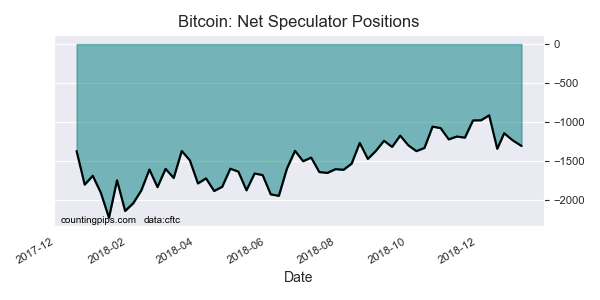

Bitcoin Non-Commercial Speculator Positions:

Large cryptocurrency speculators raised their bearish net positions in the Bitcoin Futures markets in early January, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The latest COT data is from early in January due to the government shutdown which halted the releases. The CFTC is releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,306 contracts in the data reported through Tuesday, January 8th. This was a weekly reduction of -76 net contracts from the previous week which had a total of -1,230 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 109 contracts to a weekly total of 2,120 contracts but was overcome by the gross bearish position (shorts) which saw an increase by 185 contracts for the week total of 3,426 contracts.

Speculative net positions saw higher bearish bets for two straight weeks and rose to the most bearish level in three weeks on January 8th.

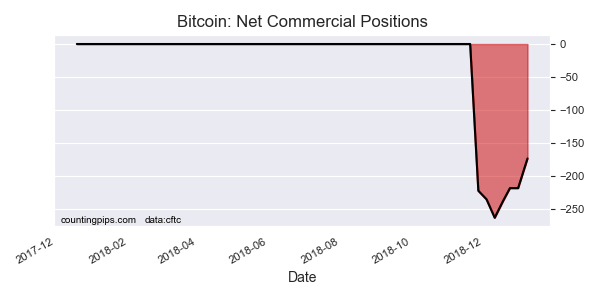

Bitcoin Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -174 contracts on the week. This was a weekly improvement of 45 contracts from the total net of -219 contracts reported the previous week.

The commercials were recently added to the data on November 27th (chart above) and have started off with a small short position.

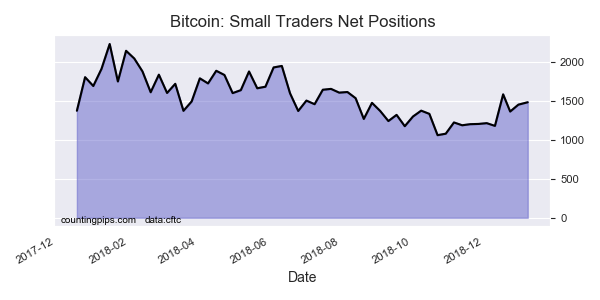

Small Traders Positions:

The small traders, meanwhile, added to their existing bullish bets by 31 contracts through January 8th to a total of 1,480 net contracts from the previous week which had a total of 1,449 net contracts.

The small trader position has continued to have a bullish standing in Bitcoin futures since the contract was introduced in December of 2017 and rose for a second straight week.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $3985 which was an advance of $335 from the previous close of $3650, according to unofficial market data.