Traders, I believe you will like the facts put forward in today's analysis. I've previously spoke about the direction of BTC on the 15m, 1h and 4h charts but I feel a reflective post on the weekly chart is well overdue.

Since my post on the cyclical measurements of bitcoin in December, price has created a new low at $5,900, it is now time to start analysing the potential for 2018 and not to concern ourselves too much with intraday movements.

Today I'd like to present a more focused view on bitcoins current situation, analysing minor and intermediate cycles.

As mentioned I'm using a logarithmic scale which presents prices in the proportional amount of percentage increase or decrease, providing us a fair representation of where bitcoin was, is and could be.

I've broken down only the most recent cycle measured from the breakout of the all time high at $1,180 to the potential new all time high being the market top.

There is now a new measurement in this piece of analysis from the low created at $5,900 to the potential new all time high.

The measurements show the percentage increase upon achieving targets at $20,000, $50,000 and $100,000 as there seems to be a lot of financial articles relating to these figures as the predicted long term targets for the asset.

$5,900 to $20,000 = 240% increase

$5,900 to $50,000 = 750% increase

$5,900 to $100,000 = 1580% increase

If you compare our most up to date targets with those measured from the breakout of the all time high at $1,180, you can see how these levels are more than achievable long term now that the market has corrected.

To those who simply don't understand why market cycles occur, to put into the most simple context it operates on a basis of two main emotions.

1. The greed for profits.

2. The fear of losses

This is why the public gets in at the top and gets out at the bottom, because their prime drivers are just that, nothing more, nothing less.

It's funny, whenever Bitcoin was sitting at $18,000 all I ever heard people say was "If bitcoin went back down to $10k I'd be the first to buy it" or "I wish I bought BTC at $6k, I would've made a fortune".

Those people are the same ones who are still not buying now, the ones that bought at $18k because it's "booming" and they failed to recognise the signs of a storm.

In this post, I will not rant about these types of traders, I will keep it strictly technical and provide a deeper understanding on bitcoins situation.

Firstly, I would like to cover the basic TA before going into the more in-depth area of my analysis.

As we can see from the daily chart the low for BTC aligned with two support trendlines, providing a key area for a reversal to take place.

This reversal occurred after the 70% correction which took less than 2 months before creating the low at $5,900.

Pay attention to both of these trendlines going forward, if support is lost they will be a useful indication of price correcting further. This may help many people to prevent further losses.

Here is my view from the weekly chart, again we have a strong support trendline which I would pay close attention to if the market-wide panic continues.

I do not see price dropping to this area but in the unlikely scenario that the daily support is lost, I will be lining up my buy orders at $3,000.

