Yesterday, Bitcoin (BTCUSD) experienced its largest single-day drop of -14.7% since it bottomed out in late November 2022. Today, it recovered almost all its losses. So, was yesterday’s one-day drop all the Bears got, or should we expect more, and if so, how much more?

Now, regular readers of our work know that we have been continuously bullish on BTCUSD since we started our extensive coverage last year; see also our 2024 special, as we always signed our articles off with

Thus, as stated in all our prior articles the past year, “We have been Bullish on BTC for quite some time … However, our Bullish scenario is entirely invalidated below $25K. Only when that happens will we change our overall, longer-term Bullish POV, which BTC is proving more correct for each update we provide in that, based on BTC’s past cycles, made up of four more minor phases, it is currently in the “Mid Bull” phase and thus close to the next Bull run, which can target $100-200+K by the end of 2025.”

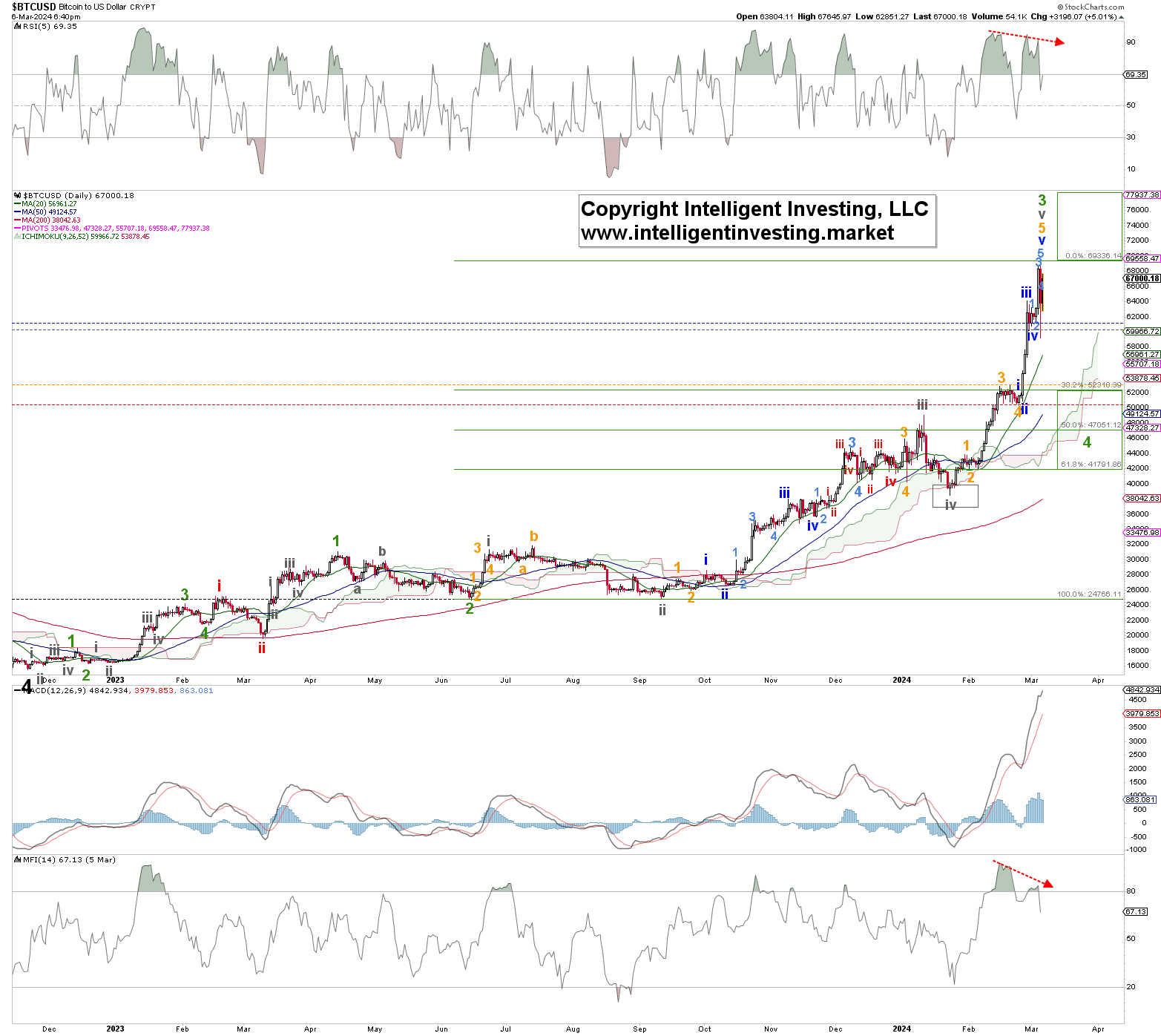

Figure 1. The daily chart of BTC with technical indicators and detailed EWP count.

