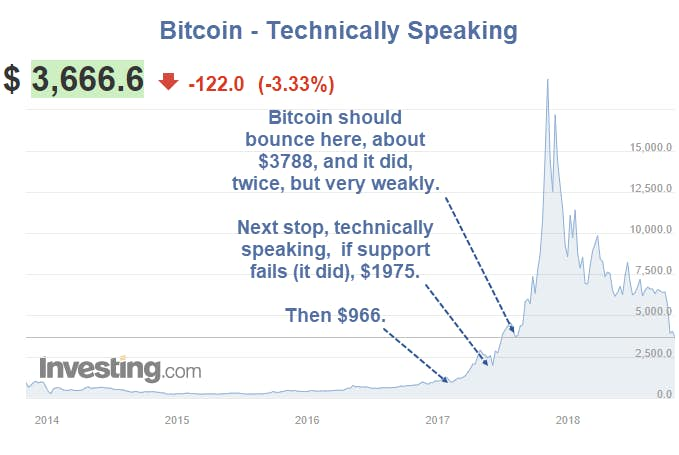

The Bitcoin chart is seriously broken. Support level after support level has given away. Where to from here?

Technical Analysis is a tool, not a given. In downtrends, support levels break easily. In uptrends, resistance levels generally smash through to higher highs.

But if you understand the theory, TA can provide good entry and exit points while minimizing risk.

Resistance Levels

On a one year chart, there was a long battle just under the $8,000 level.

Why do resistance levels often work? Because all those buyers at that level that are still holding are now praying to get out out. At $8,000 many will do so.

The same applies at the $5750 level or so.

There were two bounces at roughly the $3,800 level. Both have failed. The downtrend resumed. Now, the $3,800 level is resistance. At least it's weak resistance.

Unfortunately, the first chart shows that support (an area where buyers once entered) is a long ways off, approximately $1,975. That approximately a 50% haircut from here.

Bitcoin a Speculative Vehicle

Fundamentally speaking, there was no mass adoption of Bitcoin and it's highly unlikely there will be. And if not, Bitcoin will remain little more than a speculative vehicle.

Don't Confuse Bitcoin With Blockchain

It's important not to confuse blockchain with cryptocurrencies that use blockchain. While Bitcoin cannot succeed without blockchain succeeding, the converse is not true.

Blockchain can gain widespread adoption while the coin itself heads to zero.

Here's a March 2018 Flashback to ponder.

Mike "Mish" Shedlock