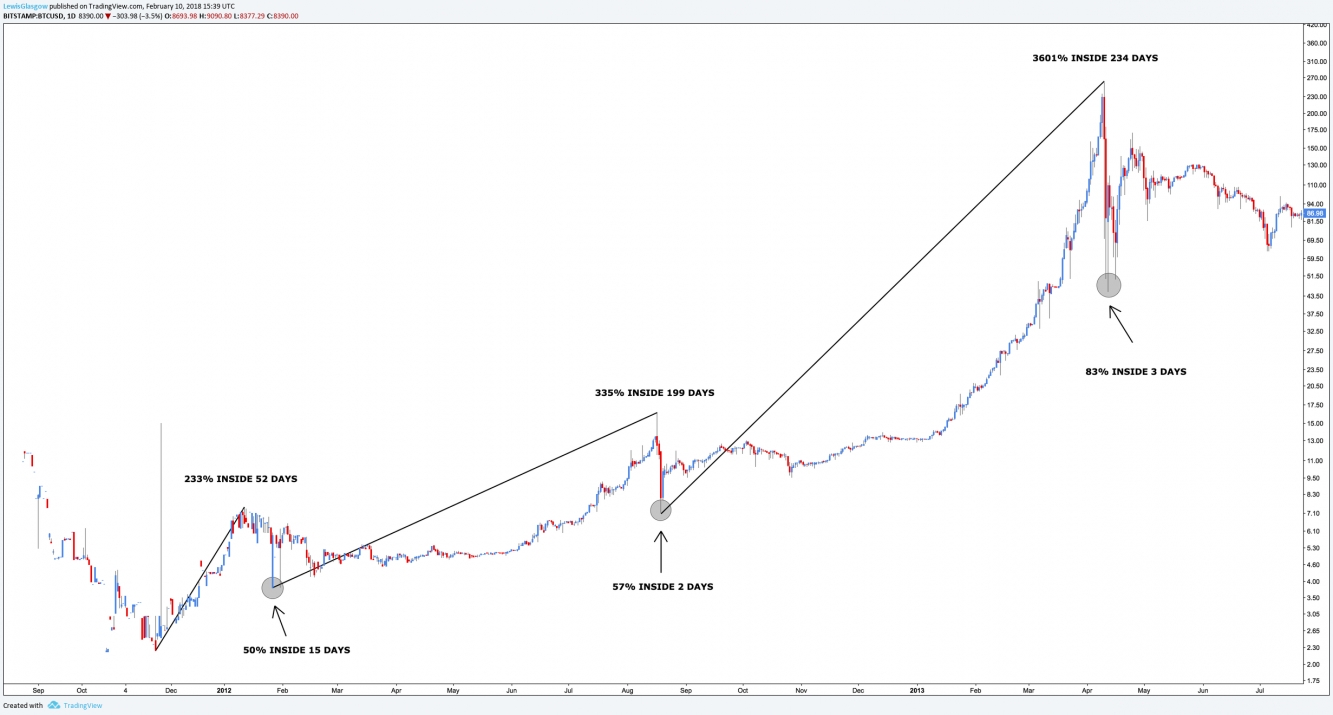

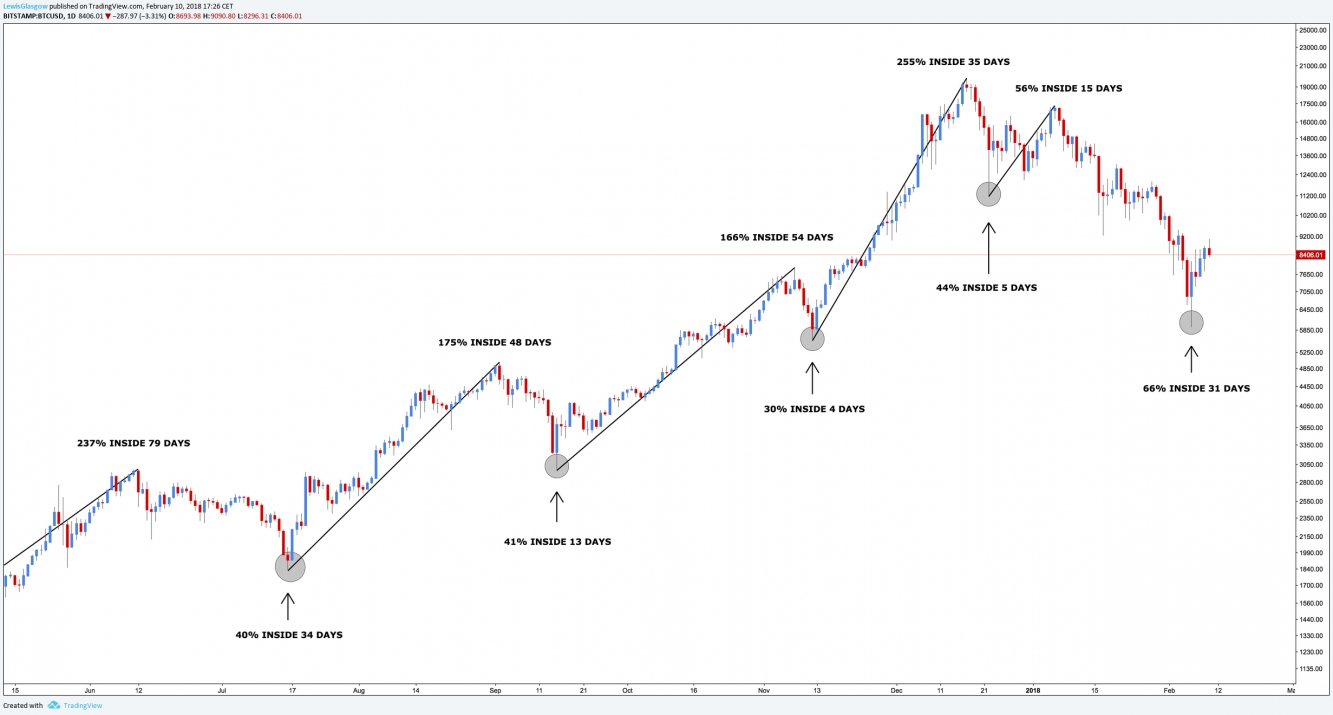

I'd like to show BTC from the beginning in every stage of the market. These are all measured moves and I have highlighted all corrections over 30%.

