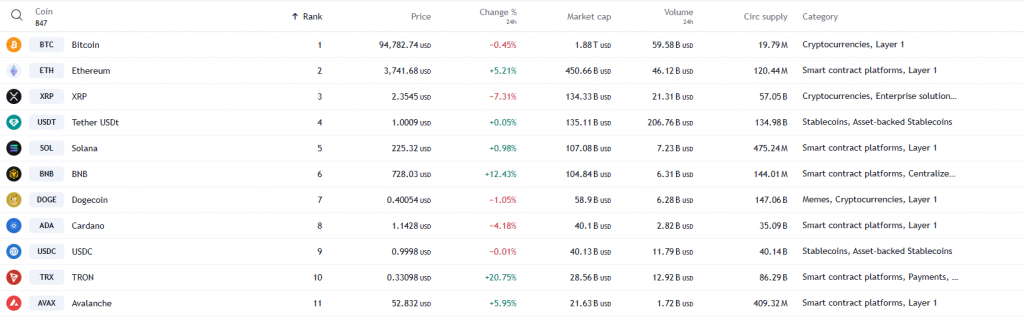

Bitcoin has dominated headlines over the past few weeks but recently altcoins are finally coming into their own. We have seen some big moves from Ripple which has become the third largest cryptocurrency by market capitalization.

Source: TradingView (click to enlarge)

XRP has climbed back to one of the top spots after almost dropping out of the top 10, following the SEC lawsuit against Ripple. Its current market value is $139 billion, making it larger than big companies like Citigroup (NYSE:C), Airbus Group NV (OTC:EADSY), and Sony (NYSE:SONY).

Ripple's stellar performance of late has seen a wider move in AltCoins with others such as Tron surging as much as 20%+ in the last 24 hours.

Will the Ripple Rally and Bitcoin Range Keep the AltCoin Pump Going?

The question on peoples minds is whether the recent rally in Bitcoin and Altcoins continue. The mood in the market was gloomy yesterday after the US Government transferred $2 billion worth of Bitcoin, but things are looking up today. Even so, Bitcoin is still stuck in a tight price range.

Interest has grown in a potential AltCoin season following significant gains by less obscure crypto coins over the last week or so. During the AltCoin phase of the market, Bitcoin slows down its rapid price growth and stabilizes. At this point, investors start moving money from Bitcoin and similar top coins (which are less risky) into riskier altcoins.

During this phase, Bitcoin’s dominance, its share of the total cryptocurrency market value often decreases, which shows that funds are being spread to other coins. This rotation of money is a key signal that the Altcoin Season has begun.

However can the AltCoin season continue?

According to analysts, something that I do tend to agree with is that for the AltCoin rally to continue, Bitcoin does need to hold the high ground. As for what that number is, there have been varying levels touted with the $90k level gaining the most traction.

Another factor is that Bitcoin tends to perform extremely well in Q4 most years. This year, given the post election rally it will be interesting to gauge whether the World’s largest crypto can hold onto its gains through the month of December and keep the AltCoin rally moving forward.

Bitcoin Exchange Reserves Plummet

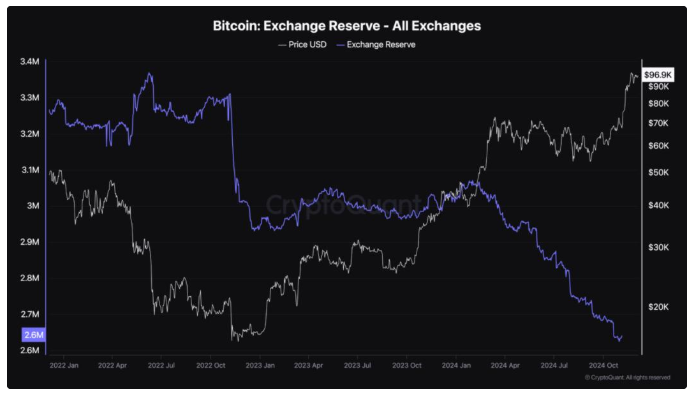

Recent data from on-chain analytics firm CryptoQuant showed that since Donald Trump, a Republican candidate, won the election with a pro-crypto campaign, over 171,000 Bitcoin have been removed from cryptocurrency exchanges, contributing to a market rally.

Data shows Bitcoin reserves on exchanges have been steadily dropping this year. At the start of the year, there were around 3 million BTC on exchanges, but now this number has fallen to 2.64 million.

Usually less Bitcoin on exchanges is seen as a lack of supply in the market which if coupled with heightened demand can lead to the type of rally we have seen post US election. This may provide some insight into one of the driving forces of the recent surge in prices.

Source: CryptoQuant (click to enlarge)

Companies like BlackRock (NYSE:BLK) and Microstrategy (NASDAQ:MSTR) have increased their holdings significantly over the past few months with Microstrategy buying up another 15,400 coins for $1.5 billion earlier this month to bring its total BTC holdings above the 400,000 threshold. This is a sign of the demand that has been present of late from institutional players with ‘financial muscle’.

Meanwhile, large Bitcoin holders, known as whales, have been buying more Bitcoin over the past few weeks as the price stays below the key $100,000 level. Last month, about 16,000 BTC, worth nearly $1.5 billion, were added to whale reserves in just one day, according to CryptoQuant. Another sign that demand may remain high while supply continues to dwindle helping keep BTC/USD elevated moving forward.

Technical Analysis BTC/USD

Bitcoin (BTC/USD) has been holding the high ground of late above the $95k handle with any attempt to push lower being met by buying pressure. The worlds largest cryptocurrency has seen 7 consecutive daily candles close above the $95k mark.

The only positive for bears eyeing a potential deeper pullback is that Bitcoin has not risen above the $100k mark as ff yet which i believe is just a matter of time.

Increasing demand, Bitcoins strong Q4 historical performance and portfolio re-balancing for 2025 could all help propel the cryptocurrency beyond the $100k mark in December. Will this come to fruition however?

For now, immediate support is at the 95000 handle before 93565 and 91804 come into focus.

Looking at a potential break higher, and the 98000 mark is the first hurdle before the massive 100000 barrier.

Bitcoin (BTC/USD) Daily Chart, December 4, 2024

Source: TradingView.com (click to enlarge)

Support

- 95000

- 93565

- 91804

Resistance

- 98000

- 10000

- 105000