Figure 1 above shows our preferred Elliott Wave Principle (EWP) count for BTC since it bottomed out in 2022. It could have topped for the green W-3 right at the lower end of the ideal target zone and now be in the green Wave-4 (W-4) of the red W-iii, part of the black W-5 that started in November 2022. Although BTCUSD has not closed below any of our warning levels (dotted colored lines, with Blue the 1st warning and red the last warning for the Bulls), yesterday’s intra-day drop does suggest a larger correction could be at hand.

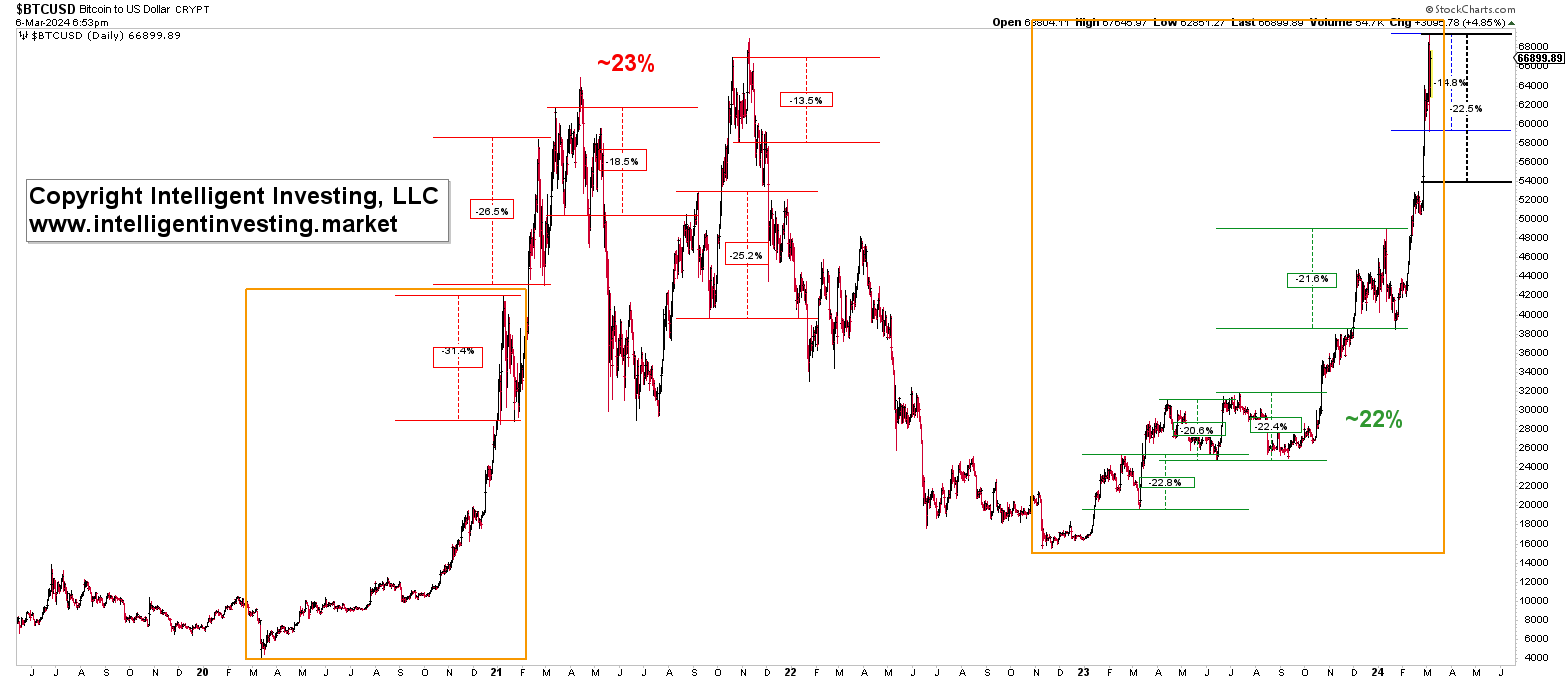

Looking at previous corrections, we find that during the Bull run of 2020-2021, BTCUSD experienced five 13.5 to 31.4% multi-day pullbacks, shown in red, whereas it has experienced four 20.6-22.8% multi-day pullbacks so far since the 2022 low. Thus, on average, BTC experiences a 22 to 23% multi-day pullback before the uptrend resumes. See Figure 2 below.

Figure 2. The daily chart of BTC with technical indicators and detailed EWP count.

Based on the EWP count and these historical patterns, we don’t expect that yesterday’s intra-day pullback of 14.8% was all BTCUSD will experience before rallying to the $100-200K level, but that a deeper multi-day correction to around ~$54+/-2K should be around the corner. See the black dotted percentage retracement in Figure 2.

Besides, the current rally (orange box) looks like the rally from the March 2022 low to the January 2021 high. In EWP terms, we call that a fractal. Once the correction was completed, BTC gained almost another 100%. For now, and in the short term, if BTCUSD can stay below yesterday’s low, we expect it to reach the low $50Ks. However, a move and close above it can target ~$78K before we expect the 20-25% correction.