As you can see from the beginning the corrective periods were extremely short lived, if you went for a long weekend break your BTC portfolio could be almost worthless by the time you checked it on the Monday/Tuesday.

During this period the average correction was 63.66% lasting 6.6 days.

Average increase is 1,389% lasting 161 days.

As you can see after every correction the market entered a long period of consolidation.

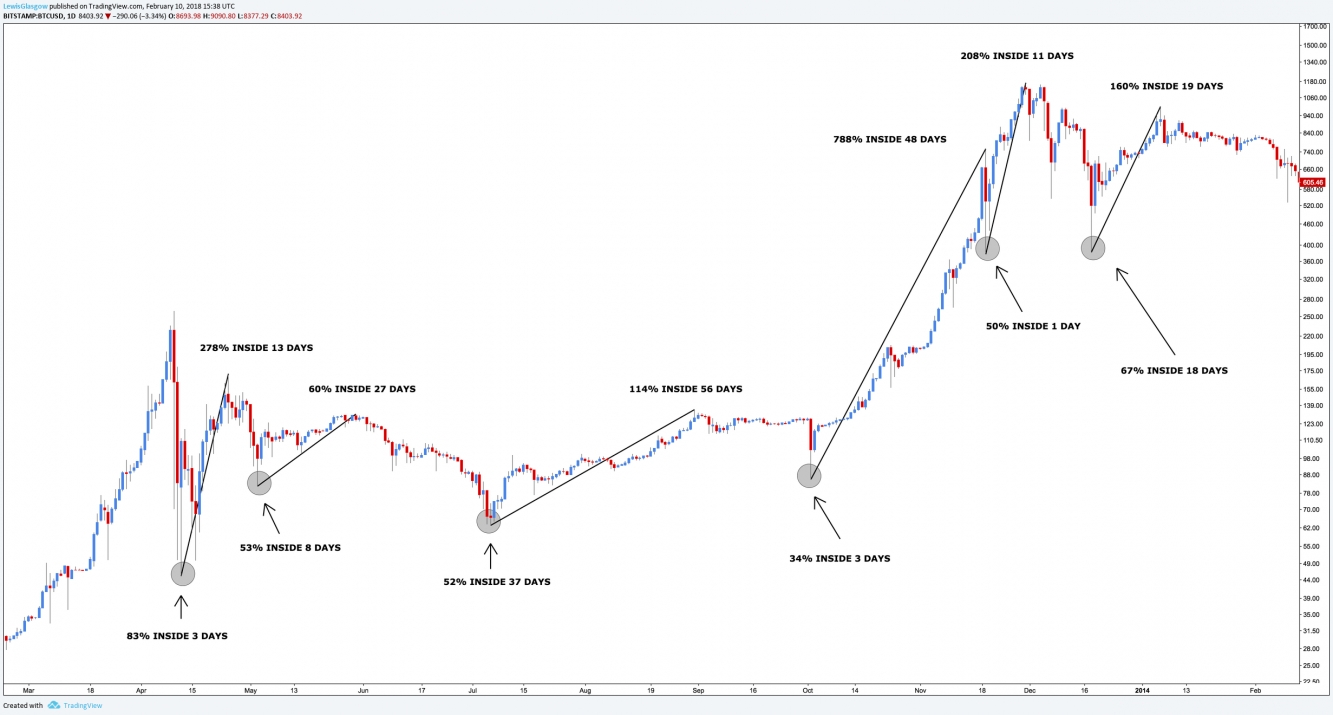

From this point the market corrections started to stabilise, but again, the frequent flash crashes in price were still occurring.

Average correction is 51% lasting 13.4 days.

Average increase is 268% lasting 29 days.

