In July, see here, we found using the Elliott Wave Principle (EWP),

“Bitcoin (BTC) rallied strongly last Thursday, [July 13], only to erase all of those gains a day later. That smells, per the EWP-“olfactory test” like a B-wave ... This means red W-ii is most likely becoming an irregular flat.”

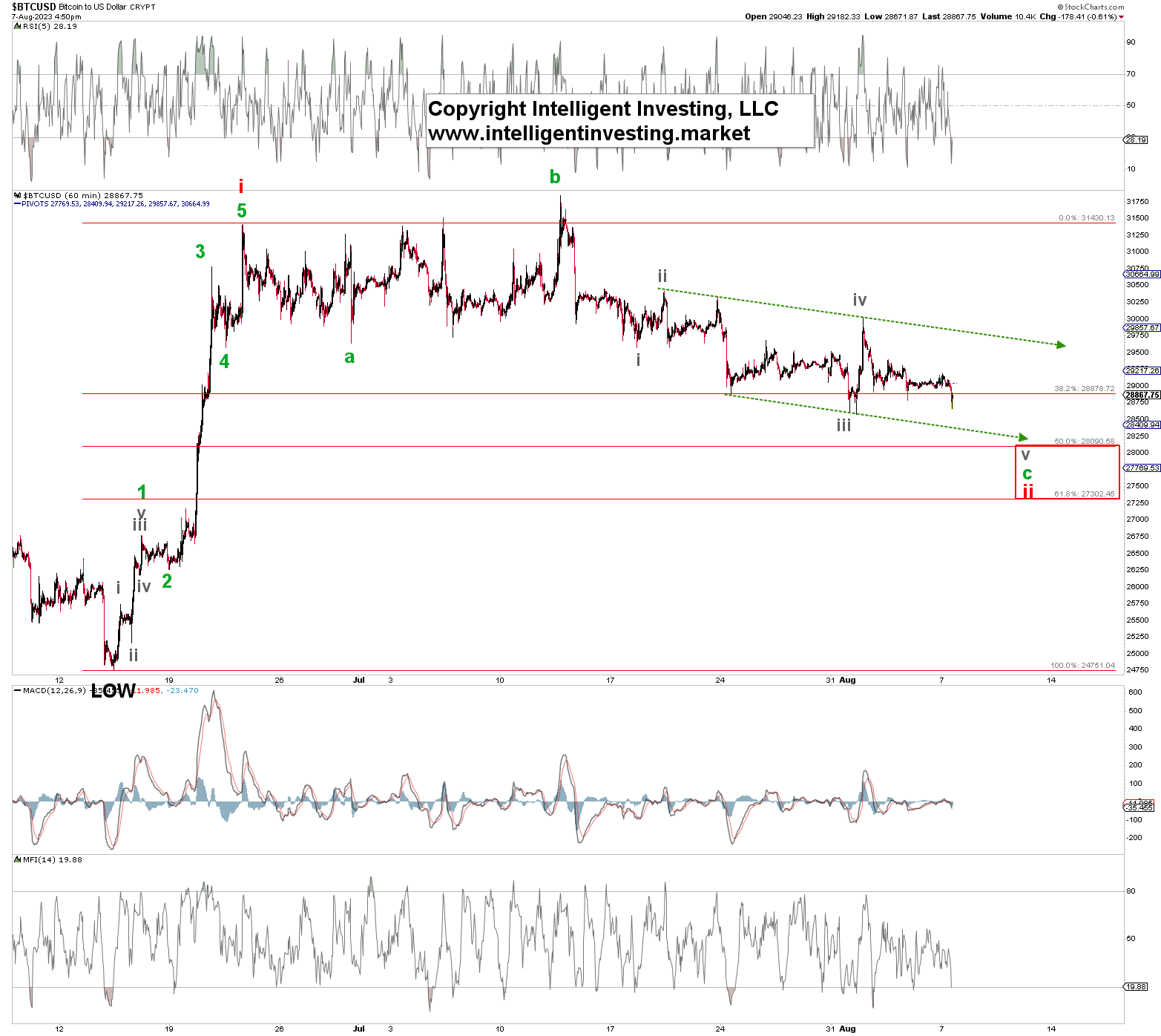

Since then, BTC has moved slowly lower, only losing ~9% of its value, and has done so in an overlapping, and thus corrective, fashion. The decline since the July 13 high is likely morphing into an ending diagonal (green) W-c of the red W-ii. See Figure 1 below.

Diagonals are overlapping five-wave price patterns, and ideally, BTC is now in grey W-v—the last wave of the green W-c. The ideal target zone is between $27300-28100, which fits well with the “$27750-29000” zone we already forecasted in June. Thus, almost two months later, BTC is still on track and behaving as anticipated. It is simply taking its time to correct the brief June-July rally. But that is not a surprise.

