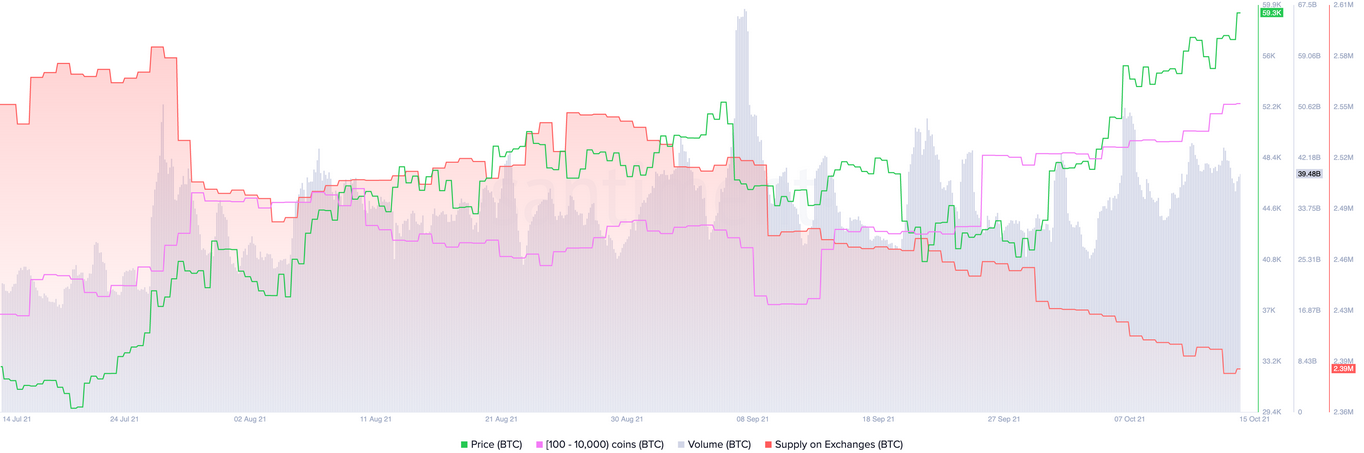

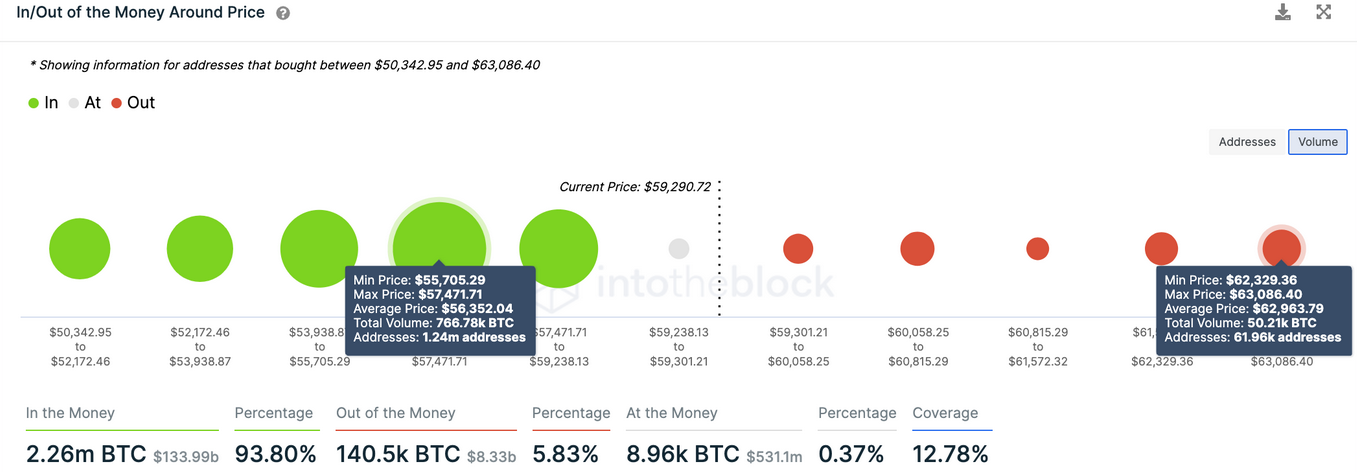

Bitcoin briefly sliced through $60,000 Saturday. The top cryptocurrency was continuing its ascent amid rumors of a potential Bitcoin futures ETF approval. While buy orders were piling up, transaction history showed that BTC could be on the path to reaching new all-time highs. Bitcoin briefly crossed $60,000 across all major exchanges Saturday morning, signaling that new record highs could be on the horizon. The flagship cryptocurrency gained over 2,600 points in market value over several hours yesterday as speculation mounted about a potential Bitcoin futures ETF approval. The U.S. Securities and Exchange Commission’s Office of Investor Education and Advocacy recently encouraged investors to “weigh the potential risks and benefits” before investing in the pioneer digital asset. Although the note refers to an investor bulletin published in mid-June, sources familiar with the matter have affirmed that the federal agency may allow a Bitcoin futures ETF to begin trading as soon as this coming week. From an on-chain perspective, whales appeared to be preparing for a positive outcome. Addresses holding 100 to 100,000 BTC bought over 30,000 BTC worth roughly $1.8 billion in the last three days. Meanwhile, more than 10,000 BTC have been removed from known cryptocurrency exchange wallets within the same period. While the buying pressure behind Bitcoin continued to increase, IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model showed there were no supply barriers ahead. The only considerable interest area sits at $63,000, where 62,000 addresses have previously purchased more than 50,000 BTC. Due to the recent buying activity among whales, it’s possible that Bitcoin could hit a new all-time high of $80,000 after breaching the $63,000 barrier. It is worth noting that a delay in a Bitcoin-related ETF approval in the U.S. could disappoint investors and increase selling pressure. Under such unique circumstances, the IOMAP shows that the most significant support level underneath BTC sits at $55,700. Failing to hold above this crucial demand wall could result in a steep decline toward $50,000. Key Takeaways

Bitcoin Targets New All-Time Highs

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Touches $60,000 Amid ETF Approval Rumors

Published 10/17/2021, 12:50 AM

Bitcoin Touches $60,000 Amid ETF Approval Rumors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.