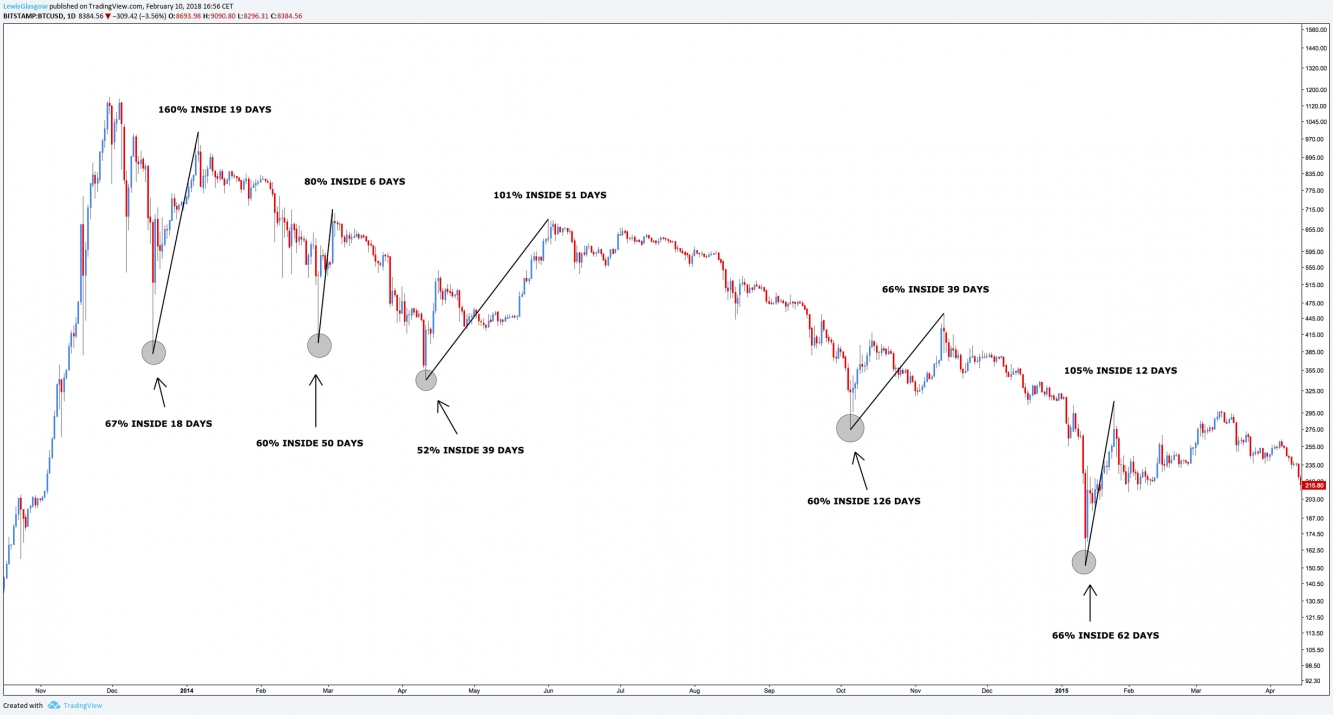

From late 2013 to early 2015, the corrections continued to stabilise.

Average correction being 59.50% lasting 69.3 days.

Average increase is 88% lasting 27 days

You can see from this chart that the average increase was significantly less, simply because we were operating inside a sellers market.

The increase was 66% less on average and lasted for almost same amount of time as the previous cycle.

