I contemplated writing about Bitcoin last week and given this latest dive, I really should have done it sooner. But hey, better late than never.

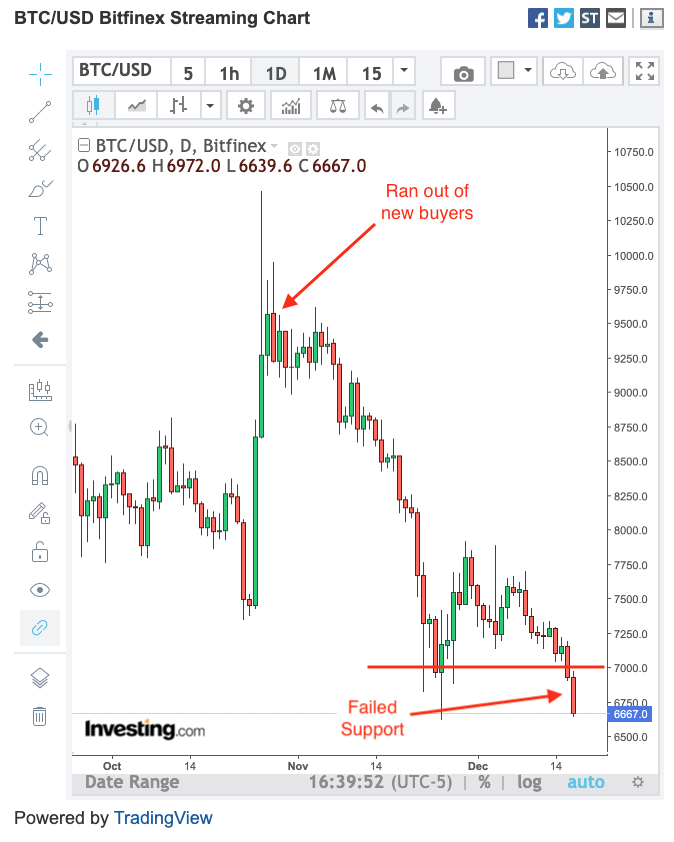

Bitcoin was hovering just above $7k support for a few weeks after retreating from this fall’s impressive $10k surge. Bulls have been trying to break the brutal bear market that started back in early 2018 and this latest run to $10k was the noblest attempt thus far. Unfortunately for the Bulls, the wider public failed to embrace the rebound and prices retreated from a lack of demand.

In 2018 Bitcoin went from the thing everyone wanted to the butt of every joke. Many late-to-the-party buyers were burned and they were not about to lose their hard-earned money a second time. And not only was the wider public not interested, but most of the Bitcoin bulls bought everything they could afford on the way down and they didn’t have any money left to add either. Mix those two factors together and you had the recipe for a failed rebound.

I’ve been warning subscribers to be careful of Bitcoin’s latest rebound and while it seems a little late now that prices are down 35%, that warning is just as applicable. Buyers are still missing and if they didn’t save us at $7k, there is little reason to think anyone will come to our rescue at $6k.

If there is one saving grace, it is that Bitcoin } bulls are a stubborn bunch. Anyone who hasn’t sold yet is a “Hodler” and plans on taking their coins to their grave. That undying confidence keeps supply tight every time prices dip under key support levels. Unfortunately, tight supply is only half of the equation and the best it can do is slow the descent.

At this point, I see no reason to own Bitcoin because the bear market is alive and well. Expect prices to fall even further over the near and medium-term.