Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators decreased their bearish net positions in the Bitcoin futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

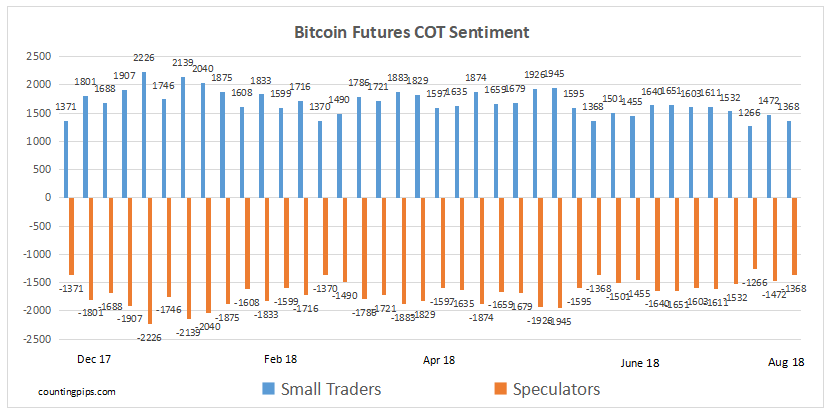

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,368 contracts in the data reported through Tuesday September 4th. This was a weekly boost of 104 contracts from the previous week which had a total of -1,472 net contracts.

Speculative bearish bets dipped this week and have trended lower for three out of the past four weeks.

The small trader position, meanwhile, slightly cut back on their existing bullish positions this week by an equally offsetting -104 contracts to a current bullish level of 1,368 net contracts.

Bitcoin Futures COT Data: Speculators vs Small Traders

The Bitcoin futures data is in its thirty-eighth week since the beginning of the cryptocurrency futures data releases on December 19th 2017. The data includes trader classifications of only speculators and small traders and without commercial traders (typically business hedgers or producers of a commodity).

Speculators continue to be on the bearish side of this market while the small traders have remained on the bullish side since the beginning of the bitcoin data releases.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $7350 which was a gain of $260 from the previous close of $7090, according to unofficial market data.