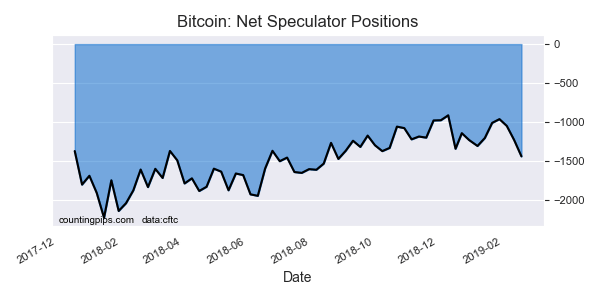

Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators increased their bearish net positions in the Bitcoin Futures markets in mid-February, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from the middle of February due to the government shutdown which suspended the releases for approximately a month. The CFTC is releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,439 contracts in the data reported through Tuesday, February 19th. This was a weekly reduction of -210 net contracts from the previous week which had a total of -1,229 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -14 contracts to a weekly total of 1,508 contracts compared to the gross bearish position (shorts) which saw a gain by 196 contracts for the week to a total of 2,947 contracts.

The speculative Bitcoin positioning saw rising bearish bets for three straight weeks through February 19th and leveled at its most bearish standing since August 28th.

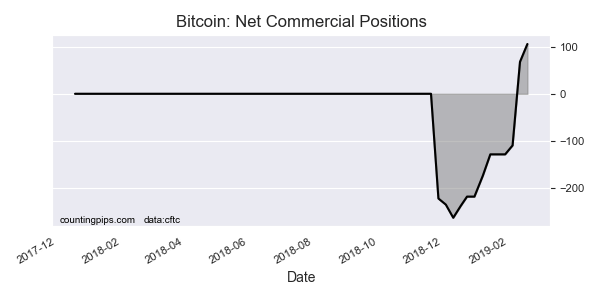

Bitcoin Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 106 contracts on the week. This was a weekly increase of 38 contracts from the total net of 68 contracts reported the previous week.

The commercials position rose higher into a bullish standing after spending their previous positionings in bearish territory. The commercial positions started getting included in the data in November after approximately a year of just speculative and small trader contracts being available.

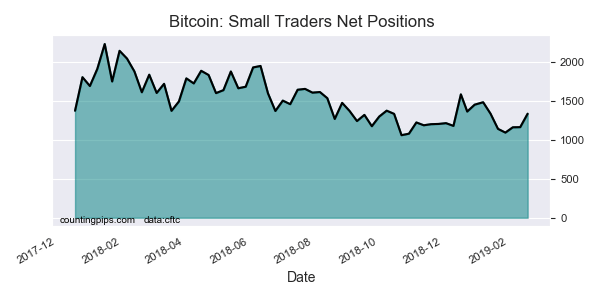

Small Trader Positions:

The small traders position, a mix of hedgers and speculators that don’t meet the requirement for large traders, rose for a third week to a total of 1,333 net contracts. This was a weekly gain of 172 contracts from the previous week.

The small trader position was at the most bullish level since January 15th and have maintained a bullish position in Bitcoin futures since the beginning in December 2017.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $3935 which was a rise of $330 from the previous close of $3605, according to unofficial market data.