Bitcoin prices have continued their impressive run today breaching the 90000 mark for the first time. The world’s largest cryptocurrency is now up around 30% since election day and a 121% YTD as the new generations ‘digital gold’ continues its ascent.

The greed around crypto markets is evident at present, can you blame the hodlers? There does seem to be somewhat of a generational shift when it comes to investment flows and this has been reflected in recent data. BlackRocks Bitcoin ETF has now surpassed the holdings of its Gold ETF (NYSE:GLD) and this switch could in part explain the struggles of the precious metal as the new digital Gold grows in popularity. It would be unwise to dismiss this as we have seen in 2024 that the world’s largest cryptocurrency appears to be less volatile than in the past. The reason for this has been touted as institutional adoption which could be part of it.

Source: FinancialJuice (click to enlarge)

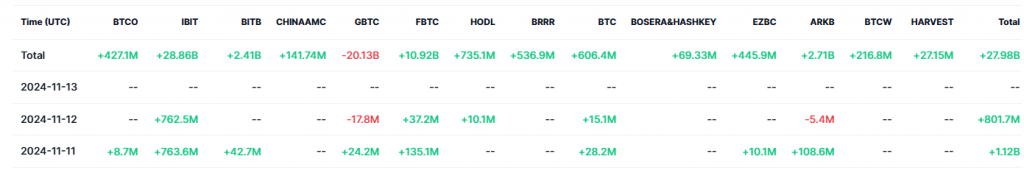

ETF Flows Soar

Bitcoin ETFs have seen remarkable inflows over the past week. The last two days however saw close to $2 billion dollars of inflows, led largely by the IBIT ETF. The continuation of ETF flows will be a comfort for fund managers and institutions in particular with market participants expecting less volatile swings as mainstream adoption continues to increase. Can the inflows continue?

Source: CoinMarketCap (click to enlarge)

On-Chain Data Analysis – New Demand Wave Incoming?

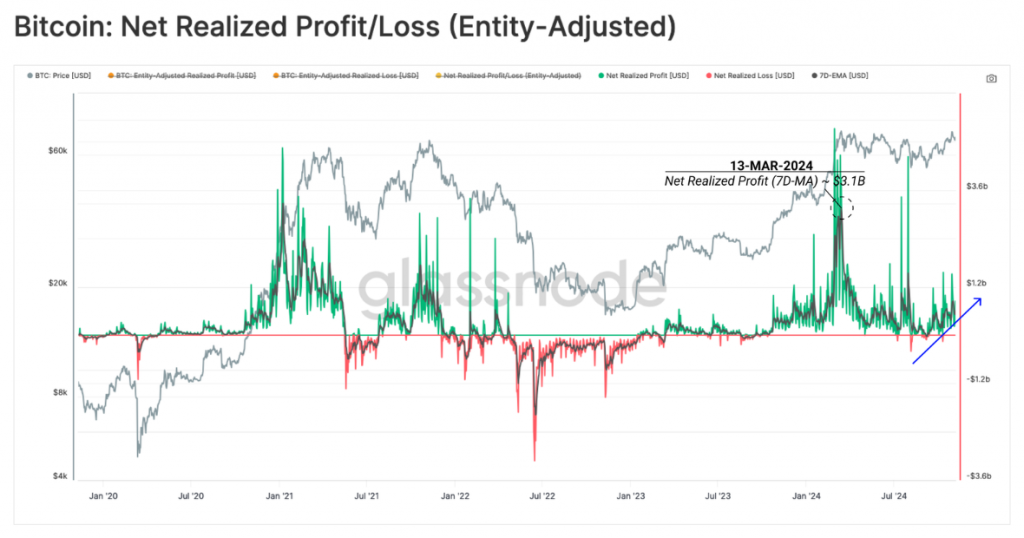

Looking at on-chain data analysis from Glassnode, In March, there was a big surge in profit-taking, reaching over $3.1 billion. Over the past seven months, as the market settled, both profits and losses balanced out. This indicates that supply and demand have reset. Now, we’re noticing an increase in profit-taking again, hinting that new demand is coming into the market.

We can see changes in the market by looking at the difference between profits and losses. Right now, the market is mostly about profits, with profits being about 47 times bigger than losses. This shows that there are very few people holding Bitcoin at a loss as the market climbs to a new all-time high. Could we see a surge in profit taking that could scupper the rally?

Source: Glassnode (click to enlarge)

President Trump Plans

The US President Elect Donald Trump is already making moves ahead of assuming office on the 20 January 2025. Markets have been buoyed by Trump’s victory with Crypto in particular benefiting. Markets are eyeing looser regulations under Trump, while Elon Musk has suggested the US Government use Bitcoin to help tackle outrageously high US debt levels.

In the coming weeks any further developments and comments by incoming members of Trump’s team may have a knock on effect for crypto. Interesting times ahead indeed.

Technical Analysis BTC/USD

Bitcoin is trading around 5% higher on the day having breached the $90k barrier.

Its is becoming extremely difficult to do any technicals as there is a lack of historical price action. On the upside i will pay attention to the round numbers like $95k before the 100k becomes a real possibility.

The downside at least leave something to look at. BTC/USD is trading in overbought territory with the RSI currently in the mid 80’s. Now of course we know that just because the RSI is in overbought territory it does not mean that a sell is imminent but worth paying attention to.

Support on the downside may be found at 90000 before 88884 and 86334 come into focus. Lower down we have the 85000 handle and and the 81500 handle to focus on.

Bitcoin (BTC/USD) Daily Chart, November 13, 2024

Source: TradingView.com (click to enlarge)

Support

- 90000

- 88884

- 86334

Resistance

- 95000

- 100000

- 105000