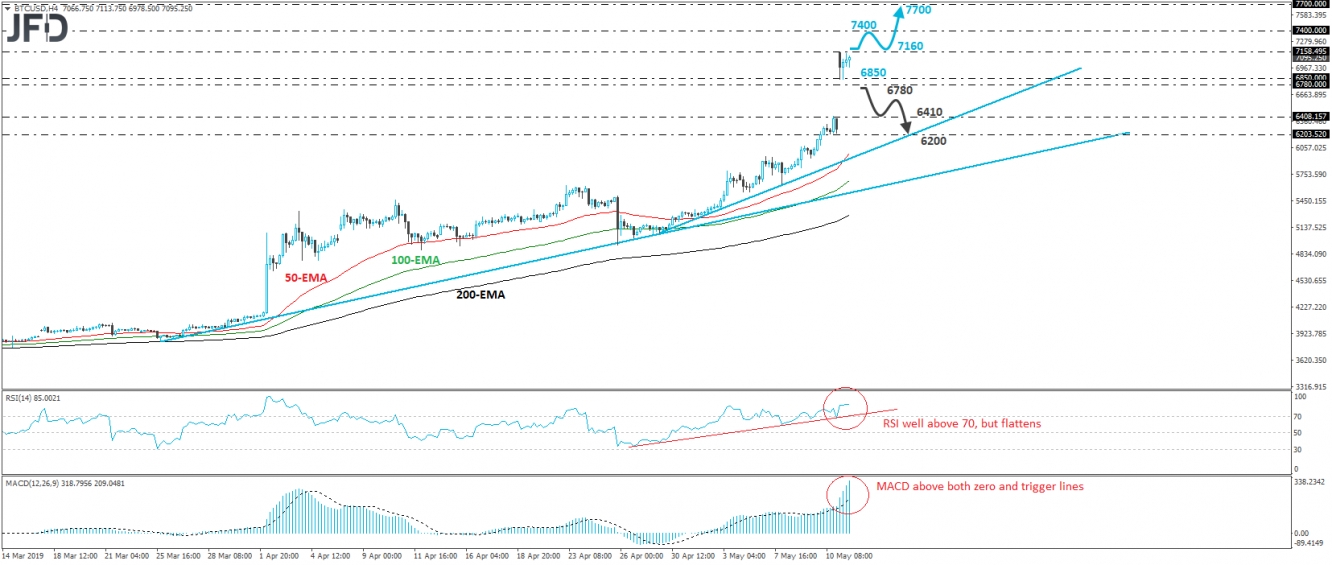

BTC/USD surged over the weekend, to hit resistance at 7160 on Monday’s open. This was the first time we saw the crypto trading above 7000 since early September. Today, the rate pulled back, but hit support near 6850 and rebounded again. The price continues to trade above the upside support line drawn from the low of March 25th, as well as above a shorter-term one drawn from the low of April 29th. Thus, we would consider the near-term outlook still to be positive.

A decisive break above 7160 could encourage the bulls to drive the battle towards the 7400 territory, defined by the peak of September 4th. If the bears are still reluctant to fight back near that zone, then its break may trigger extensions towards the 7700 level, or the 7800 hurdle, marked by the inside swing low of July 27th.

Turning attention to our short-term oscillators, we see that the RSI lies well above its 70 line, while the MACD stands well above both its zero and trigger lines. These indicators suggest strong upside speed and support the notion for further advances. That said, the RSI has flattened within its above 70 territory and thus, we would stay cautious of a possible setback before the next leg higher, perhaps for the price to test the 6850 support area once again.

In order to start examining the case of a larger correction, we would like to see a clear dip below 6780, a level that proved to be a strong resistance on September 28th and October 15th. This could allow the slide to continue towards Friday’s high of 6410, the break of which could see scope for a test near the 6200 zone or the aforementioned short-term upside line taken from the low of April 29th.