What a difference a year can make. This time last year Bitcoin was thought to be going “to the moon” by a great majority of people. BTCUSD was approaching the $20 000 mark at the time and financial gurus, hedge fund managers, celebrities and small individual investors alike were rushing to join the bulls. Many feared they were going to miss out on all the future gains the “blockchain revolution” was going to deliver.

John McAfee and other famous technology entrepreneurs were giving very bold predictions about the price of Bitcoin. Targets of $250 000, $500 000 and even $1 million per BTC could often be heard in mainstream media. Only a handful of people like Warren Buffett, John Bogle and Jamie Dimon were not afraid to openly express their skepticism. Neither were we.

We first started covering Bitcoin in August 2016, by publishing a very bullish article about it. It was still hovering near $600 and was far from the giant bubble it later evolved into. It was in the summer of 2017, when things started getting out of control. Knowing how a bubble looks like and how it always ends, we started warning our readers about the dangers.

“It is Better to be Roughly Right than Precisely Wrong” – John Maynard Keynes

We never recommended shorting Bitcoin, because one can never actually know how big a bubble can get. We did, however, advise our clients to stay away from BTCUSD ever since it exceeded $3500. The market, of course, easily made us look foolish. The Elliott Wave Principle correctly warned that Bitcoin is in the final fifth wave of the bull market, but it could not pinpoint the exact price level of the anticipated bearish reversal.

By the time Bitcoin reached the $11 000 mark in early December, 2017, we decided to take a different approach. We took the 19 leading arguments people use to convince themselves that Bitcoin was not a bubble and tried to disprove them logically. As the Bitcoin bubble kept growing, our caution attracted a lot of negative feedback.

People were angry about missing “the rocket to the moon” because of what at the time seemed to be a bad advice. Still, better safe than sorry we kept thinking.

What seemed to be an opportunity of a lifetime was actually nothing more than a great danger. Besides, experienced traders and investors know not to be afraid to miss out on an opportunity. The market always provides a new one sooner or later. In BTCUSD’s case, an excellent Elliott Wave opportunity with a much better risk/reward ratio arrived just a month later.

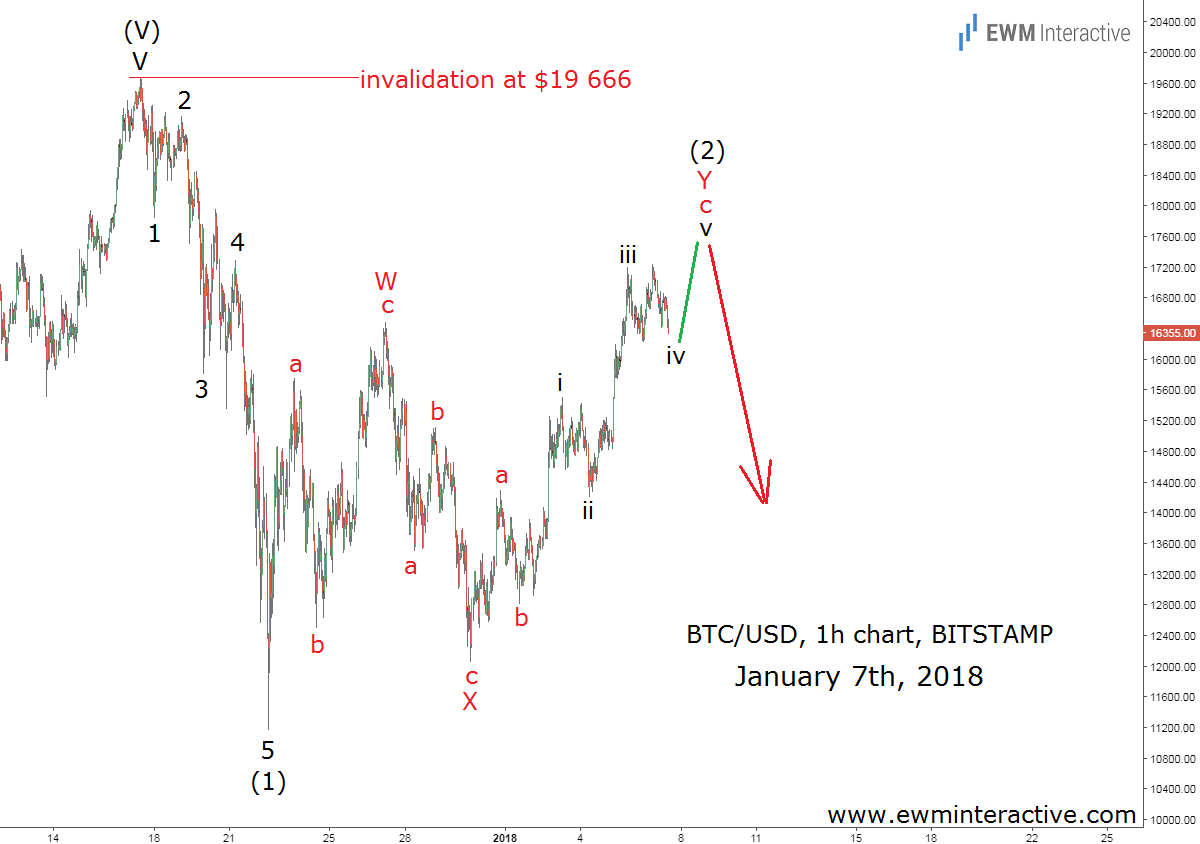

In early-January, the price of Bitcoin had already fallen from what was going to be a major top at $19 666. Optimism was still strong, though, perhaps even stronger. The crowd saw the initial drop to $11 160 as just another chance to join the infinite uptrend to riches. Elliott Wave analysts, on the other hand, recognized that there was something more to it.

Bitcoin, Just like All Other Bubbles before It, Could Not Keep its Promise

The chart above, sent to subscribers on January 7th 2018, revealed that the selloff from $19 666 to $11 160 had taken the shape of a five-wave impulse pattern. According to the Elliott Wave theory, impulses point in the direction of the larger trend. In other words, Bitcoin had changed direction without most people realizing it.

Instead of representing the continuation of the previous uptrend, the recovery to over $16 000 turned out to be the last chance for the bulls to evacuate. Few did before it was too late.

Bitcoin is barely holding above $4000 now, having lost almost 80% of its market value in less than a year. The mood of the crowd shifted from extreme optimism to extreme pessimism in a very short time. Only the most devoted crypto enthusiasts still hope Bitcoin is going to recover and reach new highs someday. Most others, including some of the largest miners, are leaving the scene now.

The cryptocurrency craze wasn’t the first bubble in history and it will certainly not be the last one. Investors must learn from the mistakes they made during the Bitcoin bubble, otherwise they risk repeating them when “the next big thing” arrives.