading the USD/RUB, remember that you're trading the strength of the USD. So if the chart is going up it means the Ruble is getting weaker.

Here we can see an overlay of the USDRUB (blue) and crude oil (purple). See how they tend to move in opposite directions but just at the far right of the chart they both spiked up.

Bitcoin's Graph

Now that we've seen a massive spike from the bottom many in the community are thinking that we may have seen the end of the dip.

The bullish price calls are now back in full force with many speculating that we may see another few notable rises in the next few years. The most famous one to come out in the last few days is from Tim Draper, who is calling for $250,000 in the next four years.

It may sound like a rather aggressive call but if you think about it, we've already seen this type of percentage growth several times since Bitcoin's creation.

The move from $3.30 to $126 in a single week in May of 2013 represents a percentage growth of 3,718%. But we don't have to go back that far. In the last two months of 2017 alone, Bitcoin's price more than doubled.

We can see these moves better on a logarithmic scale chart, which is becoming a rather popular tool in the crypto community.

The Twitter user @parabolictrav has mapped the path to $250k on a similar logarithmic graph.

Of course, these types of aggressive calls should probably be taken with a pinch of salt. They basically assume that Bitcoin's adoption rate will continue to accelerate at a similar pace as it has until now and that we see some sort of tipping point, which in my mind is probably a bit less than likely but certainly within the realm of possibility.

Let's have an amazing day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.