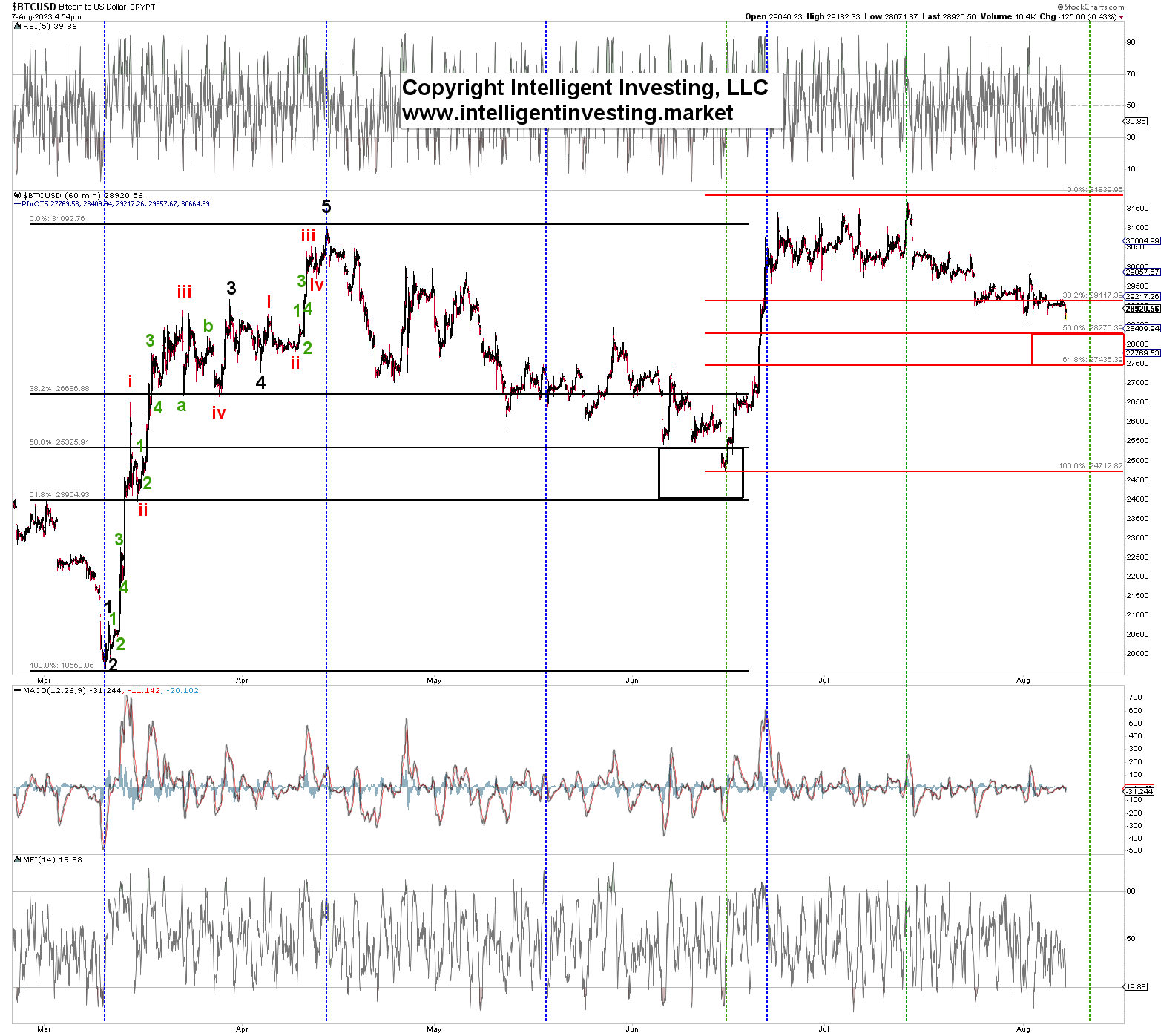

Namely, from a timing perspective, we can observe BTC rallied impulsively from March 10 to April 14: blue dotted lines in Figure 2 below. It took almost twice as long to correct between 50-62% of that rally: black box near 3rd blue dotted line. Applying a similar analogy, the current correction measured from the July 13 high has not lasted as long as the preceding rally: green dotted lines.

Back in July, we already knew “[BTC would] have to drop below the June low [at $24762], with a first warning for the bulls below the lower end of support ($28.5K) to nullify our overall Bullish thesis.

And we “would let BTC decide how it wants to fill in the short term, while we keep an eye on higher prices over the longer term.”

Fast forward, and BTC decided to “trickle” overlappingly lower: no harm has been done to our bullish thesis yet. In contrast, the additional price data and our timing analyses now allow us to specify our downside target zones and remain patient, as corrections tend to last longer than preceding rallies.