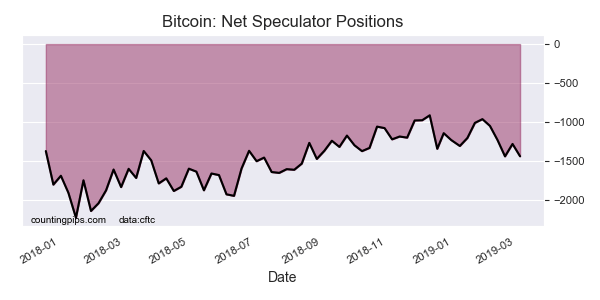

Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators advanced their bearish net positions in the Bitcoin futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. The latest COT data is now up to date after delays in previous weeks due to the government shutdown.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,438 contracts in the data reported through Tuesday March 5th. This was a weekly change of -158 net contracts from the previous week which had a total of -1,280 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 239 contracts to a weekly total of 1,789 contracts but being more than offset by the gross bearish position (shorts) which saw a rise by 397 contracts for the week to a total of 3,227 contracts.

The net speculative position has had rising bearish bets in four out of the past five weeks. Speculators continue to remain on the bearish side of this market since the start of Bitcoin futures trading in December 2017.

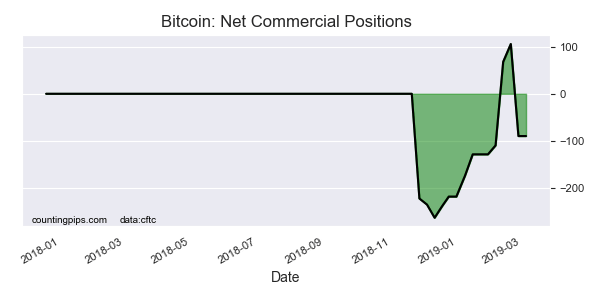

Bitcoin Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -90 contracts on the week which was unchanged from the previous week.

The commercial positions started getting included in the data in November after approximately a year of just speculative and small trader contracts being available.

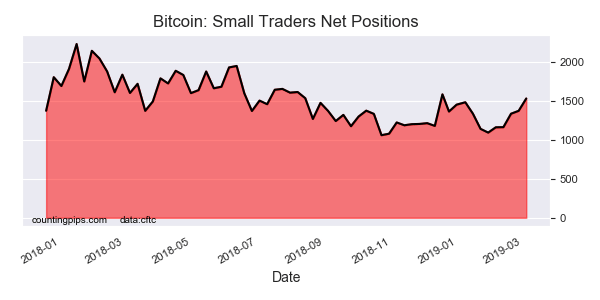

Small Trader Positions:

The small traders position, a mix of hedgers and speculators that don’t meet the requirement for large traders, gained for a fifth straight week to a total of 1,528 net contracts. This was a weekly gain of 158 contracts from the previous week.

The small trader standing is now at the most bullish level since December 18th.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $3835 which was a rise of $60 from the previous close of $3775, according to unofficial market data.