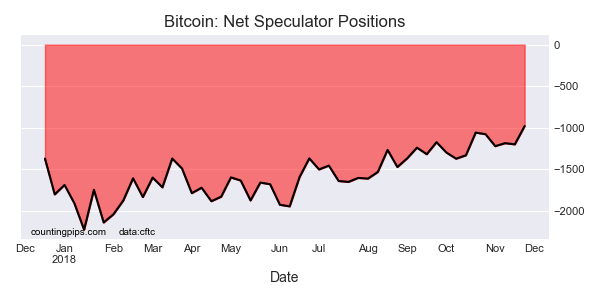

Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators reduced their bearish net positions in the Bitcoin futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -979 contracts in the data reported through Tuesday November 27th. This was a weekly boost of 220 net contracts from the previous week which had a total of -1,199 net contracts.

This week’s net position was the result of the gross bullish position growing by 254 contracts to a weekly total of 1,852 contracts compared to the gross bearish position which saw a rise by just 34 contracts for the week to a total of 2,831 contracts.

The speculative position saw its bearish position fall to the lowest level since Bitcoin futures trading began in December of 2017.

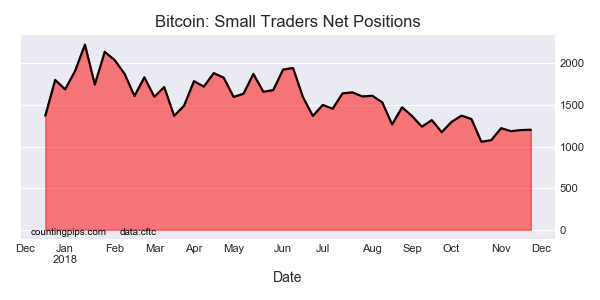

Meanwhile, the small traders raised their existing bullish bets by just 3 contracts to a total of 1,202 net contracts.

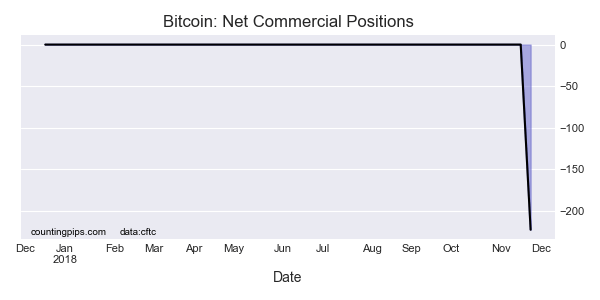

Bitcoin Futures COT Data was Speculators vs Small Traders but this week Commercial positions began

The Bitcoin futures data is in its fiftieth week since the start of the cryptocurrency futures data releases on December 19th 2017. The data had only included trader classifications of speculators and small traders up until now but commercial trader positions were in the data this week. The commercials started their trading by having a -223 net contract position in the data through Tuesday November 27th.

Commercial traders are classified as participants that buy and sell a commodity for business purposes like hedging. It will be interesting to see if this is the start of commercials being in this market continuously going forward or if this is a one-off or maybe even an error. Time will tell.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $3720 which was a fall of $-520 from the previous close of $4240, according to unofficial market data.