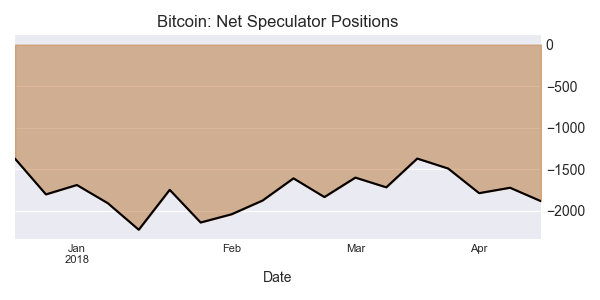

Bitcoin Futures Non-Commercial Speculator Positions:

Large cryptocurrency speculators raised their bearish net positions in the Bitcoin futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,883 contracts in the data reported through Tuesday April 17th. This was a weekly decrease of -162 contracts from the previous week which had a total of -1,721 net contracts.

Speculative positions have increased their bearish bets for three out of the past four weeks and the overall bearish position is now at the highest level since February 6th when net positions totaled -2,040 contracts.

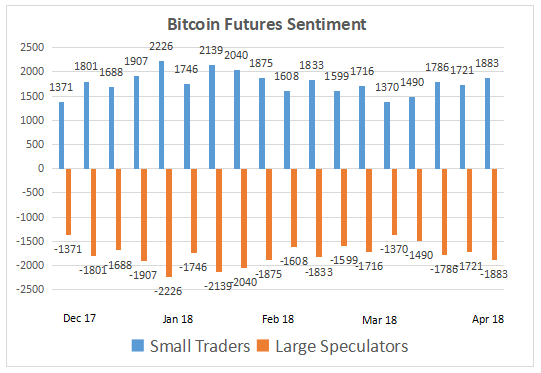

Small traders, meanwhile, advanced their existing bullish positions this week by an offsetting 162 contracts to a current level of 1,883 net contracts.

Bitcoin Futures COT Data is Speculators vs Small Traders

The Bitcoin futures data is in its eighteenth week since the start of the cryptocurrency futures data on December 19th. The data includes trader classifications of only speculators and small traders and without commercial traders (typically business hedgers or producers of a commodity).

Speculators have been on the bearish side from the beginning of the bitcoin data releases while the small traders have continued to be on the bullish side of this market.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Cryptocurrency Futures closed at approximately $7911.39 which was a gain of $1057.38 from the previous close of $6854.01, according to unofficial market data.