The fact that Bitcoin has recently hit an all-time high has already fueled wild speculation in the market and we are now seeing increased interest in the currency. The mainstream media are now full of articles on the meteoric rise of Bitcoin, Bitcoin Cash, Ethereum and the prospects of cryptocurrencies. In an article on Bloomberg, we read:

It seems like everyone is coming up with a price forecast these days, with some of the biggest banks including Goldman Sachs Group Inc (NYSE:GS). jumping into the action, while speculators to long-time investors are also making their bets.

The consensus is that the biggest cryptocurrency will face some resistance around $4,500 to $4,800 and correct, to then continue rallying. How high? Pantera Capital Management’s Paul Veradittakit, Tom Lee at Fundstrat Global Advisors and John Spallanzani at GFI Group Inc. see it going to $6,000 by year-end, while Ronnie Moas at Standpoint Research says it will keep rising to $7,500 in 2018.

Bitcoin has been on a tear this year, more than tripling in value as it crossed the $4,000 mark and touched a record $4,477 last week. It’s since retreated about 7 percent from the high as investors took profit and assessed whether the rally had gone too far. Growing adoption and institutional investor interest, agreement on a mechanism to speed up transactions and regulatory steps that will help the asset broaden its reach are some of the reasons that explain the gains.

The point at which a lot of “experts” start expressing a lot of opinion on an asset might mean that a lot of the appreciation is already behind us. And this might be the case with Bitcoin. Particularly striking is the list of potential “reasons” supporting the move up. Growing adoption? Institutional interest? Not much of that in the market, at least not now. The point about improved transactions might have some merit to it but the problem here is that the Segregated Witness protocol and other tweaks to Bitcoin are only one step on a long road make transactions quick and seamless. However, the market might have actually taken SegWit and Bitcoin Cash as legitimate long-term solutions, or at least tectonic shifts in how Bitcoin works. While both SegWit and Bitcoin Cash are interesting attempts to rectify some of Bitcoin’s faults, they might have been triggers or accelerants of the move rather than lasting solutions.

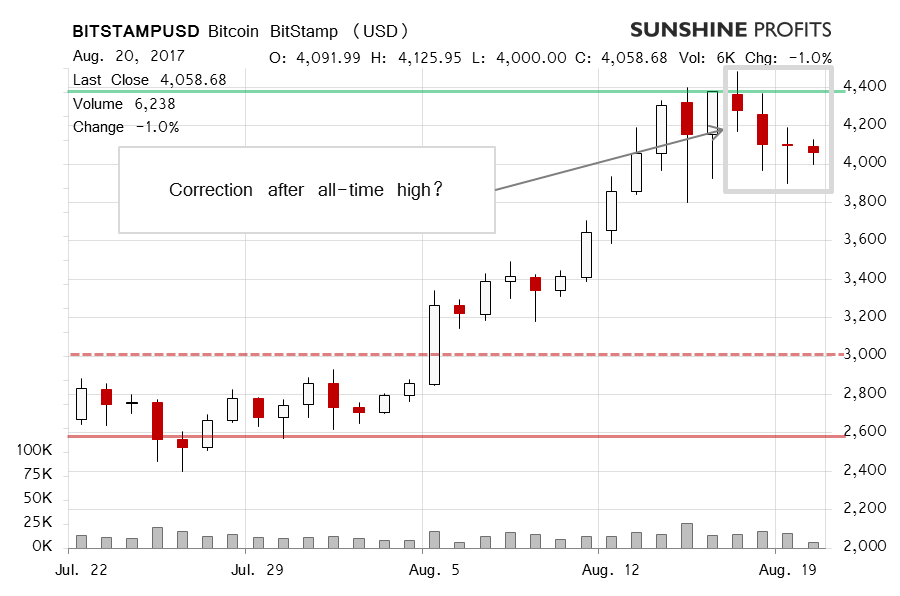

For now, let’s focus on the charts.

The hectic move up has stalled recently. Does this depreciation mean that the top is already in? Recall our recent comments:

The fact that we saw a move above the previous all-time high is a bullish indication. The volume was not spectacular but the appreciation was definitely visible and the currency hasn’t depreciated much since then (...). The fact that Bitcoin has been holding up is a bullish hint.

We have seen Bitcoin hold up above the recent all-time high. This is still a bullish indication. The other side of the story is the decline in volume we have seen today (...). Actually, the action today has been up but the volume has been so weak that this is a bearish indication. The general idea is that the move up on low volume might suggest that the buying power is dying out.

So, Bitcoin went out of the trading range, broke the previous top and it then very rapidly appreciated to yet another all-time high. The volume was not low but it was not really strong either. We now have seen an extremely strong move on volume which was not spectacular.

From a long-term point of view, the move up is actually parabolic. This is a clear sign that things have gotten really crazy. We are now seeing one of the most significant moves in the history of Bitcoin. If we take a look at the RSI based on 3-day returns, the digital currency is visibly above 70. Almost all such cases in recent years coincided with at least local tops. This means that we might see a short-term pullback. Whether it will be “the top” is still unclear. The hectic nature of the move suggests that we might be very close or even right at an important top. The RSI suggests the situation is extreme but also that it could get even more extreme. If we see signs of the market turning, we might consider hypothetical short positions. This is not the case just now as Bitcoin might still move further.

Since our previous alert was posted, Bitcoin has actually gone down. Not much, for Bitcoin, but the move has been quite visible. The volume was similar to what we had seen during the previous move up. Later on, trading greatly diminished and the resulting volume was weak. The situation became slightly more bearish in the wake of these moves, however, it doesn’t seem that any sort of trigger has been reached. If we look at the Fibonacci retracements based on the recent move from $1,830 to the all-time high at $4,480, we notice that the last couple of days of depreciation haven’t even brought Bitcoin down below the 23.6% retracement ($3,855).

Taking all of the above into account, it seems that Bitcoin might be after an important top, possibly even a long-term one, however, we haven’t seen enough of a move down for now. In such an environment, we would prefer to wait for a confirmation of a move down before considering any hypothetic position.