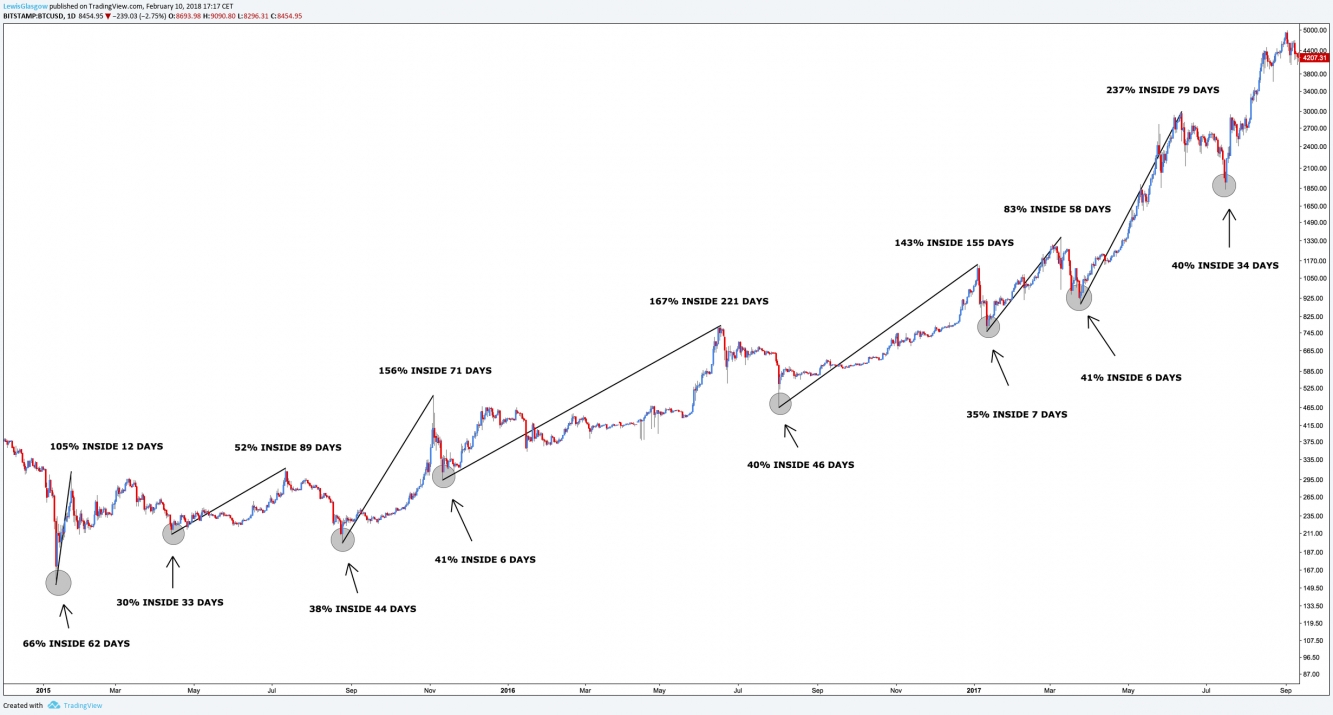

At this stage, the market entered a new phase and began the bull trend to the high at $20k.

As you would expect, the corrective periods were shorter but more volatile.

Average correction at 37.80% lasting 22.8 days.

Average increase is 139% lasting 112 days.

Now this is interesting, although the average increase was 50% greater than the previous cycle, the length of time from low to high is over 4x. As you would expect, the market is picking up from depression lows and took a long time to build momentum.

Here is the final move towards $20k, the average correction is 45.45% lasting 13.3 days.

You can see that as price has progressed, it has certainly stabilised, what people consider to be a "flash crash" is nothing in comparison to what happened 4 years ago in the market.

Average increase 163% lasting 38 days.

Compare those figures to the previous movement, not only was the average increase 15%+ greater but the length of time it took to complete each move was 3x less.

Tie all of those charts together, observe what is going on, compare the figures I have presented.

Taking every single correction into account for BTC, the overall average correction is 49% lasting 25 days.

The overall average increase for bitcoin to date is 331% lasting 69 days.

To keep these figures relevant to what is occurring right now.

If we take the average increase in every stage of the market from the low in 2015 to the all time high, you will find that the average increase is 145% lasting a period of 76 days... Which aligns with my views for the asset.

I see price levelling out over February as long as the daily support trendline holds, going into March the market will start to pick back up and a new cycle beginning in April for bitcoin.

What can you take away from this entire post? What if you don't understand a word I'm saying? Well, just remember this.

Average Correction: 49%

Duration: 25 DAYS

Average Increase: 331%

Duration: 69 DAYS

Filtered Average Increase (2015-2018): 145%

Duration: 76 DAYS

What does this mean?

If price declines by 49%, and you bought at the market top, meaning your portfolio almost cuts in half in terms of value... Then you understand that this is the AVERAGE correction for bitcoin, it is perfectly normal.

It is not a CRASH, but simply an average.