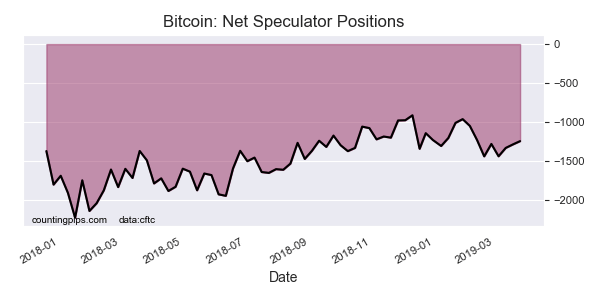

Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators slightly edged their bearish net positions lower in the Bitcoin Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,244 contracts in the data reported through Tuesday, March 26th. This was a weekly lift of 42 net contracts from the previous week which had a total of -1,286 net contracts.

The week’s net position was the result of the gross bullish position (longs) sliding by -324 contracts to a weekly total of 1,456 contracts that were more than offset by the gross bearish position (shorts) which saw a reduction by -366 contracts for the week to a total of 2,700 contracts.

This week showed that speculator bearish bets have fallen for three straight weeks to the least bearish level of the past six weeks.

Overall, the bitcoin futures market remains in a very sleepy state as open interest levels (the number of outstanding contracts open in the market) have fallen for two straight weeks and are currently at the lowest level since the first week of Bitcoin futures trading (in December 2017). This shows very little conviction among traders and decreasing trader actions (contract positions) being taken at the moment.

Bitcoin Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 0 contracts on the week. Bitcoin has not had any commercial positions for the past three weeks which could be due to the fact that with very low interest at the moment, there are no entities with enough open positions to satisfy the CFTC requirements for large commercials.

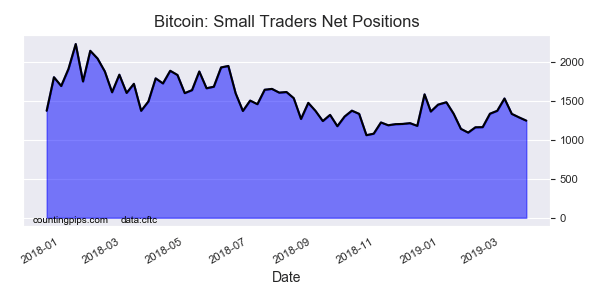

Small Traders Positions:

The small traders' position, a mix of hedgers and speculators that don’t meet the requirement for large traders, fell for the third straight week to a total of 1,244 net contracts. This was a weekly decline of -42 contracts from the previous week.

The small trader position has continued to see contracts in a range of between +1,000 and +1,500 net positions over the recent weeks and months.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $3905 which was a decrease of $-90 from the previous close of $3995, according to unofficial market data.