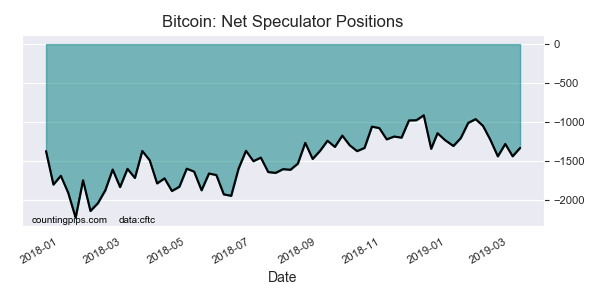

Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators decreased their bearish net positions in the Bitcoin futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,331 contracts in the data reported through Tuesday, March 12th. This was a weekly change of 107 net contracts from the previous week which had a total of -1,438 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 163 contracts to a weekly total of 1,952 contracts which more than offset the gross bearish position (shorts) which saw an increase by 56 contracts for the week to a total of 3,283 contracts.

The speculator positioning has been above the -1,000 contract level for six straight weeks after falling below this threshold in late January.

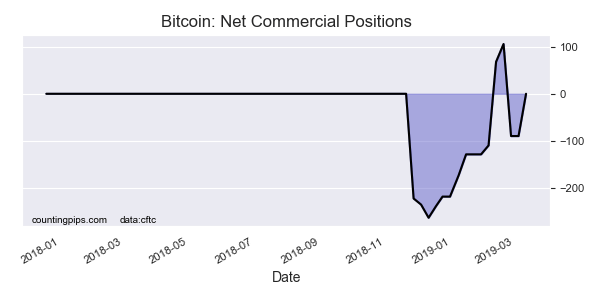

Bitcoin Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 0 contracts on the week. This was a weekly advance of 90 contracts from the total net of -90 contracts reported the previous week.

The commercial position has now gone back to zero (no hedgers in the market) after these positions started showing up in the data in November.

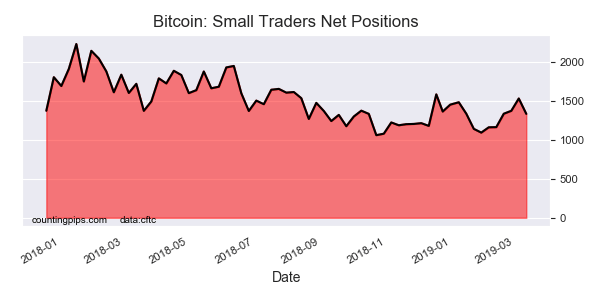

Small Trader Positions:

The small traders position, a mix of hedgers and speculators that don’t meet the requirement for large traders, fell for the first time in six weeks to a total of 1,331 net contracts. This was a weekly decline of -197 contracts from the previous week.

The small trader position had risen to the most bullish level since December 18th before this week’s retreat.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $3845 which was an uptick of $10.00 from the previous close of $3835, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders), as well as the commercial traders (hedgers & traders for business purposes), were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).